Dublin City School District Five-Year Financial Forecast

advertisement

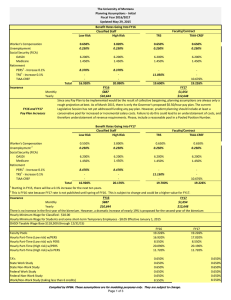

DUBLIN CITY SCHOOL DISTRICT 10/26/2015 FIVE YEAR FORECAST FOR THE FISCAL YEARS ENDING JUNE 30, Original ACTUAL 7/10 - 6/11 ACTUAL 7/11 - 6/12 ACTUAL 7/12 - 6/13 ACTUAL 7/13 - 6/14 ACTUAL 7/14 - 6/15 ESTIMATED 7/15 - 6/16 ESTIMATED 7/16 - 6/17 ESTIMATED 7/17 - 6/18 ESTIMATED 7/18 - 6/19 ESTIMATED 7/19 - 6/20 OPERATING REVENUES: Real Estate Tax Tangible Tax Interest Other Local Federal State Taxes Reim. State $124,286,218 747,838 565,218 1,291,683 1,240,380 21,804,689 12,755,743 $126,677,030 36,950 438,701 1,337,931 690,146 18,895,750 13,325,468 $133,678,702 7,653 267,684 1,458,504 104,948 16,850,849 13,428,352 $144,698,952 10,443 171,488 1,379,821 0 18,156,207 14,750,497 $148,635,768 446 282,692 1,484,162 0 18,403,144 17,950,153 $150,345,346 0 332,689 1,255,280 0 15,109,354 18,117,487 $153,170,948 0 395,450 1,272,866 0 14,483,220 19,382,549 $156,195,093 0 441,048 1,290,804 0 14,710,142 19,563,874 $159,261,736 0 488,144 1,309,100 0 14,939,695 19,747,013 $162,273,866 0 496,746 1,327,762 0 15,164,616 19,931,983 Total Operating Receipts $162,691,769 $161,401,976 $165,796,692 $179,167,408 $186,756,365 $185,160,156 $188,705,033 $192,200,961 $195,745,688 $199,194,973 OPERATING EXPENDITURES: Wages Fringe Benefits Purchased Services Materials Capital Outlay Other Expenditures $111,108,944 36,158,049 8,083,861 4,137,385 383,373 2,602,918 $110,831,340 38,522,008 7,437,397 3,672,855 216,623 2,363,925 $108,586,841 39,019,413 11,401,014 3,620,885 233,883 2,824,841 $109,496,900 40,362,690 12,170,261 4,985,676 338,738 2,807,867 $112,021,200 40,294,738 13,828,455 4,661,465 2,164,907 2,800,715 $116,989,157 39,428,626 14,540,341 5,476,643 1,772,220 2,898,740 $122,421,740 41,900,588 15,153,373 5,575,496 7,780,387 2,985,702 $127,995,710 44,824,563 15,759,508 5,677,315 7,788,799 3,075,273 $133,790,474 47,965,167 16,502,879 5,782,188 1,797,463 3,167,531 $139,827,293 51,342,999 17,352,254 5,890,207 1,806,387 3,262,557 Total Operating Exp. $162,474,531 $163,044,148 $165,686,877 $170,162,132 $175,771,480 $181,105,727 $195,817,286 $205,121,168 $209,005,702 $219,481,697 $109,815 $9,005,276 $10,984,885 $4,054,429 ($7,112,253) ($12,920,207) ($13,260,014) ($20,286,724) Revenue Over/(Under) Expenditures OTHER SOURCES (USES): Transfers/Advances In Transfers/Advances (Out) $217,238 ($1,642,172) 11,420 (72,921) 268 (538,444) 52,519 (566,240) 774,078 (646,544) 1,024,490 (805,692) 361,768 (592,825) 50,000 (575,050) 50,000 (575,050) 50,000 (575,050) 50,000 (575,050) Total Other Sources (Uses) ($61,501) ($538,176) ($513,721) $127,534 $218,798 ($231,057) ($525,050) ($525,050) ($525,050) ($525,050) Total Receipts Over/ (Under) Expenditures $155,737 ($2,180,348) ($403,906) $9,132,810 $11,203,683 $3,823,372 ($7,637,303) ($13,445,257) ($13,785,064) ($20,811,774) Beginning Cash Balance $40,670,020 $40,825,757 $38,645,409 $38,241,503 $47,374,313 $58,577,996 $62,401,368 $54,764,065 $41,318,808 $27,533,744 Ending Cash Balance $40,825,757 $38,645,409 $38,241,503 $47,374,313 $58,577,996 $62,401,368 $54,764,065 $41,318,808 $27,533,744 $6,721,970 Encumbrances ($1,535,296) ($1,436,940) ($2,625,344) ($2,966,359) ($2,635,673) ($2,807,139) ($3,035,168) ($3,179,378) ($3,239,588) ($3,401,966) Ending Unreserved Balance $39,290,461 $37,208,469 $35,616,159 $44,407,954 $55,942,323 $59,594,229 $51,728,897 $38,139,430 $24,294,156 $3,320,004 Enrollment 14,223 14,461 14,771 The Notes To The Five Year Forecast Are An Integral Part Of This Presentation. 