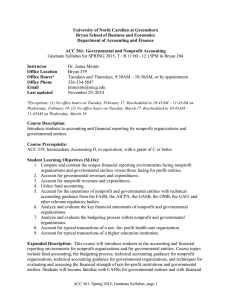

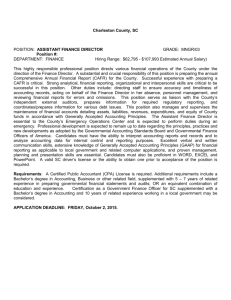

University of North Carolina at Greensboro Department of Accounting and Finance

University of North Carolina at Greensboro

Bryan School of Business and Economics

Department of Accounting and Finance

ACC 561: Governmental and Nonprofit Accounting

Undergraduate Syllabus for SPRING 2015, T / R 11:00 - 12:15PM in Bryan 204

Instructor Dr. Jenna Meints

Office Location Bryan 339

Office Hours*

Office Phone

Last updated

Tuesdays and Thursdays, 9:30AM – 10:30AM, or by appointment

336-334-5647 jmmeints@uncg.edu

November 29, 2014

*Exceptions: (1) No office hours on Tuesday, February 17. Rescheduled to 10:45AM – 11:45AM on Wednesday, Feb

18. (2) No office hours on Tuesday, March 17. Rescheduled to 10:45AM – 11:45AM on Wednesday, Mar 18.

Course Description :

Introduce students to accounting and financial reporting for nonprofit organizations and governmental entities.

Course Prerequisite:

ACC 319, Intermediate Accounting II, or equivalent, with a grade of C or better

Student Learning Objectives (SLOs):

1.

Compare and contrast the unique financial reporting environments facing nonprofit organizations and governmental entities versus those facing for profit entities.

2.

Account for governmental revenues and expenditures.

3.

Account for nonprofit revenues and expenditures.

4.

Utilize fund accounting.

5.

Account for the operations of nonprofit and governmental entities with technical accounting guidance from the FASB, the AICPA, the GASB, the OMB, the GAO, and other relevant regulatory bodies.

6.

Analyze and evaluate the key financial statements of nonprofit and governmental organizations.

7.

Analyze and evaluate the budgeting process within nonprofit and governmental organizations.

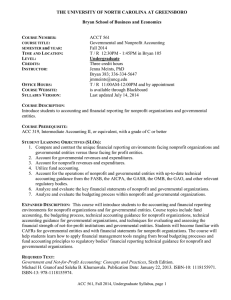

Expanded Description: This course will introduce students to the accounting and financial reporting environments for nonprofit organizations and for governmental entities. Course topics include fund accounting, the budgeting process, technical accounting guidance for nonprofit organizations, technical accounting guidance for governmental organizations, and techniques for evaluating and assessing the financial strength of not-for-profit institutions and governmental entities. Students will become familiar with

CAFRs for governmental entities and with financial statements for nonprofit organizations. The course will help students learn how to apply financial management tools ranging from broad budgeting processes and fund accounting principles to regulatory bodies’ financial reporting technical guidance for nonprofit and governmental organizations.

Required Text and Materials:

Government and Not-for-Profit Accounting: Concepts and Practices , Sixth Edition.

Michael H. Granof and Saleha B. Khumawala. Publication Date: January 22, 2013. ISBN-10: 1118155971.

ISBN-13: 978-1118155974.

ACC 561, Spring 2015, Undergraduate Syllabus, page 1

INTERACTIVE CLASSROOM TOOL: i>clicker2: ISBN: 1429280476. Available online at multiple outlets, including here: http://www.amazon.com/I-Clicker-2-I-Clicker/dp/1429280476 . Also available in the bookstore. i>clicker1 will work for this class as well.

CAFR and financial statement examples, class cases, and other relevant materials not in the required text will be made available via Blackboard or Canvas as .pdfs or web links.

Teaching Methods:

Class time will be a mix of informative lectures, interactive presentations, discussion of assigned readings, practical skills-building exercises that relate to graded assignments, and occasional short videos.

