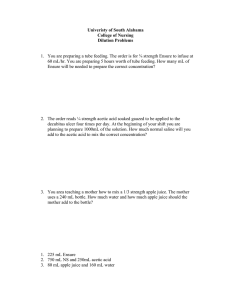

Staff Paper

advertisement