2016-2017 Verification Worksheet - Independent

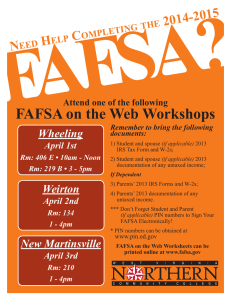

advertisement

V6 2016-2017 Verification Worksheet - Independent Your FAFSA has been selected for a review process called “Verification.” What is Verification? Verification is a process to confirm the information you provided on the FAFSA. Normally the U. S. Department of Education selects those FAFSAs the school must verify. The school may also select files to be verified. Can I still receive aid? You cannot receive aid until Verification is completed. What must I do to complete Verification? You must complete this Verification Worksheet and submit all requested information to Lourdes Financial Aid Office (FAO). All forms and documentation must be received at the same time, as one package, at the FAO. Incomplete packages cannot be reviewed and will be returned. How long does the Verification process take? After you have turned in your complete package of information to Lourdes FAO, the package will be reviewed by FAO’s Verification team. During this review, the team may need to contact you to clarify information or ask for additional documentation. Then the team can finalize the review and transmit the verified data to the U.S. Department of Education (DOE). DOE receives, processes, and returns a response to you in the form of an updated Student Aid Report (SAR) and also notifies Lourdes FAO. This is normally about 5 business days. Lourdes FAO will then review the information returned from the DOE and adjust your aid, if needed. If your aid package has changed a revised award will be created within 5 business days. Check your Web Self Service account on the Lourdes Portal. Federal IRS Tax Transcripts are now required if you did not pull your IRS federal tax information over to your FAFSA using th e IRS Data Retrieval Tool when you filed your FAFSA online. Previously schools were able to accept copies of federal tax forms these are no longer permitted. If received they will be shredded. You must contact the IRS and requests an IRS Tax Transcript. The transcripts must be sent to you. DO NOT HAVE TAX TRANSCRIPTS SENT/FAXED DIRECTLY FROM THE IRS TO LOURDES FAO Submit required IRS Tax Transcripts with all other forms and documents requested to Lourdes FAO so your Verification package is complete when received. Incomplete packages cannot be processed. HOW TO ORDER YOUR TAX TRANSCRIPT The easiest way is going online and filing out the electronic form at www.irs.gov. Select “Get Transcript of Your Tax Records” and you can request your transcripts by mail or online. Or telephone 1-800-908-9946, this may take longer. Make sure to request the “IRS tax return transcript” (not the “IRS tax account transcript.”) Do not have the IRS Tax Transcript sent to Lourdes FAO You must turn in all verification documents in together, including IRS Tax Transcripts V6 2016-2017 Verification Worksheet - Independent Your FAFSA has been selected by the U.S. Department of Education for a review process called “Verification.” Verification must be completed before your financial aid can be finalized and before any aid will be cr edited to your student account. If there are differences between your FAFSA and this information, we will update your FAFSA, recalculate your aid eligibility , and notify you of the revision INSTRUCTIONS: All supporting documents must be included with this form. Incomplete form/documentation cannot be accepted and will be returned. Verification cannot be completed until all requested documents are received and reviewed. Your aid cannot be processed until verification is completed. Please complete ALL sections of this worksheet, attach ALL requested documentation, sign and return to Lourdes Financial Aid Office (FAO). Step 1 – Student Information __________________________________________________________________________________________________ Student’s Last Name First Name Middle Initial ____________________________________________________________________________________________________________ Student Home Address Lourdes Student ID# ____________________________________________________________________________________________________________ City, State, ZIP Phone number (include area code) Step 2 - Household Information Independent Student: List the persons in your household. Include: Yourself, and your spouse if you have one Your children if you provide more than half of their support from July 1, 2016 through June 30, 2017, even if they don’t live with you Other people if they now live with you, and you provide more than half of their support and will continue to provide more than half of their support from July 1, 2016 through June 30, 2017 Include the name of the college for any household member who you support, who will be enrolled at least half-time in a degree or certificate program between July 1, 2016 and June 30, 2017. (If more space is needed attach a separate page with student name and student Social Security Number or Lourdes ID on it.) Family Member’s Name Age Relationship to Student Name of University/College 1 2 3 4 5 6 7 Self Lourdes University