Farm Futures, IL 06-08-06 Senate Republicans Gamble with Estate Tax Repeal

advertisement

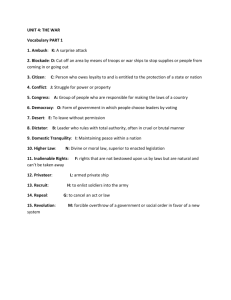

Farm Futures, IL 06-08-06 Senate Republicans Gamble with Estate Tax Repeal Chances slim for successful cloture vote today. Jacqui Fatka Before estate tax legislation can be brought to the Senate floor senators must first approve cloture on the motion to proceed with debate. That vote is scheduled for today (Thursday) and is expected to fail despite major groups efforts to keep the full repeal alive. In 2001 tax law changes, Congress approved a gradual reduction and eventual repeal of the estate tax. From 2006 to 2008 the exempt amount is $2 million with a 45% maximum rate (46% in 2006). In 2009 the exempt amount jumps to $3.5 million. In 2010 the estate tax is fully repealed and max rate is 0%. Unless the tax act is reenacted before the end of 2010, the estate tax repeal sunsets in 2011, effectively limiting estate tax repeal to one year. The House passed a bill, H.R. 8, in April 2005 striking the sunset provision from the original bill passed in 2001, extending the 2010 exempt amounts. A vote was originally scheduled for September 2005 on estate tax but was delayed after the hurricanes and death of William Rehnquist quickly filled up the Senate calendar last fall. Michelle Reinke, National Cattlemen's Beef Association associate director of legislative affairs, says in the past that 60 senators have at one time or another voted in support for the repeal. Several senators who once supported the repeal are now hesitant because of rising budget deficit explains Pat Wolff, American Farm Bureau tax specialist. Wolff says the first vote of whether or not to take up the bill is questionable. Democrats are looking for assurances to offer some kind of alternative to a full repeal if needed, but Senate Majority Leader Bill Frist hasn't given those assurances, Wolff says. Similar to the controversy behind immigration debate, the Senate is attempting to agree to terms of whether or not any amendments, including potential exemption limits language, can be made. Iowa State University ag law specialist Roger McEowen says the Senate will definitely fall short of obtaining the needed 60 votes for cloture but compromise legislation is possible. Reports out this week indicate the cost of full repeal of the tax reaches $1 trillion over the next 10 years. The President's budget estimates the costs at $360 billion over 10 years. The Center for American Progress states a 2009 freeze will save nearly $600 billion when compared with repeal (costing only 40% as much as repeal) over the 2012-2021 period. NCBA delegates say the only viable solution is full repeal. Wolff says AFBF delegates support a $10 million exemption (which would eliminate nearly all farmers) if full repeal fails. However, the Center for American Progress says lowering the top estate tax rate to 15% and raising the individual exemption level to $10 million (so descendents could pass the first $10 million of any estate to their heirs tax-free, and couples could pass on $20 million tax-free) would cost 94% as much as a full repeal. Even combining a 15% top rate with an individual exemption level of $3.5 million ($7 million per couple) would still cost 87% as much as a full repeal. If the Senate passes something less than a full repeal both chambers will engage in negotiations to work out differences between the two bills. Wolff says it's difficult to know how that would go without knowing what kind of compromise the Senate may pass. In an election year the vote is highly political. "It's hard to get a good sense of those votes until you actually get down on the floor," Reinke says.