Credit Supply Shocks and Economic Activity in a Financial Accelerator Model

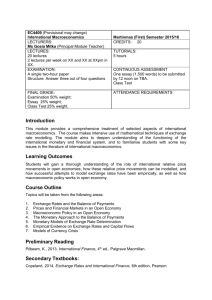

advertisement