MISSOULA CAMPUS FISCAL YEAR END PROCEDURES PREPAID EXPENSES

advertisement

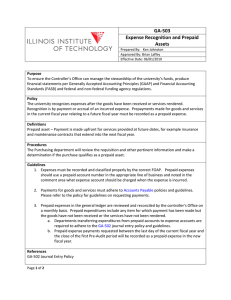

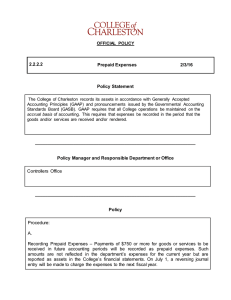

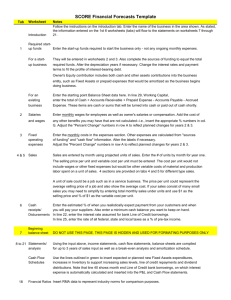

MISSOULA CAMPUS FISCAL YEAR END PROCEDURES PREPAID EXPENSES 1 Definition Prepaid expenses are items over $500.00 that are paid during the current fiscal year but are actual costs for the next fiscal year. All items or services must be received or provided after June 30 to be considered a prepaid expense. These expenses are recognized as an asset (prepaid) in the current fiscal year and as an expense in the next fiscal year. This process is not applicable to Grants and Plant Funds. Examples of Prepaid Expenses Airline tickets purchased for trips to be taken after July 1. Prepaid registration fees/hotel accommodations for conferences occurring after July 1st. Subscriptions or membership fees for next fiscal year. Prepaid service fees (service contracts) or software licenses for next fiscal year. Expenditure transactions, which are matched to deferred revenue (i.e., summer session). Procedures Invoices Processed through GrizMart Payments identified as prepaid expenditures will require a special activity code when entered for payment. The Activity Code is PREPAY. Back up for Banner/GrizMart PREPAY will be in GrizMart, no additional backup will be required. Accounting Services will run a report on the activity PREPAY and move those documents to 1905 for year end and reverse after fiscal year end to FY16 expenses. ProCard / Request and Authorization for Travel (RAT) ProCard / RATpayments relevant to the new fiscal year will be recorded in BANNER to the appropriate balance sheet account 1905. Departments can code directly to 1905 for any ProCard expense that meets the required prepaid criteria. Departments must submit supporting documentation to Barb Bybee on or before noon Friday July 8, 2016. Documentation must include: Copy of invoice that shows proof that the expense belongs in the new fiscal year Banner Document Number and date (i.e. S0022337 6/30/0X) Index Account Code Amount Accounting Services will prepare a journal voucher to be entered in Banner to reverse the prepayments and record the expense in the new fiscal year. The JV is a debit to expense and credit to the prepaid balance sheet account 1905. 1 of 3 MISSOULA CAMPUS FISCAL YEAR END PROCEDURES PREPAID EXPENSES Missoula BANNER A/R Prepaid Expenses Summer semester UM – Missoula scholarship and fee waivers recorded via the BANNER system will be correctly coded as a prepaid expense through the system, utilizing the term based detail codes. Accounting Services will clear this activity in the new fiscal year by preparing an Excel spreadsheet to debit expense and credit 1905 (prepaid). The spreadsheet will be converted to a feed file and submitted to Systems to be loaded into Banner in the New Year. These prepaid transactions can be found by doing a query in BANNER Finance (FGIGLAC) for account code 1905 and document numbers that begin with ‘F’. Payroll Summer Session teaching salaries will be coordinated through Departments. Salaries identified as prepaid will require special coding on the RPT for proper payroll processing. These are as follows: Correct Position Number Index Code Correct Expense Account Code SMR-16 in the activity code field Using activity code SMR-16 will identify these transactions as next year’s expense on the JGRBDSC and JGROMYG reports until they are moved before year-end closing. The process to convert the SMR-16 expenses to the 1905 prepaid account is automated through Payroll. 2 of 3 MISSOULA CAMPUS FISCAL YEAR END PROCEDURES PREPAID EXPENSES Reports The available budget balance reported on JGIBDST will be correct for all expense accounts except payroll and GrizMart PREPAY transactions. GrizMart PREPAY transactions and prepaid payroll expenses will be moved to the balance sheet account 1905 on a periodic basis. To view the true FY16 activity prior to the move, you will need to follow the instructions below. JGIBDST (online) Enter the index code and activity code SMR-16 or PREPAY (This will display all prepaid payroll activity or GrizMart PREPAY activity). Record the prepayment total Rollback Enter the index code only. (This will display all current and prepaid activity expenses). Subtract the prepayment amount from the current activity to see expenses applicable to current year. Add the prepayment total to the available balance to see current year available balance. This should be done account code by account code. DepartmentsTo ensure all prepaid expenses are properly recorded, a summary sheet should be sent to Barb Bybee. This sheet should include: Banner document number, date, index code, expense account code, vendor name, and amount for each prepaid expense incurred using a procard or RAT payment. Please contact Accounting Services/Barb Bybee (x6261) for any questions regarding these procedures. 3 of 3