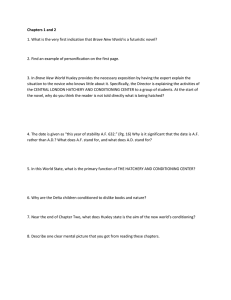

Des Moines Register 08-14-06 Tax incentive puts new face on Huxley

advertisement

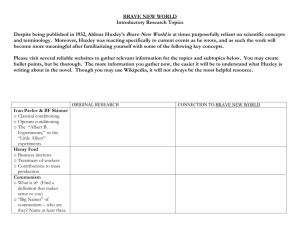

Des Moines Register 08-14-06 Tax incentive puts new face on Huxley Projects proliferate, but so does cost to residents, nearby towns By LEE ROOD REGISTER STAFF WRITER Huxley, Ia. — Here's what a ton of debt can buy a small town: Roughly 200 new jobs and at least 180 homes. A water treatment system. Three miles of roads and sewers. A recreation center, library and police station, all hitched in one spacious building to the local high school. Huxley's city leaders have transformed their town using borrowed money, and they are far from done. Like hungry consumers using credit cards to live more comfortably, officials have leveraged their growing tax base to finance projects that the town of roughly 2,400 could never afford to pay for outright. Increasingly, they have relied on an economic development tool called tax increment financing, or TIF, to jump-start development, from high-end home building to public works to expensive amenities for new employers, such as Monsanto Corp. "When used properly, it can be an excellent economic development tool," City Administrator John Haldeman said. But city officials in Huxley have not always used the tool wisely in the eyes of some officials and economic development experts. Huxley collects more in property taxes for TIF-related projects than any other city in Iowa — almost $30 for every $1,000 worth of property, according to Iowa's Legislative Services Agency. The average is about $12. Most money in the city's coffers is specially earmarked for TIF-related development. Huxley spent almost $1.3 million during its 2006 fiscal year on debt service for those projects. That left roughly $357,000 to pay for city services. Today, all but a few square blocks of the city are contained within the special taxing districts in which property taxes are reserved for development. Few of the districts have expiration dates, or sunsets, assuring that all the new property taxes generated within them can be used indefinitely to finance debt on new projects that may or may not be successful. Some of the development incentives negotiated by city leaders, meanwhile, have stunned townsfolk, pushed the limits of state law and fueled concerns that the state's TIF laws are too permissive. City leaders agreed to give local developers David and Dixon Jensen up to $14 million over 10 years if they filled their 200-lot residential project north of town. The payoff, they gambled, would be nearly 200 new homes worth more than $200,000, which would one day produce revenue for the city. State experts say the handout is enormous compared with other incentives paid to businesses that trigger economic growth: Allied Insurance, for example, will receive $15 million in similar financing over 20 years for its expansion in downtown Des Moines, but the company pledged it would create at least 1,600 jobs. If Huxley had to pay up now, that one housing deal would effectively cost every man, woman and child in town roughly $6,000. Instead, the city has promised to pay the developers a maximum of $700,000 annually - but only if new residents fill the homes quickly. Mayor Nels Nord said to be fair, the City Council subsequently agreed to give all who develop homes in the city tax rebates equal to the costs they incur for new infrastructure, such as streets and sewers. Today, $1 million annually — an amount equal to roughly one-fifth of the city's maximum debt limit by law — is committed to paying incremental rebates on such housing projects. Steve Quick, who started developing homes in Huxley long before any such breaks were offered to developers, said he now stands to get $550,000 back from the city over the next 12 years. "My personal opinion was that I thought it was a little much, but it was being offered to me, so why not take advantage of it?" said Quick, who also owns a hardware store in town. Others question why Huxley — a bedroom community nestled between Ankeny and Ames — would pay so much. Developers in nearby growth areas, they argue, are willing to spend big on such projects with no handouts from local government. The property tax rollback that by law the state receives from new residential housing cuts the tax benefit to the city in half. "Quite frankly, I was shocked when I heard they were doing this," said Craig Sommerfeld, founder of Kreg Tool, the city's largest employer. Sommerfeld, who volunteers on the board of the Huxley Development Corp., a nonprofit group that recruits new businesses to town, said he believes wholeheartedly that tax increment financing can be used effectively to lure new business. His company, the first to move into the city's industrial park in a TIF area, has expanded three times. "But if TIF is just there to make more money for a developer, I don't see the value," Sommerfeld said. If all of Huxley's plans come to fruition — for public works, infrastructure, and commercial and residential development — city leaders could pay out at least $27 million through at least 2021. That's a considerable sum for a town that took in just $1.8 million in property taxes in 2006. In simple terms, Huxley's long-term debt is now 15 times its annual income, and its ambitious plans are akin to someone with a $45,000 income trying to build a $650,000 house over time. Haldeman, who took over as city administrator in 2004, said he cannot speak about the pros and cons of projects approved before he arrived. However, he said, he believes the spending is paying off: The value of all property in Huxley has risen in the last five years, reaching $110 million in 2006 from almost $66.7 million since 2001. "So far, the growth and everything has begun to happen," he said. "And there's a lot more yet to come." Many of Huxley's residents also share a perception that their tax dollars have been put to good use. But the actual benefits of such projects to an area's overall economy are harder to assess. Most owners in the city's first TIF district conceived two decades ago, a business park, have since expanded or otherwise prospered. Haldeman boasts that tax dollars spent on that development yielded 180 jobs. Some business owners in the park, however, simply relocated there from elsewhere in the immediate area. A few said the tax breaks they received were not the primary factor in their decision to move to or remain in Huxley. "The TIF deal came up after we had already made a commitment to buy the land," said Ken Wiggers, who moved his growing business, Prairie Foam Insulators, to Huxley from his home in Kelley nearby. "We would have been there regardless." The city's latest plans are to spend another $4 million in TIF funds to build infrastructure for the city's newest commercial development. The project will house a research park for Monsanto and, soon, a John Deere distributor. Together, they will employ as many as 200 people. Current TIF revenues also will be used to pay debt service on the city's new community center and water treatment plant, as well as designs for the wastewater plant and a park improvement project. Longtime resident Don Brendeland says such a small town cannot justify such spending, especially on public buildings that pay no taxes such as Huxley's new Citizens Community Center. "It's really gotten out of hand," said Brendeland, who heads the Huxley Development Corp. After the first TIF project was created, he said, "TIF kind of became seen as a cash cow, like inventing money. I just think people got the wrong attitude about what it really was." As Huxley's debts have mounted, county officials, state experts, Mayor Nord and officials in neighboring communities have all begun to question whether the city should be allowed to spend so aggressively without more checks and balances. "I hate to speak ill of a neighboring community, but what they are doing in Huxley is definitely having an impact on the rest of us," said Gwen Ihle, city clerk in nearby Slater, a few miles away. Haldeman said the city itself and its residents are in fine shape, as long as Huxley can pay for the services people in town expect, such as police protection. If the city does a good job managing its money, it should be able to continue to pay all its debt and meet growing demand for services. "The dollars won't be there immediately, but they will be there eventually," he said. City official was also investor in local project Huxley's city leaders have gotten in trouble more than once while trying to accelerate their town's growth. The state's urban renewal law prohibits government workers, including elected officials, from benefiting financially from the actions they take to spur development. Court records show that in 2001 and 2002, city officials paid Bill Bass, Huxley's then-city administrator, bonuses above his salary for any new taxes he helped generate. Bass was responsible for most TIF-related planning in the city. Later, Bass negotiated a TIF deal for a local developer, allowing Signature Development to receive $1.5 million in rebates for preparing up to 39 lots. Bass later bought a one-third interest in Signature, even though state law also prohibits public officials from having more than a 5 percent interest in an urban renewal project. In 2004, Huxley's City Council decided to remove Bass without cause. He declined to comment for this story. Lawsuits over Bass' dismissal are ongoing, so city officials have been reluctant to discuss the deal. Bass told city leaders he thought investing in a local company - instead of somewhere else - would be a good thing. He also said he sought guidance from a local attorney and approval from the city's former mayor and mayor pro tem before going ahead with the investment, court records show. "But you can just see how it stinks to high heaven," said Mayor Nels Nord, who was the first to raise questions about the investment when he was police chief. — Lee Rood Can TIF save small cities? Small and midsized cities in Iowa are generally less successful than metropolitan and suburban areas in making lasting job and population gains, in spite of using tax increment financing