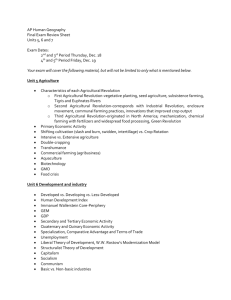

Agriculture-Based Economic Development in New York State: Assessing the Inter-industry

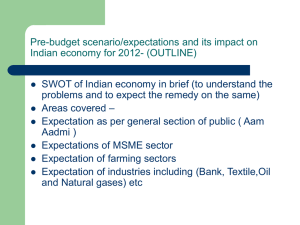

advertisement