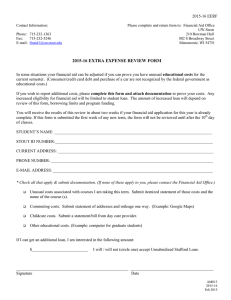

A federal student aid eligibility criteria for postsecondary students who:

advertisement