14,886 15,165 15,579 15,764 15,956 16,235 16,454 NOTES TO THE FIVE YEAR FORECAST GENERAL FUND ONLY October 26, 2015 REVENUE ASSUMPTIONS REAL ESTATE VALUE ASSUMPTIONS Property values are established each year by the County Auditor based on new construction and complete or updated values. A reappraisal update of district property values occurred for 2014 values collected in calendar year 2015. The reappraisal provided modest increases. These have been factored into the projection for district property values along with their corresponding tax reduction factors affecting outside voted millage. The Dublin School District has values in Delaware, Franklin and Union Counties. The district's next reappraisal will occur in calendar year 2016 with collections in 2017 for Union County and in calendar year 2017 with collections in 2018 for Delaware and Franklin Counties. For collection year 2016 the historic growth trends will be adjusted from/ to: Res./Ag. 2.0% to 2.0 % (no change); Comm./Ind. 2.0% to 2.0% (no change). For collection year 2017 the historic growth trends will be adjusted from/ to: Res./Ag. 2.0% to 2.0 % (no change); Comm./Ind. 2.0% to 2.0% (no change) For collection year 2018 the historic growth trends will be adjusted from/ to: Res./Ag. 2.0% to 2.0 % (no change); Comm./Ind. 2.0% to 2.0% (no change) Total AV is estimated to increase $60.78 M for new construction and $84.46 M due to reappraisal increases resulting in Class I rates of 46.80 mills and Class II rates of 54.57 mills. For collection year 2019 the historic growth trends will be adjusted from/ to: Res./Ag. 2.0% to 2.0 % (no change); Comm./Ind. 2.0% to 2.0% (no change) For collection year 2020 the historic growth trends will be adjusted from/ to: Res./Ag. 2.0% to 2.0 % (no change); Comm./Ind. 2.0% to 2.0% (no change) ESTIMATED ASSESSED VALUE BY COLLECTION YEARS (IN MILLIONS) Classification Res./Ag. Comm./Ind. P.U... Pers. Total Est. 2016 $2,209 765 62 Est. 2017 $2,259 780 62 Est. 2018 $2,365 819 62 Est. 2019 $2,412 836 62 Est. 2020 $2,467 853 62 $3,036 $3,101 $3,246 $3,310 $3,382 NEW TAX LEVIES New levies are estimated to be collected at 96% of the annual amount. This allows for 2.25% delinquency and 1.75% A & T fees. Also, 52% of new Res./Ag. is expected to be collected in March tax settlements and 48% collected in August tax settlements. Public Utility taxes are estimated at 50% in March and August. These timing estimates are very important to estimating when new levy or new construction tax dollars will be available to the district. ESTIMATED REAL ESTATE TAX Source New Base New Construction Delinquent Reappraisal Dublin City Cooperative Agreement FY16 $145,174,685 $1,895,225 $2,868,005 $107,431 $1,500,000 Win Win Deduction ($1,200,000) Total $150,345,346 FY17 $147,177,342 $2,697,937 $2,982,725 $12,944 $1,500,000 ($1,200,000) $153,170,948 Page 1 FY18 $149,888,223 $2,716,488 $3,102,034 $188,348 $1,500,000 ($1,200,000) $156,195,093 FY19 $152,793,059 $2,779,730 $3,226,116 $162,831 $1,500,000 ($1,200,000) $159,261,736 FY20 $155,735,620 $2,868,946 $3,355,160 $14,140 $1,500,000 ($1,200,000) $162,273,866 INTEREST INCOME Interest income will increase and decrease as the cash position of the General Fund fluctuates over the forecast period. The Federal reserve's overnight rate is 0.00 - 0.25% and is expected to stay at those levels until later half of 2015. We have used approximately 0.18% of general fund revenues as a guide for interest income in FY15. Funds are predominately invested in STAR Ohio, STAR Plus, Brokered CD's, Highly Rated Commercial Paper, Agencies, T-bills, T-notes, and interest bearing sweep accounts. Security of the funds collected by the district is the top priority of the treasurer's office. OTHER LOCAL REVENUES These amounts are estimated based on past trends. Our tuition rate will increase along with the percentage of total General Fund income that comes from local property taxes. Rentals, pay to participate, & student