The Financial Secrecy Index: Shedding Abstract

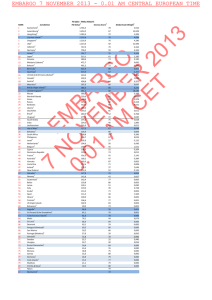

advertisement