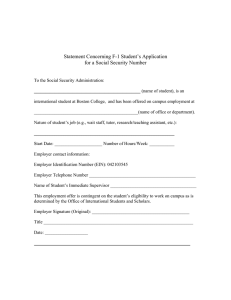

January 2014 Internal Revenue Service

advertisement