fees are generally stable. Slight increases in building rental rates are planned at this time and could be increased over the five year forecast. Other fees are expected to remain stable. Source Pay To Participate Tuition Student Fees Building Rentals Donations Other Total FY16 $248,000 440,231 68,000 439,049 0 60,000 FY17 $248,000 449,036 68,000 447,830 0 60,000 FY18 $248,000 458,017 68,000 456,787 0 60,000 FY19 $248,000 467,177 68,000 465,923 0 60,000 FY20 $248,000 476,521 68,000 475,241 0 60,000 $1,255,280 $1,272,866 $1,290,804 $1,309,100 $1,327,762 STATE TAXES REIMBURSEMENT a) ROLLBACK & HOMESTEAD REIMBURSEMENT These funds are reimbursements from the State for tax credits given owner occupied residences equaling 12.5% of the gross property taxes charged residential taxpayers and up to 10% for commercial and industrial taxpayers. These amounts will grow along with new levies and new construction in Res./Ag/ and Comm. /Ind. property classifications. HB 66 has eliminated the 10 percent rollback on Class II property (commercial and industrial), and HB119 has expanded the homestead exemption for seniors for the first $25,000 of value. Source Base R & H New Construction Total FY16 $14,104,894 $166,876 FY17 $14,271,770 $211,450 FY18 $14,483,220 $226,922 FY19 $14,710,142 $229,553 FY20 $14,939,695 $224,921 $14,271,770 $14,483,220 $14,710,142 $14,939,695 $15,164,616 b) TANGIBLE PERSONAL PROPERTY REIMBURSEMENTS These amounts reflect the state's reimbursement of tangible personal property tax that is being phased out in HB66. The current state biennium budget has increased the rate of the phase out of the TPP "hold harmless" payments so that the District will be completely phased out of the "hold harmless" payments in FY17 and beyond. Source TPP Reimbursement FY16 837,584 Total FY17 $837,584 Page 2 FY18 FY19 FY20 0 0 0 0 $0 $0 $0 $0 SUMMARY OF STATE TAXES REIMBURSEMENT Source Rollback and Homestead TPP Reimbursement FY16 $14,271,770 837,584 FY17 $14,483,220 0 FY18 $14,710,142 0 FY19 $14,939,695 0 FY20 $15,164,616 0 $15,109,354 $14,483,220 $14,710,142 $14,939,695 $15,164,616 STATE REVENUE ESTIMATES The current biennium budget for FY16 & FY17 has anticipated increases in basic aid for Dublin of 7.5% in FY16 compared to FY15 and an additional 7.5% compared to FY16. We have assumed modest increases beyond the current biennium budget of 1.0% per year. With the best information available, we have developed these estimates for FY16 and beyond. A) State Foundation Funding Revenue Source State Foundation Formula Casino Revenue Special Ed Catastrophic Total FY16 16,867,487 750,000 500,000 FY17 18,132,549 750,000 500,000 FY18 18,313,874 750,000 500,000 FY19 18,497,013 750,000 500,000 FY20 18,681,983 750,000 500,000 $18,117,487 $19,382,549 $19,563,874 $19,747,013 $19,931,983 RETURN OF ADVANCES & REFUND OF PRIOR YEAR EXPENDITURES These are non-operating revenues which are the repayment of short term loans to other funds over the previous fiscal year and reimbursements for expenses received for a previous fiscal year in the current fiscal year. All advances over year end are planned to be returned in the succeeding fiscal year. Source Advance Returns R.O.P.Y.E. (*) Total FY16 $328,000 33,768 FY17 $50,000 0 FY18 $50,000 0 FY19 $50,000 0 FY20 $50,000 0 $361,768 $50,000 $50,000 $50,000 $50,000 (*) refund of prior years expenditures. SHORT TERM BORROWING No short term or long term General Fund borrowing is anticipated at this time. Page 3 EXPENDITURE ASSUMPTIONS WAGES The model reflects pay increases approved by the Board of Education for certificated, administrative and technical staff of 2.00% effective August 1, 2014; 2.00% effective August 1, 2015; 2.00% effective August 1, 2016 and estimates for historic/ economic