ECON 3141/4141: International macro and finance

advertisement

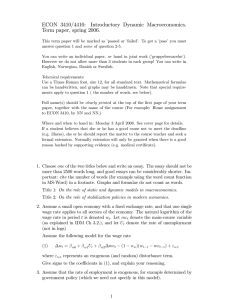

ECON 3141/4141: International macro and finance This is a 3000-words home assignment, i.e., to get a pass the number of words cannot exceed 3000 (figures, equations, diagrams etc. do not count as words). The home assignment will be marked and counts 40 % towards the overall mark in this course. If a student believes that she or he has a good cause not to meet the deadline (e.g. illness) she or he should discuss the matter with the course teacher and seek a formal extension. Normally extension will only be granted when there is a good reason backed by supporting evidence (e.g. medical certificate). 1. Consider the following dynamic macro model (1) (2) Ct = β 0 + β 1 Yt + αCt−1 Yt = Ct + Jt where Ct denotes private consumption (in period t), Jt denotes autonomous expenditure and Yt symbolizes GDP. Assume that the initial conditions C0 and J0 are known, and that the parameters β 0 , β 1 , α also are known numbers. (a) Explain the economic interpretation of the model in equation (1) and (2). (b) Assume Jt = J0 , i.e., constant at the initial level J0 . Draw a graph that illustrates the stable solution path for Yt in the case where Y0 is above the long run steady state level of Y . Explain. Replace (2) by (3) Yt = Ct + Jt + P CAt where P CAt denotes the primary current account (or trade balance). Assume the following function for P CAt : (4) P CAt = γ 0 + γ 11 σ t + γ 12 σ t−1 + γ 20 Yt where σ t denotes the real exchange rate (as defined in the book by Burda &Wyplosz). (a) What do you regard to be reasonable signs of the derivative coefficients (γ 11 , γ 12 , γ 20 ) in equation (4)? What about the sum γ 11 + γ 12 ? (b) Discuss the condition(s) of stability of the system made up of (1), (3) and (4). (c) Choose a set of numbers for the derivative coefficients of the system (1), (3) and (4) and (using that set of coefficients values), show how GDP is affected by a permanent increase in the real exchange rate. 2. In small open economies, there is a lot of interest (and concern) about wage formation, in particular in the sectors of the economy which face competition from foreign firms, i.e., the exposed sector. 1 (a) Why, according to your understanding, is wage formation so important in the economic-policy debate? A general wage equation is represented by (5) we,t = β 0 + β 11 mct + β 12 mct−1 + β 21 ut + β 22 ut−1 + αwe,t−1 . where we is the log of hourly wage costs (wage costs per man-hour) in the exposed sector, and ut is the rate of unemployment (or its log) in the economy. mct represents the main-course variable of the Norwegian model of inflation, hence mct = qe,t + ae,t where qe,t and ae,t denote the logs of the e-sector product price and average labour productivity, respectively. (b) Explain (briefly) under which theoretical assumptions mct can be viewed as an exogenous variable in the wage equation. (c) Show that the restriction 0 < α < 1 implies a dynamic wage equation in equilibrium correction form (EC). (d) Show that the following restrictions on (5): α = 1, β 11 + β 12 = 0, β 21 + β 22 < 0, imply a dynamic wage equation in Phillips-curve form. (e) Explain why both the Phillips curve and the EC versions of equation (5) are consistent with a main hypothesis of the Norwegian model of inflation, namely that in steady-state, wage growth ( ∆we,t ) is equal to the growth in the main-course variable (∆mct ). 3. Figure 1 shows graphs of the Swedish nominal and real exchange rate. You may want to down-load the data series from the web-page: http://folk.uio.no/rnymoen/ECON3410_index.htm. The name of the file is swefex.zip. (a) In your view, has the Swedish governments of the past successfully used devaluation to improving competitiveness? (b) What does macroeconomic theory predict about the short- and long-run effects of a devaluation on the real exchange rate? (c) In late 1992, Sweden adopted a floating exchange rate regime. Try to investigate empirically, using the data set, whether the correlation between the nominal and real exchange rate has been increased or reduced after the change to a floating exchange rate regime. 2 160 150 Nominal effective exchange rate (fall means devaluation/depreciation) 140 130 120 110 Real effective exchange rate (fall means improved competetiveness) 100 90 1980 1985 1990 1995 2000 Figure 1: Swedish effective (i.e., trade weighted) exchange indices (1995=100). 3