Innovation Inducement Prizes: Connecting Research to Policy Please share

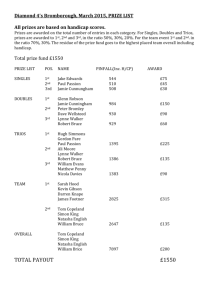

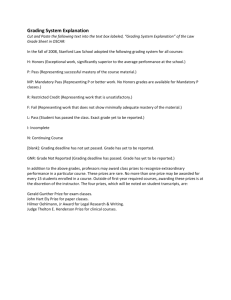

advertisement