wage increases each year through FY 2020. Increases and step & training increases are projected to grow as additional staff members are added for growth in staff. Classified employees, covered by the DSA agreement, approved increases of 2.0% for contract periods effective July 1, 2014; 2.00% effective July, 1, 2015; 2.00% effective July 1, 2016 and estimates have been included through FY 2020. Estimates in staff growth have been included in the estimates based on the District's staffing plan that has been included. Source Base Wages Increases Steps & Training Growth Staff Reductions Total FY16 $111,821,200 2,236,424 2,124,603 806,930 0 FY17 $116,989,157 2,339,783 2,222,794 870,006 0 FY18 $122,421,740 2,448,435 2,326,013 799,522 0 FY19 $127,995,710 2,559,914 2,431,918 802,932 0 FY20 $133,790,474 2,675,809 2,542,019 818,991 0 $116,989,157 $122,421,740 $127,995,710 $133,790,474 $139,827,293 FY16 $15,654,968 313,099 297,444 112,970 871,061 297,855 268,332 FY17 $16,378,482 327,570 311,191 121,801 914,614 312,748 0 FY18 $17,139,044 342,781 325,642 111,933 960,345 328,385 0 FY19 $17,919,399 358,388 340,469 112,410 1,008,362 344,804 0 FY20 $18,730,666 374,613 355,883 114,659 1,058,780 362,044 0 $17,815,729 $18,366,406 $19,208,130 $20,083,832 $20,996,645 FRINGE BENEFIT ESTIMATES A) STRS/SERS will increase by 14% of wages paid. Source Base Wages Increases Steps & Training Growth STRS/SERS Pickup SERS Surcharge SERS Arrearage Total Page 4 B) A reduction of 10.0% for FY16 and 9.0% increases per year have been included in FY17 through FY20 estimates , for medical, dental and vision insurances which is the best data available at this time. Source Base Costs Growth Inflation Total FY16 $21,435,755 64,554 ($2,143,576) FY17 $19,356,733 69,600 1,742,106 FY18 $21,168,439 63,962 1,905,160 FY19 $23,137,561 64,235 2,082,380 FY20 $25,284,176 65,519 2,275,576 $19,356,733 $21,168,439 $23,137,561 $25,284,176 $27,625,271 WORKERS COMPENSATION C) Workers compensation is expected to increase by 4.5% per year reflecting growth in wages. We will continue to explore options to our current group rating plan. Source Base Costs Growth Total FY16 $487,869 4,115 $491,984 FY17 $514,123 4,437 $518,560 FY18 $541,895 4,078 $545,973 FY19 $570,542 4,095 $574,637 FY20 $600,496 4,177 $604,673 D) Medicare will continue to increase along with salaries. Contributions are 1.45% for all new employees to the district since April 1, 1986. Source Base Costs Growth Total FY16 $1,552,480 11,700 $1,564,180 FY17 $1,634,568 12,615 $1,647,183 FY18 $1,721,306 11,593 $1,732,899 FY19 $1,810,879 11,643 $1,822,522 FY20 $1,904,535 11,875 $1,916,410 FY16 $17,815,729 19,356,733 491,984 1,564,180 200,000 FY17 $18,366,406 21,168,439 518,560 1,647,183 200,000 FY18 $19,208,130 23,137,561 545,973 1,732,899 200,000 FY19 $20,083,832 25,284,176 574,637 1,822,522 200,000 FY20 $20,996,645 27,625,271 604,673 1,916,410 200,000 $39,428,626 $41,900,588 $44,824,563 $47,965,167 $51,342,999 SUMMARY OF FRINGE BENEFITS Source STRS/SERS Insurance's Workers Comp Medicare Other Total Page 5 PURCHASED SERVICES The district has negotiated electric and gas service contracts and implemented an aggressive energy conservation program to help hold down energy cost increases. The district has continued to contract with the ESC-COG for sub personnel services in FY 16. In FY13, additional maintenance projects were identified that were need over the next several years so additional monies were allocated in for FY14 - FY20. An overall inflation rate of 4% is being estimated for this category of expense. Source Base Services Technology License & Maint Agreements Maintenance Total FY16 $13,956,593 183,748 400,000 FY17 $14,721,955 31,418 400,000 FY18 $15,359,508 0 400,000 FY19 $15,989,888 112,991 