ECO 323 Public Economics UNC Greensboro Spring 2014

advertisement

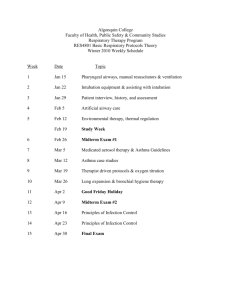

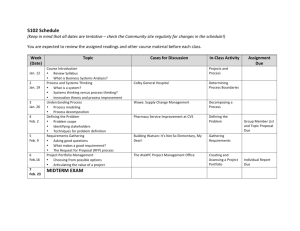

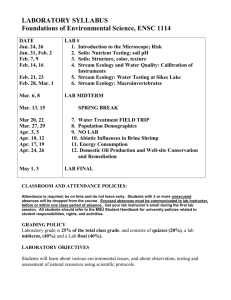

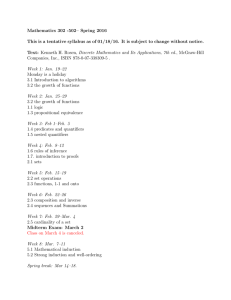

ECO 323 Public Economics UNC Greensboro Spring 2014 Contact Information Name: Office: Email: Chris Swann 467 Bryan chris_swann@uncg.edu Lectures: TH 1230-1345 in Bryan 202 Course Overview This course deals with the justifications for government activities, the design of programs consistent with these justifications, and the effects of current expenditure programs and taxes. The first section examines the theoretical justification for having any government programs at all and the ways that voting may affect the policies that are implemented. The heart of the course is a discussion of some of the major social programs funded by the federal government such as Social Security, Medicare, Medicaid, AFDC, and Food Stamps. Finally, we discuss the tax system used to fund such programs. While I intend to follow the schedule outlined below, many tax and spending topics are being debated in Washington, and we may deviate from the schedule from time to time to address these issues. Students are expected to be familiar with and abide by the University’s Academic Integrity policy (see http://academicintegrity.uncg.edu/) and the University’s Student Code of Conduct (http://studentconduct.uncg.edu/). Office Hours Tuesday and Thursday 1400 to 1500 and by appointment. Email is the best way to contact me to make an appointment. Readings The assigned readings come from Gruber, Jonathan, Pubic Finance and Public Policy, 4th edition, Worth, 2013. Other books will cover similar material. In particular, earlier editions of Gruber’s text should be most similar. In the past I have also used Rosen, Harvey S. and Ted Gayer, “Public Finance, 9th edition”, McGraw-Hill, 2010. Additional readings may also be assigned. They will be made available via blackboard, from a publicly accessable web site, or as photo copies. Grading Your grade will be based on 3 homework assignments (25%), 2 midterm exams (25% each), and a final exam (25%). Tentative Outline and Readings Date Topic Reading Jan 14 Jan 16 Jan 21 Jan 23 Jan 28 Jan 30 Feb 4 Feb 6 Feb 11 Feb 13 Feb 18 Feb 20 Feb 25 Feb 27 Mar 4 Mar 6 Mar 11 Mar 13 Mar 18 Mar 20 Mar 25 Introduction Theoretical Tools None Chapter 2.1 and 2.2 Chapter 2.3 and 2.4 Chapter 3.1 and 3.2 Chapter 3.3 Chapter 4.1 – 4.3 Chapter 5.1 to 5.3 Chapter 6.1 and 6.2 Chapter 7 Chapter 12.1-12.3 & 12.5 Mar 27 Apr 1 Apr 3 Apr 8 Apr 10 Apr 15 Apr 17 Apr 22 Apr 24 May 2 Empirical Tools Budget Analysis Externalities Externalities Public Goods Social Insurance Material from Jan 14 to Feb 11 Social Security Unemployment Insurance Health Economics Medicaid Spring Break Spring Break Medicare Health Care Reform Income Distribution and Poverty Measurement Cash Welfare Material from Feb 13 to Mar 25 Welfare Reform (TANF) Food Stamps Other/Multiple Programs Taxation in the US Assignment Hand out HW 1 Collect HW 1 Midterm 1 Chapter 13 Chapter 14 Chapter 15 Chapter 16.1 – 16.2 Chapter 16.3-16.4 Chapter 16.6 Chapter 17.1 Hand out HW 2 Collect HW 2 Chapter 17.2 and 17.3 Midterm 2 Chapter 17.4 and 17.5 Chapter 17.2 TBA Hand Out HW 3 Chapter 18.1 to 18.3 Chapter 18.4 to 18.6 Incidence and Optimal Taxation Chapter 19.1 and 20.2 Fiscal Federalism Chapter 10 Collect HW 3 Final Exam – Bryan 202, 1530-1830; Covers material from Mar 27 to April 24.