DAIRY FARM BUSINESS SUMMARY WESTERN AND CENTRAL PLAIN

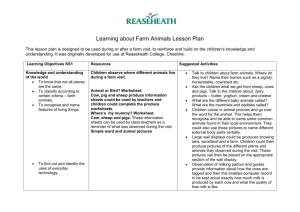

advertisement