Class Assignments:

UNDERGRADUATE students will be evaluated based on the following:

Assignment

Homework

CAFR Analysis Assignment

Quiz 1

Points Date Due

40

25

12.5

As assigned

Friday, April 17 by 2PM

Tuesday, March 31

Quiz 2 12.5

Class Attendance and Participation 10

Team Work XC

Thursday, April 23

Ongoing, including intro

GNP, CAFR presentations XC

February 17 and March 17.

Up to 2% added to final course grade

As scheduled by student.

Up to 3% added to final course grade

105% with maximum XC Total Available 100

Class attendance and Participation (10 pts)

The full number of points will be awarded when students miss no more than two classes (and complete makeup work for the classes that they missed, if necessary) and make active and thoughtful contributions to several class discussions and other learning activities. These contributions should demonstrate that the student is critically engaged with course content, class material, and/or the current environment facing nonprofit organizations and governmental entities. Fewer points will be awarded when absences and contributions do not meet these criteria, at the discretion of the instructor. In extenuating circumstances (medical or family emergency), absences will be considered excused. Being on time for class is important and is a sign of respect for the learning environment. Being late and/or leaving early may result in the loss of class participation points.

Homework (40 pts) – All seven SLOs.

There will be several problems, exercises, and short projects assigned throughout the semester. Specifically, there will be one homework assignment for each of chapters 1 through 11 (11 assignments). There will be three assignments for chapter 12 and two assignments for chapter 16 (5 assignments). There are 16 possible assignments. Homework will be graded for accuracy. Students may drop their two lowest homework scores.

Students must work independently. Cheating will result in an F for the course and an Honor Code violation.

Homework is due by the beginning of the class period in which it is listed as due in the day-to-day schedule located later in this syllabus. Homework will not be accepted via e-mail. No late assignments accepted.

Details will be posted to Canvas or BB.

Governmental CAFR analysis (25 pts) – All seven SLOs. Due by 2PM on April 17, 2015

Students will analyze aspects of the Comprehensive Annual Financial Report (CAFR) for a governmental entity. Details will be posted to Canvas or BB.

ACC 561, Spring 2015, Undergraduate Syllabus, page 2

Quiz 1 – Tuesday, March 31; Quiz 2 – Thursday, April 23 (12.5 pts each) – All seven SLOs.

Students will complete a take home quiz that includes any mix of multiple choice, short answer, and/or essay questions covering concepts, principles, and techniques that were covered in readings, discussions, class sessions, presentations, and any other relevant materials distributed and/or available to the class. Details will be posted to Canvas or BB.

Undergraduate Grading System:

100-98%

97-93%

A+

A

92-90%

89-88%

A-

B+

87-83%

82-80%

79-78%

77-73%

72-70%

B

B-

C+

C

C-

69-68%

67-65%

D+

D

Below 65% F

Extra credit:

Extra Credit Possibility #1: Identify a governmental entity that interests you. Find that entity’s CAFR.

Highlight aspects of the government’s CAFR that have or have not been covered in class. Present to the class

(in approximately 3 minutes) the background of the organization, why you chose it, and at least three accounting/financial reporting aspects that stood out to you and/or that related to class material in the entity’s

CAFR. You must show the class images of the CAFR when you explain. Be open to questions from and interaction with the class.

Extra Credit Possibility #2: Identify a nonprofit entity (NPO) that interests you. Find that entity’s IRS

Form 990, and if applicable, its audited financial statements, IRS Form 990T, and annual financial report.

Highlight aspects of the NPO’s reporting that have or have not been covered in class. Present to the class in approximately 3 minutes the background of the organization, why you chose it, and at least three accounting/financial reporting aspects that stood out to you and/or that related to class material in the entity’s reports. You must show the class images of the IRS Form 990, IRS Form 990T, Annual Report, and/or audited financial statements when you explain. Be open to questions from and interaction with the class.

Each extra credit possibility is worth up to 1.5% to be added directly to your overall course grade.

Your actual percentage earned will depend on the number/quality of issues that you identify, the research that you conduct, the planning and organization that you put into your class presentation, and your understanding of relevant accounting and financial reporting issues that have, at least, been covered in class.

Each student may complete none, one, or both extra credit assignments. The maximum extra credit to be earned, therefore, is 3% of your final course grade. This is an amount sufficient enough to move a student up one step of a grade. For example, a regular grade of 90% (A-) could move up to 93% (A) with the maximum points earned on both extra credit possibilities. A regular grade of 75% (C) could move up to a

78% (C+) with the maximum points earned on both extra credit possibilities.