much more aggressively, an Iowa State University study shows. Some posted job and earnings gains, but many lose population anyway, researcher David Swenson said. Few small cities in Iowa have used the financing as aggressively as Huxley. At least 64 percent of the town's total property valuation this year - some $37 million - is tied up in such development projects. Huxley's population growth, meanwhile, appears to have been modest. The city made a net gain of fewer than 50 people from 2000 to 2004, according to the U.S. census. Still, some predict the official population will jump significantly when a special census is conducted this summer. No one knows how Huxley would look today if city leaders had used TIF more judiciously. Steve Quick, a local housing developer who has benefited from TIF, said he believes growth would be slower. "I know if the city didn't offer me anything, I would have been more conservative" in developing new homes, he said. "But I've found that if you build 'em, they come. I've sold 35 lots in a year and a half." What happens to schools? Roughly two-thirds of the property in Huxley's school district is off limits to taxation for education, in large part because so much of it is already committed to TIF projects. That translates into $775,000 annually that the Ballard school district does not receive from the city to educate a growing number of students, according to an analysis by Iowa's Legislative Services Agency. Neighboring communities and state taxpayers help make up the difference — to the tune of about $530,578 annually. That's because, by law, school districts must receive a set amount of money annually in property taxes. When some of those dollars are committed elsewhere, state taxpayers and local residents pony up the funds that don't come out of a TIF district. "These new houses they are building with TIF money have kids, and those kids need to be educated," said Jeff Robinson, who performed the analysis for the Legislative Services Agency, an independent state information agency. Today, the Ballard district, which includes Huxley and three other towns, has one of the highest levies in the state because so much of Huxley's property taxes are tied up in TIF projects. "I feel Huxley needs to be accountable to people," said Becky Long, a former school board member who lives near Kelley. "Of course, we all want our cities to grow and people to move in, but you have to have a quality school district, too." State experts say Long's concerns about fairness are spreading statewide. "This is all public money being used, but there doesn't seem to be any accountability," said Mark Imerman, an Iowa State University economist. City Administrator John Haldeman said he believes the new development in town has benefited the school district, bringing at least 133 more children into the school system since 2002. Is Huxley's TIF use prudent? The main purpose of using tax increment financing, numerous economic experts say, is to create more tax revenue from projects that otherwise would not happen. Under state law, the new taxes generated in the designated area are used to help pay for some of the costs of the development. Cities use the money to pay bonding debt associated with the development or rebate taxes to a company. After a set period of years, however, that new tax money is supposed to be returned to the city's general fund to pay for local services, such as schools and police protection. But some of Huxley's TIF projects, such as its new Citizens Community Center replete with a running track, weight room, library, city offices and police station will never generate new taxes because, as public buildings, they are exempt. The city's existing tax base must be tapped to pay the ongoing debt - which, in the case of the center, amounts to roughly $500,000 annually through 2013. City Administrator John Haldeman said the community center adds to Huxley's quality of life, which in turn helps lure new people and businesses. "Other communities are looking at it as a model," he said. Mayor Nels Nord says the project, built jointly with the school district, was excessive. "I don't think a referendum would have passed with the citizens of Huxley to have a $4.5 million recreation center," he said. Huxley has also used TIF funds to pay part of the costs of new water and sewer systems - public works that also are exempt from paying taxes. Proponents say TIF projects that enhance quality of life qualify as economic development because they make cities more appealing to workers and businesses weighing new locations. "We've had companies come to town and ask, 'What do you have to do?' " said Brian Wagner, city manager in Maquoketa, which plans to spend $700,000 in TIF revenue to help build its own $4.6 million recreation center. But two Iowa State University researchers who studied TIF this year said such spending plans are made in "defiance" of state law. "It is increasingly easy for communities to argue with all sincerity that nearly everything they have to do has an economic development foundation," the researchers wrote