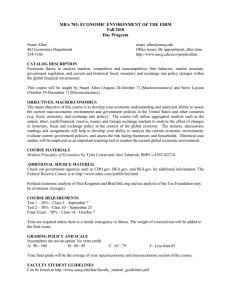

ECO 202: Syllabus Principles of Macroeconomics Fall 2014 Instructor

advertisement

ECO 202: Syllabus Principles of Macroeconomics Fall 2014 Instructor: Dr. Stuart Allen Email: sdallen@uncg.edu Office: 458 Bryan Sections: .03 (9:30TR) & .04 (11TR) Office Hours: 8:30-9:15 TR or by appointment Phone: TBA REQUIRED: Textbook: Foundations of Macroeconomics, 7th edition by Bade and Parkin. Packet: There is a course packet that includes this syllabus, spring 2014 tests (but not the final exam), chapter excerpts from a manuscript, graphs and a number of exercises for class and practice at home. This packet is only available by order from the UNCG bookstore. PURPOSE: This course uses market analysis (supply and demand at the aggregated national level) to develop an understanding of the working of the macroeconomic system. The economy is modeled by studying various markets such as the output, labor market, financial (credit or loanable funds), foreign exchange, money market, and bank reserves market and their interaction. Understanding how these individual markets are interconnected will enable analysis of the effects from policy changes and shocks to the national (international) economy. Understanding the effectiveness of fiscal and monetary policy and their effectiveness in offsetting recessionary and inflationary episodes and the sustainability of these policies are important learning objectives. Fiscal policy (performed by the Treasury) refers to federal government tax and expenditure policy and resulting federal budget deficit/tax surplus. Monetary policy (the responsibility of the central bank) refers to the changes in interest rates and the money supply. A policy change in either will effect output growth (real GDP), interest rates, the rate of inflation and a country’s exchange rate. CATALOG DESCRIPTION: Introduction to macroeconomic principles and analysis. Topics include national income, business cycle and short run fluctuations, the monetary system, inflation, fiscal policy, the national debt, exchange rates, balance of payments, and economic growth. PREREQUISITE: ECO 201 (or ECO 101) Principles of Microeconomics FACULTY STUDENT GUIDELINES: Found at http://www.uncg.edu/bae/faculty_student_guidelines.pdf ATTENDANCE: Attend class and take good notes. If you miss a class, you should borrow two sets of notes and rewrite them. You may have the class lecture (audio) recorded. Page 1 of 8 ACADEMIC HONOR POLICY: Students are expected to comply with the UNCG Honor Policy and not to tolerate cheating. Using a cell phone during a test or exam is considered to be a violation of the Honor Policy. Students are responsible for being familiar with the UNCG policy on cheating, plagiarism, misuse of academic resources, falsification and facilitation of dishonest conduct. Procedures and penalties related to these and other policy violations are found at: http://academicintegrity.uncg.edu/. Any violation of the Honor Policy may result in a failure for the assignment and subsequently the course. COURSE OBJECTIVES: 1. Define and have some insight into the measurement of macroeconomic data such as: nominal and 2. 3. 4. 5. 6. 7. 8. real GDP; price indices such as the CPI, the GDP price deflator and the personal compensation expenditure deflator; the potential and actual rate of economic growth; inflation and deflation; and the unemployment and employment rate. Explain the role of the Treasury in a situation where the federal budget is either in a deficit or a tax surplus and describe how each affects the national debt. Graph and describe the effect of various macroeconomic factors that shift the aggregate demand (AD) schedule and analyze the effect using the output market. Describe the role of savings and investment in terms of the rate of long-term economic growth, especially for developing countries. Illustrate the economy in a state of recession or inflation using the output market diagram and explain how policy variables can correct the recession or inflationary period. Understand the role of the Treasury in fiscal policy and the crowding out effect on the economy. Analyze the role of the Federal Reserve in the implementation of monetary policy and the effects on interest rates and the rate of inflation. Define the federal funds rate, the discount rate and the prime rate, and the role of fractional reserve banking in the creation of money. TESTS There will be two mid-terms that count 30% each and a comprehensive final exam that counts 40% of your final grade. The tests will include calculations (worth 15% to 30% of most tests) that require the student to have their own nonprogrammable calculator. Tests may also include some true/false, definitions, and multiple choice questions (usually 5% to 15% of the test). All tests will include diagram and discussion questions that emphasize the key concepts form the class lectures and discussions (40% to 60% of the test). Student will be able to identify testable content from class exercises and assignments. Students should be prepared to use the various supply and demand diagrams of major