Student Name_________________________________________ Lourdes ID___________________ Step 3 – Student Income Information to be Verified Select: 1.Tax Return Filer, or 2. Non-filer of Tax Return below 1. TAX RETURN FILER—Important Note: If you (or your spouse, if married) filed, or will file, an amended 2015 IRS tax return, the student must contact Lourdes Financial Aid Office (FAO) before completing this section. Instructions: Complete this section if you, the student, filed or will file a 2015 income tax return with the IRS. The best way to verify income is by using the IRS Data Retrieval Tool that is part of FAFSA on the Web. If the student has not already used the tool when he/she completed the FAFSA, go back into FAFSA.gov, log into the student’s FAFSA record, select “Make FAFSA Corrections,” and navigate to the Financial Information section of the form. From there, follow the instructions to determine if the student is eligible to use the IRS Data Retrieval Tool to transfer 2015 IRS income tax information into the student’s FAFSA. NOTE: It takes up to two weeks for IRS income information to be available for the IRS Data Retrieval Tool for electronic IRS tax return filers, and up to eight weeks for paper IRS tax return filers. If you need more information about when, or how to use the IRS Data Retrieval Tool see your financial aid administrator. Check the item below that applies: _____ I, the student, have used the IRS Data Retrieval Tool in FAFSA on the Web to transfer my (and, if married, my spouse’s) 2015 IRS income information into my FAFSA, either on the initial FAFSA or when making a correction to the FAFSA. If you use the IRS Data Retrieval Tool on FAFSA you do not need to turn in Tax Transcripts. (Note: IF YOU MAKE ANY CHANGES ON THE IRS INFORMATION YOU WILL BE REQUIRED TO PROVIDE A COPY OF YOUR 2015 IRS TAX TRANSCRIPT.) _____ I, the student, have not yet used the IRS Data Retrieval Tool, but I will use the tool to transfer my (and, if married, my spouse’s) 2015 IRS income information into my FAFSA once I have filed my 2015 IRS tax return.(See instructions above for information on how to use the IRS Data Retrieval Tool.) Lourdes cannot complete your verification process until the IRS information has been transferred into the FAFSA. (Note: IF YOU MAKE ANY CHANGES ON THE IRS INFORMATION YOU WILL BE REQUIRED TO PROVIDE A COPY OF YOUR 2015 IRS TAX TRANSCRIPT.) _____I, the student, am unable or chooses not to use the IRS Data Retrieval Tool in FAFSA on the web; therefore I have attached a copy of the 2015 IRS tax return transcript to this worksheet. (Copies of income tax return forms are not acceptable.) It takes up to two weeks for IRS income information to be available for electronic IRS tax return filers, and up to eight weeks for paper IRS tax return filers. ____ I, the student, and spouse if married, will not and was not required to file a 2015 federal tax return. Step 4 – W2 Required Complete this section by checking the applicable box below and filling out the table. ATTACH W2 TO FORM. _______ The student (and, if married, the student’s spouse) was not employed and had no income earned from work in 2015 _______ The student (and /or the student’s spouse, if married) did work in 2015. Complete the table below and attach all W2 forms (student and spouse, if married.) (If more space is needed, attach a separate page with your name and Social Security Number or Lourdes ID on it) Employer Name(s) 2015 Amount Earned Is IRS W2 Attached? Yes or No Student Name_________________________________________ Lourdes ID___________________ Step 5 – Food Stamps (SNAP) Did someone in your household (listed in Step 2) receive SNAP (Supplemental Nutrition Assistance Program) food stamps benefits anytime during 2014 or 2015 calendar year? YES______ NO______ Step 6 – Child Support Paid Did you, and/or your spouse if married, pay child support in 2015? If YES, complete the following section: Name of person who paid support Name of person to whom child support was paid YES______ NO______ Name of child for whom support was paid Amount of child support paid in 2015 Step 7 – Verification of Other Untaxed Income for 2015 If any item does not apply, enter “N/A” for Not Applicable where a response is requested, or enter 0 in an area where an amount is requested. If the student was required to provide parental information on the FAFSA answer each question below as it applies to the student and the student’s parent(s) whose information is on the FAFSA. To determine the correct annual amount for each item: If you paid or received the same dollar amount every month in 2015, multiply that amount by the number of months in 2015 you paid or received it. If you did not pay or receive the same amount each month in 2015, add together the amounts you paid or received each month. If more space is needed, provide a separate page with the student’s name and ID number at the top. A. Payments to tax-deferred pension and retirement savings List any payments (direct or withheld from earnings) to tax-deferred pension and retirement savings plans (e.g., 401(k) or 403(b) plans), including, but