Program Modification Form Department/program Summary

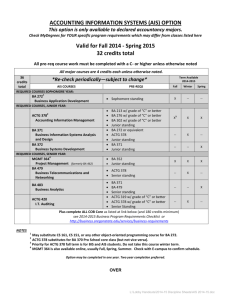

advertisement

Program Modification Form I Summary of Proposed Changes Masters of Accountancy (Dept. of Accounting & Finance) Department/program Change course requirements (add one required, drop another), remove Summary requirement for technology credits, limit internship credits applicable to degree. II Endorsements and Approvals Please obtain the Program Chair/Director’s approval and Dean’s approval. Please type / print name Signature Requestor: Phone: Program Chair/Director: Dr. Terri Herron X5878 Dr. Teresa Beed Department Dean Dr. Larry Gianchetta Dr. Bambi Douma, MBA Director Other affected Programs: (Use additional sheet if needed) Date Are other departments/programs affected by this Please obtain signature(s) from the modification because of Chair/Director of any such department/ program (a) required courses incl. prerequisites or (above) before submission corequisites, (b) perceived overlap in content areas (c) cross-listing of coursework III Type of Program Modification (e.g. adding a writing course required of all majors.) Please X check the appropriate box. Major Minor Option Teaching X major/minor Other Please describe IV Catalog Language If you are proposing a change to an existing Please provide the proposed copy as you wish it program or major, please cut and paste the to appear in the catalog. requirements as they appear in the current catalog below. www.umt.edu/catalog On Graduate School website: On Graduate School website: M.Acct. Accountancy M.Acct. Accountancy Requirements: 30 credits including 16 credits of required courses and 14 elective credits, and an exit exam. In addition to the foundation program, 24 credits of accounting fundamentals courses are prerequisite to graduate work. Requirements: 30 credits including 15 credits of required courses and 15 elective credits, and an exit exam. In addition to the foundation program, 23 credits of accounting fundamentals courses are prerequisite to graduate work. On SoBA website: MAcct Professional Program ACTG ACTG ACTG ACTG 611 615 631 641 Consol. Financial Stmts. 2 Accounting Theory 3 Advanced Tax 3 Advanced Auditing 3 On SoBA website: MAcct Professional Program ACTG ACTG ACTG ACTG ACTG 611 615 616 631 641 Consol. Financial Stmts. 2 Accounting Theory 3 Advanced Financial Topics 3 Advanced Tax 3 Advanced Auditing 3 ACTG 661 Accounting Law & Ethics 3 ACTG/MBA/IS 655/656 Technology Perspective 2 ACTG 675 Elective--Contemp. Acct. Prob. 4 Electives: 600-level electives 1-3 600-level electives 1-3 300- to 600-level elective 3 One of the accounting fundamentals courses may be used as an elective in the professional program if taken for graduate credit. MAcct Fundamentals ACTG 203 Accounting Lab 1 ACTG 321 Accounting Information Systems I 3 ACTG 305 Corporate Reporting I 3 ACTG 306 Corporate Reporting II 3 ACTG 307 Corporate Reporting III 3 ACTG 410 Cost/Management Accounting I 3 ACTG 401 Principles of Fed. Taxation--Individuals 3 ACTG 411 Auditing I 3 ACTG 415 Government/Not-for-Profit Accounting I 3 Total 25 cr. NOTES: 1. Must earn a C or better, but an overall GPA of 3.0 or better is required for these 8 classes. 