TD/B/47/12

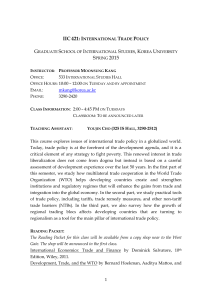

advertisement