not limited to, amounts reported on W-2 forms in Boxes 12a through 12d with codes D, E, F, G, H, and S. Name of Person Who Made the Payment Total Amount Paid in 2015 B. Child support received List the actual amount of any child support received in 2015 for the children in your household. Do not include foster care payments, adoption payments, or any amount that was court-ordered but not actually paid. Name of Adult Who Received the Support Name of Child For Whom Support Was Received Amount of Child Support Received in 2015 C. Housing, food, and other living allowances paid to members of the military, clergy, and others Include cash payments and/or the cash value of benefits received. Do not include the value of on-base military housing or the value of a basic military allowance for housing. Name of Recipient Amount of Benefit Received in 2015 Type of Benefit Received D. Veterans non-education benefits List the total amount of veterans non-education benefits received in 2015. Include Disability, Death Pension, Dependency and Indemnity Compensation (DIC), and/or VA Educational Work-Study allowances. Do not include federal veterans educational benefits such as: Montgomery GI Bill, Dependents Education Assistance Program, VEAP Benefits, Post-9/11 GI Bill Name of Recipient Type of Veterans Non-education Benefit Amount of Benefit Received in 2015 E. Other untaxed income List the amount of other untaxed income not reported and not excluded elsewhere on this form. Include untaxed income such as workers’ compensation, disability, Black Lung Benefits, untaxed portions of health savings accounts from IRS Form 1040 Line 25, Railroad Retirement Benefits, etc. Do not include any items reported or excluded in A – D above. In addition, do not include student aid, Earned Income Credit, Additional Child Tax Credit, Temporary Assistance to Needy Families (TANF), untaxed Social Security benefits, Supplemental Security Income (SSI), Workforce Investment Act (WIA) educational benefits, combat pay, benefits from flexible spending arrangements (e.g., cafeteria plans), foreign income exclusion, or credit for federal tax on special fuels. Name of Recipient Type of Other Untaxed Income Amount of Other Untaxed Income Received in 2015 F. Money received or paid on the student’s behalf List any money received or paid on the student’s behalf (e.g., payment of student’s bills) and not reported elsewhere on this form. Enter the total amount of cash support the student received in 2015. Include support from a parent whose information was not reported on the student’s 2016–2017 FAFSA, but do not include support from a parent whose information was reported. For example, if someone is paying rent, utility bills, etc., for the student or gives cash, gift cards, etc., include the amount of that person's contributions unless the person is the student’s parent whose information is reported on the student’s 2016–2017 FAFSA. Amounts paid on the student’s behalf also include any distributions to the student from a 529 plan owned by someone other than the student or the student’s parents, such as grandparents, aunts, and uncles of the student. Purpose: e.g., Cash, Rent, Books Amount Received in 2015 Source G. Additional information: So that we can fully understand the student’s family's financial situation, please provide below information about any other resources, benefits, and other amounts received by the student and any members of the student’s household. This may include items that were not required to be reported on the FAFSA or other forms submitted to the financial aid office, and include such things as federal veterans education benefits, military housing, SNAP, TANF, etc. If more space is needed, provide a separate page with the student’s name and ID number at the top. Type of Financial Support Name of Recipient Amount of Financial Support Received in 2015 Comments: ______________________________________________________________________________________________________________ ______________________________________________________________________________________________________________ ______________________________________________________________________________________________________________ ______________________________________________________________________________________________________________ ______________________________________________________________________________________________________________ ______________________________________________________________________________________________________________ ______________________________________________________________________________________________________________ ____________________________ Step 8 – Certifications and Signatures By signing this form, I affirm that all information on this form and any attachments are complete and accurate to the best of my knowledge. If requested, I agree to provide documentation to support the information I have provided on this form. I understand that if I purposely give false or misleading information on this worksheet it may be cause for denial, reduction, withdrawal, and/or