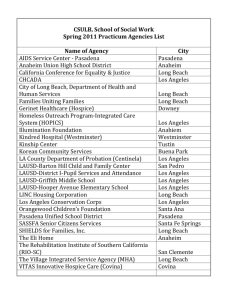

Trade Impact Study Final Report

advertisement