2. One 400-level accounting fundamentals course can be taken for graduate credit after admission to the MAcct. ACTG 661 Accounting Law & Ethics 3 ACTG/MBA/IS 655/656 Technology Perspective 2 Electives (15 cr chosen from): ACTG 675 Contemp. Acct. Prob. 4 ACTG 698 Internship 1-3 600-level electives 1-3 400-level- to 600- elective 1-3 600-level electives 5-15 Up to three credits from one of the 400-level accounting fundamentals courses may be used as an elective in the professional program if taken for graduate credit. MAcct Fundamentals ACTG 203 Accounting Lab 1 ACTG 321 Accounting Information Systems I 3 ACTG 305 Corporate Reporting I 3 ACTG 306 Corporate Reporting II 3 ACTG 307 Corporate Reporting III 3 2 ACTG 410 Cost/Management Accounting I 3 ACTG 401 Principles of Fed. Taxation--Individuals 3 ACTG 411 Auditing I 3 ACTG 415 Government/Not-for-Profit Accounting I 3 ACTG 425 State & Local Gov’t Acctg 2 ACTG 426 Acctg for Nonprofit Organizations 1 Total 25 23 cr. NOTES: 1. Must earn a C or better, but an overall GPA of 3.0 or better is required for these 8 classes. 2. Up to three credits from the One 400-level accounting fundamentals courses can be taken for graduate credit after admission to the MAcct. Please explain/justify the new proposal or change. We are proposing three changes to the curriculum: (1) remove the requirement to obtain 2 “tech” credits within the 30 credits for the degree, (2) limit the number of internship credits allowed as free electives to a maximum of 3 credits, and (3) deleted ACTG 611 and add ACTG 616 as necessitated by a shift in curriculum content at the undergraduate level. 1. Remove the requirement to obtain 2 “tech” credits within the 30 credits for the degree. Since this requirement was implemented some years ago, many of the required MAcct classes have incorporated a technology component. Further, the committee believes that students entering the MAcct have sufficient technology skills that do not warrant making them complete computer technology courses in the graduate program. 2. Limit the number of internship credits allowed as free electives to a maximum of 3 credits. Because the degree is 30 credits, the current maximum of 6 credits of internship allowed in the degree represents 20% of the degree. Note that limiting the number of internship credits allowed for the degree does not preclude students from completing lengthy internships. They will only be able to count 3 of the credits toward the 30 credits required to complete the MAcct Program. 3. The undergraduate accounting curriculum is changing to comply with credit restrictions in posed by AACSB. The proposed changes in the undergraduate accounting curriculum result in corresponding changes to the MAcct curriculum and accounting fundamentals courses as follows: Current MAcct Requirements: ACTG 611 ACTG 615 ACTG 631 ACTG 641 ACTG 661 Consolidations Actg Theory Adv Taxation Adv Audit Actg Law & Ethics Proposed MAcct Requirements: 2 cr 3 cr 3 cr 3 cr 3 cr ACTG 616 ACTG 615 ACTG 631 ACTG 641 ACTG 661 Adv Financial Topics Actg Theory Adv Taxation Adv Audit Actg Law & Ethics 14 cr Technology Courses Free Electives (400-level max 3 cr) Total 3 cr A 3 cr 3 cr 3 cr 3 cr 15 cr 2 cr Technology Courses 2 cr 14 cr Free Electives (ACTG 698 max 3 cr; 400-level max 3 cr) 15 cr Total 30 cr 30 cr NOTE A: Course would include material from the old ACTG 611, plus material shifted from ACTG 307. The content would focus on complex financial accounting topics not included elsewhere in the accounting curriculum. ACTG 611 would be deleted. Current ACTG Fundamentals Courses Required (beyond ACTG 201/202): ACTG 203, 305, 306, 307, 321, 401, 410, 411, 415 (25 cr.) Proposed ACTG Fundamentals Courses Required (beyond ACTG 201/202/203): ACTG 203, 305, 306, 307, 321, 401, 410, 411, 425, 426 (23 cr.) (reflects change in undergraduate program and lists ACTG 203 as a business foundation course rather than an accounting fundamental course) V Copies and Electronic Submission Once approved, the original, a paper copy and an electronic file are submitted to the Faculty Senate Office, UH 221 (camie.foos@mso.umt.edu). VI Department Summary Required if several proposals are submitted. In a separate document list program title and proposed change of all proposals. Revised 11-2009