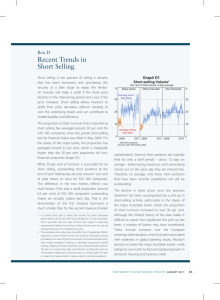

Working Paper A Study of Market-Wide Short-Selling Restrictions

advertisement