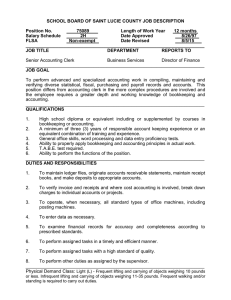

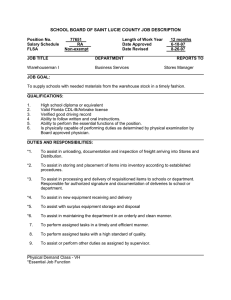

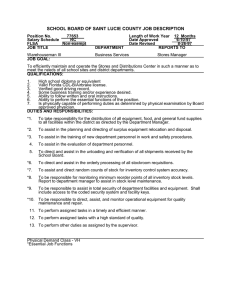

Position: Accounting Technician Position Control: Business & Human Department: Business Office

advertisement

Position: Accounting Technician Department: Business Office Gives Direction: -Director of Fiscal Direct Supervisor: Services Next Level Supervisor: Executive VP of Educ. Admin.: Administrative Services Date Established: Position Control: Business & Human Position Class: Resources Unit: Classified Salary Range: 20 Hours per week: 40 Months per year: 12 FLSA Exemption: Non-Exempt DEFINITION Under general supervision performs a variety of complex technical and responsible accounting duties in the preparation, processing and maintenance of Taft College financial records and the student accounts receivables in the Banner ERP system; may assume a lead responsibility on specific projects or specific accounting operations within the Business Office. Perform related duties as required. CLASS CHARACTERISTICS The Accounting Technician performs complex accounting duties related to the development, preparation and maintenance of Taft College financial reports. REPRESENTATIVE DUTIES: The following duties are typical of those performed by employees in the classification, however, employees may perform other related duties not listed and not all duties listed are necessarily performed by each employee. Collect and monitor cash transactions and cash flows for all district funds. Assemble source documents ensuring appropriate Account coding and posting in a timely manner process, pay invoices and purchase orders. Balance and resolve discrepancies of assigned accounts including cash box. Monitoring and updating effective control system over student receivables and collection accounts. Review and analyze WESTEC activities for accuracy of invoicing and payments. Produce reports to inform program directors and purchasers of financial aid operational performance. Accounting Technician Page 1 of 4 REPRESENTATIVE DUTIES, continued: Assist in the preparation of the District budget and other reports as needed. Aid in preparing audit schedules and accounting reports documenting adjustments to account balances, detailing the audit trails. Ensure deposits are properly recorded and made in a timely manner. Periodically audit purchase requisitions and purchase orders for compliance with the CCCCO budget and accounting manual. Maintain capital project accounting records. Review and maintain record retention files, coordinate destruction of files and ensure proper retention periods are adhered to. Prepare and enter journal entries into the computer. Prepare, distribute and monitor billing statements. Prepare financial and statistical reports, capital project claim forms, and reconciliation statements. Organizes information and prepare reports on current liabilities at year-end. Compile budget reports and researches questionable expenditures for each department. Perform cashier and reception duties as required. Perform purchasing duties as required. Assist and advise student workers. Perform related duties as assigned. EMPLOYMENT STANDARDS Minimum Qualifications Education and Experience An applicant may meet minimum qualifications in one of four (4) ways listed below: 1) High school diploma or equivalent and six (6) years of experience in a responsible accounting/bookkeeping capacity; 2) Non-related degree or equivalent and four (4) years of experience in a responsible accounting/bookkeeping capacity; 3) Associate degree or equivalent in a business related field and two (2) years of experience in a responsible accounting/bookkeeping capacity); 4) Bachelor’s degree or equivalent in a business related field and one (1) year of experience in a responsible accounting/bookkeeping capacity. Accounting Technician Page 2 of 4 Desirable Qualifications: Experience working in a public agency accounting department. Personal: Ability and desire to work effectively with students, staff and the public. Show initiative, poise, good judgment and tact. Oriented in customer service. Flexible in assuming other assignments as the need arises. Possess the sensitivity to and understanding of the diverse academic, socioeconomic, cultural, disability, and ethnic background of community college students. Willing to accept other duties. Knowledge of: Clerical and office skills. Accounting processes, codes, bookkeeping and computer skills. Accounting procedures and programs for collecting fees, preparation of checks, payment of invoices and maintaining and reporting financial records. Computerized word processing, spreadsheets, data entry, internet and email programs as well as use of other common office machines. Maintenance of confidentiality. Basic maintenance of office machines and sources for repair. Basic cashier duties. Effective communication skills. Ability to: Be efficient and well organized. Work independently. Learn basic college procedures. Communicate cordially and effectively with public, students and staff members in person and over the telephone. Prepare forms accurately and neatly. Keep files current, accurate and in order. Analyze and comply with requested data, reports and fiscal operations. Maintain neat and accurate records. WORKING CONDITIONS Assignments are typically 40 hours per week and 12 months per year. May require overtime or evening hours throughout the year. Work is generally performed indoors but may involve traveling to complete assignments or for research, workshops, training or meetings. Accounting Technician Page 3 of 4 PHYSICAL REQUIREMENTS 1. Vision sufficient to read documents and computer terminal displays. 2. Speech and hearing sufficient to communicate in person or by telephone. 3. Manual dexterity sufficient to use a variety of office equipment, computer keyboards, and to handle paper. 4. Ability to sit for long periods of time. 5. Ability to lift and carry up to 25 pounds such as paper and reports. 6. Ability to bend and reach to retrieve and file supplies, equipment and documents. Reasonable accommodations will be made for candidates and employees with physical disabilities. ENVIRONMENT Community college campus serving a diverse student population and with an emphasis on student success. Work is primarily performed in a busy office environment serving students, faculty, staff and the public. SUPERVISION Supervision is received from the Director of Fiscal Services. May provide direction to student workers. May provide or receive direction as assigned. PAY RANGE Range 20 on the Classified Employees Salary Schedule/Non-Exempt. Accounting Technician Page 4 of 4