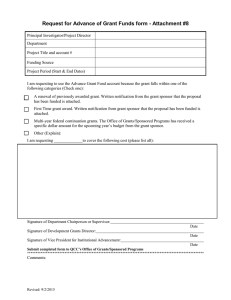

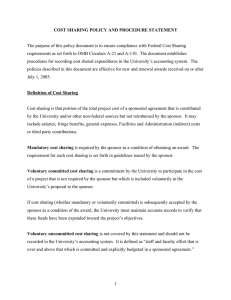

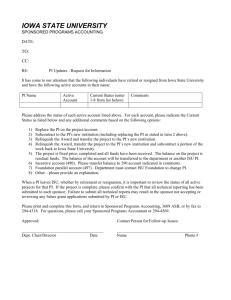

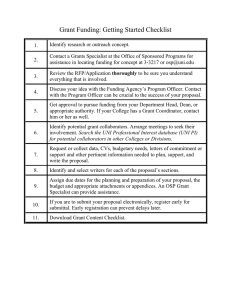

Project Directors Guide and Policy & Procedures Manuals of the

advertisement