repayment of financial aid, and I may be subject to a fine, imprisonment or both, under provisions of the United States Criminal Code. Student Signature (Required) Spouse Signature (If married spouse signature is optional.) Submit this worksheet to Lourdes Financial Aid Office (FAO) 6832 Convent Blvd. Sylvania, Ohio 43560 Phone: 419-824-3732 Fax: 419-517-8866 Email: Finaid@lourdes.edu Student Income & Living Expenses Assessment Form 2016-2017 The income reported on your Free Application for Federal Student Aid (FAFSA) does not appear sufficient to meet your basic living expenses (i.e. housing, utilities, etc.). You may have additional resources (other than earnings from employment) that should have been included on your FAFSA documenting how you are meeting your living expenses. If so, some types of resources must be considered when determining your federal financial aid eligibility. A. STUDENT INFORMATION Last Name First Name M.I. Lourdes ID Number Address (include apt. no.) Phone Number (include area code) City State Zip Code Lourdes E-mail Address B. DETERMINING YOUR FAMILY HOUSEHOLD INCOME AND RESOURCES Answer each of the following questions based on resources received in 2015: Did you receive free housing from a parent, friend, relative or someone with whom you have a relationship? □ Yes □ No Did you receive food/groceries from a parent, friend, relative or someone with whom you have a relationship? □ Yes □ No Did you receive free child care from a parent, friend, relative or someone with whom you have a relationship? □ Yes □ No List all forms of income/resources you had during calendar year 2015. If you list little or no income/resources you are REQUIRED to provide an explanation in the space provided on the next page of this form. Not all types of income are considered when determining financial aid eligibility. The intent is to establish how you are being supported by the income reported on the FAFSA. If you are a dependent student, your parent information will be used. 2015 Student/Family Income/Resources Income from work (gross amount) Spouse’s income from work (gross amount) Resources from parents or relatives Resources from boyfriend/girlfriend Resources from partner/life partner Unemployment or disability benefits Child support received Business, rental, or farm income Trust fund income Interest/dividend income Annual Amount From January 2015 through December 2015 $ Social Security retirement benefits Social Security Disability benefits (SSI) Public assistance (including TANF) Free or reduced price lunch for children Subsidized housing income Food stamps Veteran’s benefits (non-education) Financial aid refund Other (specify) TOTAL INCOME AND RESOURCES FOR THE ENTIRE YEAR 2015 $ x x x x x x x x x x 12 12 12 12 12 12 12 12 12 12 = = = = = = = = = = total per year total per year total per year total per year total per year total per year total per year total per year total per year total per year x x x x x x x x x 12 12 12 12 12 12 12 12 12 = = = = = = = = = total per year total per year total per year total per year total per year total per year total per year total per year total per year C. DETERMINING YOUR FAMILY HOUSEHOLD EXPENSES Lourdes ID# List all forms of expenses you had during calendar year 2015. If you list few or no expenses you are REQUIRED to provide an explanation in the space provided below. 2015 Student/Family Expenses Rent or mortgage payment Car payment Car fuel and maintenance Groceries Medical, vision, dental insurance Out of pocket medical expenses Clothing expenses Child care expenses Natural gas or fuel oil bill Electric bill Regular and/or cellular telephone bill Annual Amount From January 2015 through December 2015 $ Cable TV bill Internet provider bill Recreational/entertainment Miscellaneous personal expenses Court ordered child support paid Other (specify) TOTAL LIVING EXPENSES FOR THE ENTIRE YEAR 2015 x x x x x x x x x x x 12 12 12 12 12 12 12 12 12 12 12 = = = = = = = = = = = total per year total per year total per year total per year total per year total per year total per year total per year total per year total per year total per year x x x x x x 12 12 12 12 12 12 = = = = = = total per year total per year total per year total per year total per year total per year $ D. PROVIDE ADDITIONAL INFORMATION Please add any clarifying comments regarding your situation that will help with our review. If you listed few or no expenses and/or income you are REQUIRED to provide an explanation. Failure to do so may cause unnecessary delays in the processing of your federal financial aid application. E. SIGN THIS WORKSHEET I understand that signing this form certifies that all the information reported on it is complete and correct. I also understand that if I purposely give false or misleading information on this worksheet, I may be fined, sentenced to jail, or both. Student Date Lourdes University Financial Aid Office 6832 Convent Blvd. Sylvania, OH 43560 P: (419)824-3732. Finaid@lourdes.edu F: (419)517-8866. Lourdes University FAO 6832 Convent Blvd. Sylvania, OH 43560 Ph. 419-824-3732 Fax: 419-517-8866