2009 FEDERAL REFERENCE MANUAL FOR REGIONAL SCHOOLS Small Businesses and Farms

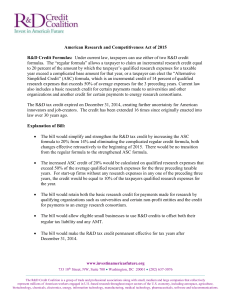

advertisement