400,000 FY20 $16,762,994 189,260 400,000 $14,540,341 $15,153,373 $15,759,508 $16,502,879 $17,352,254 MATERIALS AND SUPPLIES Additional maintenance projects were identified over the next couple years so additional monies were allocated in FY15-FY20. An overall inflation rate of 3% is being estimated for this category of expense. Source Supplies GCOS Maintenance Total FY16 $3,295,101 1,981,542 200,000 FY17 $3,393,954 1,981,542 200,000 FY18 $3,495,773 1,981,542 200,000 FY19 $3,600,646 1,981,542 200,000 FY20 $3,708,665 1,981,542 200,000 $5,476,643 $5,575,496 $5,677,315 $5,782,188 $5,890,207 CAPITAL OUTLAY / EQUIPMENT The District entered into a cooperative agreement with the City of Dublin in FY14, and as part of the agreement the City of Dublin is planned to make $1.5 million payments to the District each year over the next 30 years. For the next several years, the District plans to use the funds for technology equipment and infrastructure upgrades. An overall inflation rate of 3% is being estimated for all other expenses in this category. In November 2012, the District passed a $15.87 million bond issue to purchase replacement buses and equipment, as well as, expand, maintain, and repair district facilities over the proceeding 3-4 years. As the bond money has depleted on the established projects, facility needs are aniticipated in FY16 & FY17 paid from the general fund while other funding possibilites are discussed for continued future needs. Source Capital Outlay Maintenance/Buses/Technology Dublin City Coop Agreement Total FY16 $272,220 0 1,500,000 FY17 $280,387 6,000,000 1,500,000 FY18 $288,799 6,000,000 1,500,000 FY19 $297,463 0 1,500,000 FY20 $306,387 0 1,500,000 $1,772,220 $7,780,387 $7,788,799 $1,797,463 $1,806,387 Page 6 OTHER EXPENSES The category of Other Expenses consist mostly of Auditor & Treasurer fees and County Educational Service Center deductions for participation in the SB140 City/County agreement. Auditor and treasurer fees will increase sharply anytime a new operating levy is collected. Also new construction will cause A & T fees to increase as more tax dollars are collected. Source Other expenses Total FY16 $2,898,740 FY17 $2,985,702 FY18 $3,075,273 FY19 $3,167,531 FY20 $3,262,557 $2,898,740 $2,985,702 $3,075,273 $3,167,531 $3,262,557 NON OPERATING EXPENSES This account group covers fund to fund transfers and end of year short term loans from the General Fund to other funds until they have received reimbursements and can repay the General Fund. Summer school costs have increased due to additional state mandated remediation of students struggling with achievement tests and because the Board of Education has departed from the policy of making summer school operate at a breakeven with fees collected. Source Athletic Transfer Summer School Sinking Fund Refund of Prior Year Receipt Advances Total FY16 $84,050 65,000 380,000 13,775 50,000 $592,825 FY17 $80,050 65,000 380,000 0 50,000 $575,050 FY18 $80,050 65,000 380,000 0 50,000 $575,050 FY19 $80,050 65,000 380,000 0 50,000 $575,050 TAX ANTICIPATION NOTE REPAYMENT No General Fund borrowing is planned in this five year projection. ENCUMBRANCES These are outstanding purchase orders that have not been approved for payment as goods were not received in the fiscal year in which they were ordered. This is estimated to run about 1.55% of expenditures for the foreseeable future. ENDING UNENCUMBERED CASH BALANCE This amount must not go below $-0- or the district General Fund will violate all Ohio Budgetary Laws. Any multi-year contract which is knowingly signed which will cause a negative unencumbered cash balance is a violation of 5705.412, ORC, punishable by personal liability of $10,000. Page 7 FY20 $80,050 65,000 380,000 0 50,000 $575,050