Each student is encouraged to meet with me at any time about their interests – in person, via e-mail, via phone, or via whatever channel is best for you (and that I can figure out!). I love this interaction! There are so many great and fascinating organizations out there that could be covered! That said, each student is required to only let me know (via e-mail is fine) of exactly what each student plans to present to the class at least two class periods before the actual in-class presentation. (First come, first serve.) Be creative! Have fun!

Chat with me any time!

ACC 561, Spring 2015, Undergraduate Syllabus, page 3

Policy on Incompletes and Late Assignments:

No late assignments accepted.

Expectations for written assignments/Formatting:

Students are expected to use good academic English; grades will be lowered for poor grammar, syntax, or spelling. Those who have difficulty writing can make an appointment with the campus Writing Center to receive guidance. Graduate students are expected to follow APA or MLA format for in-text citations and references.

Policy on Incompletes and Late Assignments:

No late assignments accepted. No incompletes allowed.

Use of laptops or other electronic devices:

Laptops and electronic devices are fine to use for learning purposes. Personal use (e.g. Facebook, checking email) is prohibited.

Cell Phone Policy:

Cell phones are a disruption to the learning process. Students are expected to turn off their cell phones during class. Any cell phone making noise during a class session will result in student ejection from the classroom and a marked absence from class for participation purposes.

E-mail Policy:

Please allow at least 24 hours for me to respond to any e-mail(s) that you send to me. I try my best to respond as soon as possible, but this does not always happen as quickly as I wish it could. I apologize in advance for any delayed responses. Please note that I rarely have the chance to read or respond to e-mails on

Mondays . If you send me an e-mail after 5PM on a Sunday and before 2PM on a Tuesday when I finish teaching at UNCG, then I most likely will respond, at the earliest, Tuesday evening or Wednesday.

Because of the volume of e-mails that I receive throughout the semester, I highly suggest that you send me just one message with multiple questions/issues at a time, if possible, rather than a sending me a series of e-mails with one issue each in rapid succession.

Policy on Academic Dishonesty:

It is the responsibility of every student to obey and to support the enforcement of the Honor Code, which prohibits lying, cheating, or stealing in actions involving the academic processes of this class. Students will properly attribute sources used in preparing written work. In keeping with the UNCG Honor Code, if reason exists to believe that academic dishonesty has occurred, a referral will be made to the appropriate

University disciplinary division for investigation and further action as required. You and I are expected to abide by the UNCG Academic Integrity Policy as well as by the UNCG Codes of Conduct. These can be accessed at: http://bae.uncg.edu/assets/faculty_student_guidelines.pdf

. Specifically, UNCG’s Student

Conduct Code is available at http://studentconduct.uncg.edu/policy/code/ and its Academic Integrity Policy is available at http://academicintegrity.uncg.edu/violation/ .

Policy on Accommodations for Students with Disabilities:

To request and receive accommodations at UNCG you must be registered with the Office of Disability

Services (ODS). If you have any specific questions or concerns call ODS at (336)334- 5440 or visit their website: http://ods.dept.uncg.edu/services/. Students with disabilities that affect their participation in the course and who wish to have special accommodations should contact ODS and provide documentation of their disability. ODS will notify the instructor that the student has a documented disability and may require accommodations. Students should discuss the specific accommodations they require (e.g. changes in instructional format, assignment format) directly with the instructor as well. Please visit http://ods.dept.uncg.edu/services/ for further information.

ACC 561, Spring 2015, Undergraduate Syllabus, page 4

Students in Distress:

UNCG cares about your success as a student. We recognize that students often balance many challenging personal issues and demands. Please take advantage of the University resources designed to help.

For assistance accessing these resources, contact the Dean of Students Office at 334-5514 or Student

Academic Services at 334-5730. The Counseling and Testing Center is available for mental health assistance,

334-5874.

Use of Laptops or other electronic devices:

Laptops and electronic devices are fine to use for learning purposes. Personal use (e.g. Facebook, checking email) is prohibited.

