Document 11951140

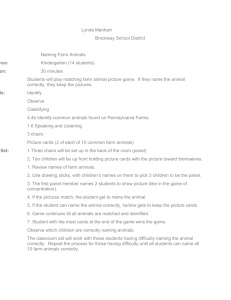

advertisement