Blackboard, Canvas, and Technology:

For those who are not familiar to Blackboard, please consult the following resources:

Watch "Blackboard Video Tutorials" ( http://ondemand.blackboard.com/students.htm

)

Go to "Blackboard Help for Students" (http://help.blackboard.com/student/index.htm)

UNCG Canvas Resources (http://its.uncg.edu/services/service/canvas-learning-management-system)

Contact 6-TECH: (336) 256-TECH (8324); 6tech@uncg.edu

Class time and environment

I will respect you and your time. In return, I expect you to do the same for me and for your fellow classmates. I expect you to read the relevant materials before class. I will cold call during classes. If you are not prepared to contribute to a class session, then I suggest that you do not attend at all. Lateness and leaving/re-entering the classroom is disruptive to everyone and should be avoided.

ACC 561, Spring 2015, Undergraduate Syllabus, page 5

DATE

Tues Jan 13

Thurs Jan 15

Tues Jan 20

SCHEDULE OF CLASS TOPICS AND ASSIGNMENTS

(subject to change at instructor’s discretion)

TOPIC CHAPTER ASSIGNMENT DUE

Introduction to Class NA READ Syllabus

GNP Environment 1 E-mail intro DUE*

*E-mail me something unique about yourself with a picture

Not-for-Profit Organizations 12 READ Chapter 12

HW CH 1 DUE

HW CH 12 A DUE Thurs Jan 22 Not-for-Profit Organizations 12

Tues Jan 27

Thurs Jan 29

Tues Feb 3

Thurs Feb 5

Tues Feb 10

Thurs Feb 12

Tues Feb 17

Thurs Feb 19

Not-for-Profit Organizations

Not-for-Profit Organizations

Fund Accounting

Fund Accounting

Issues of Budgeting and Control

Issues of Budgeting and Control

Recognizing Revenues in

Governmental Funds

Team work review

Tues Feb 24

Thurs Feb 26

Recognizing Revenues in

Governmental Funds

Recognizing Expenditures in

Governmental Funds

Tues Mar 3 Recognizing Expenditures in

Governmental Funds

Thurs Mar 5 Accounting for Capital Projects and Debt Service

Tues Mar 10 and Thurs Mar 12 – no class – spring break

12

12

2

2

3

3

4

5

5

6

Team work as assigned, no formal class

4

HW CH 12 B

HW CH 12 C

READ

HW CH 2

HW CH 4

HW CH 5

DUE

DUE

Chapter 2

DUE

READ Chapter 3

HW CH 3 DUE

READ Chapter 4

DUE

DUE

READ Chapter 5

READ Chapter 6

ACC 561, Spring 2015, Undergraduate Syllabus, page 6

DATE

Tues Mar 17

Thurs Mar 19

Tues Mar 24

Thurs Mar 26

Tues Mar 31

Thurs Apr 2

Tues Apr 7

Thurs Apr 9

Tues Apr 14

Thurs Apr 16

Friday, April 17

Tues Apr 21

Thurs Apr 23

TOPIC CHAPTER ASSIGNMENT DUE

Team work as assigned, no formal class

Accounting for Capital Projects and Debt Service

Team work review

6

Capital Assets… in Marketable Securities 7

Capital Assets… in Marketable Securities 7

HW CH 6 DUE

READ Chapter 7

HW CH 7 DUE

Quiz 1 Closure

Long-Term Obligations

2, 3, 4, 5, 6, and 7

8

Quiz 1 DUE

READ Chapter 8

Business-Type Activities 9 READ Chapter 9

HW CH 8 DUE

Fiduciary Funds and Permanent Funds

Auditing GNP Organizations

Federal Government Accounting

10 READ Chapter 10

16 READ Chapter 16

HWs for CH 9 and 10 DUE

17 READ Chapter 17

HWs CH 16 - A and B DUE by 2:00PM – CAFR Assignment DUE*

*Submit the physical assignment by sliding a signed, sealed manila envelope with the assignment in it under the door of Bryan 339. Electronic files are due via e-mail by this time as well. You must submit both the physical and electronic assignments on time to receive any credit.

Optional class for undergraduates

Colleges and Universities

Health Care Providers

Quiz 2 Closure

CAFR Assignment Closure

Chapter 13

Chapter 14

8, 9, 10, 16, and 17 Quiz 2 DUE

ACC 561, Spring 2015, Undergraduate Syllabus, page 7