macroeconomic markets and time series diagrams in their answers. Most students had multiple choice tests in ECO 201 and are not prepared. This is a major reason that last semester’s two mid-terms are in your course packet that can purchased from the UNCG bookstore. The mid-terms (late September and early November) will count 30% each. The final exam will count 40%. Make-up tests are not given. Missing a mid-term means that the weight of the final becomes 70%. If the class misses a test due to severe weather, then the test will automatically be given the next class period. The final exam for the 9:30 class begins at 8 am on Thursday, December 4. The final exam for the 11 TR class begins at noon on Tuesday, December 9. Finals are in the same class room. Page 2 of 8 GRADING SCALE: 90% and above A- or better 70% but less than 80% Below 60% C- or better F 80% but less than 90% 60% but less than 70% B- or better D- or better EXTRA CREDIT There are no extra credit opportunities at the end of the course. Extra credit, however, will be available during the course. Extra credit assignments are contained in the course syllabi. There will be a target of the maximum number points that will be awarded to the very best work. There are due dates that will be assigned to the extra credit projects. Extra “Extra credit” may be granted for a written critique of web sites that area trying to teach economics. You are invited to Google: Hayek and Keynes Rap and listen to the rap that tells the story of their intellectual debate. A rap could be a special extra credit project. ECO 202: SPECIFIC LEARNING OBJECTIVES Students should be able to: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. Define and explain the difference between macroeconomic data such as: nominal and real GDP, the CPI and the GDP price deflator, the rate of economic growth and the rate of inflation and deflation; the unemployment and employment rate; the federal budget deficit and the national debt, and the budget deficit and the trade (net export) deficit. Explain and graph actual real GDP (the business cycle) and potential real GDP (long-term economic growth) and explain why there may be a change in the underlying rate of growth of potential real GDP and in the output gap. Clearly articulate and understand the role of the Treasury and the Federal Reserve as it is related to fiscal and monetary policy. Define current and capital accounts (balance of payments) and explain why the U.S. is a debtor. Explain the sources of long-term economic growth especially for developing countries and the role of savings and investments in the growth process. Explain the effect of changes from various economic and policy variables using the output market (aggregate demand and aggregate supply) to explain movements in the price level and real GDP. Use an output market diagram to show and explain the policy options that exists to correct either a recession or inflation. Explain the workings of the Federal Reserve and the banking system in the creation of money. Explain how the Federal Reserve conducts monetary policy by targeting federal funds rate. Explain the effect of inflationary expectations on nominal interest rates through the credit market diagram and distinguish between nominal and real interest rates. Explain the cause of 1970s inflation, Volcker's policy shift to fight inflation in October 1979, and the subsequent effect on the U.S. economy from 1980 to 1982. Analyze the effect of budget deficit spending on private sector investment and the trade sector and provide historical examples of two different types of “crowding out”. Explain Taylor’s Rule and use it to analyze the recent shifts in monetary policy since 2001. Explain the reason and the consequences of why the Chinese usually maintain a fixed or pegged change rate with the dollar that is considered to be below the true equilibrium value. Page 3 of 8 ECO 202 Outline: DRAFT for ECO 202 Day 1 Complete Exercise 1: True/False Questions: The Current Economic Environment. Day 2 Economic Growth Read Ch 9.4: Make a list of the important factors that contribute to economic growth. Introduction to Hans Rosling. Read “Hans Rosling: The man who’s making data cool” on the web Listen to Rosling “Myths of developing nations” Feb 4, 2011 Listen to Rosling “Stats that reshape your world view” What graph(s) does Rosling use to challenge preconceived notion of development Google Gapminder and explore data and graphs EXTRA CREDIT Opportunity 1: Google the “gapminder” web site to investigate a country’s standard of living from a social, economic, education, and public health perspective. Read the Human Development Index to give you some ideas of data that is available. Create a minimum of five graphs (maximum of 15) from the available data and make a comparison of your home country and another country. Show the movement of the two countries over time. Limit your analysis to 400 words. This assignment will require your individual effort. Maximum Value is 15 – 20 points on your first mid-term. Economic Systems and Growth. Read Ch 2.1: How does Ch 2.1 provide support for Ch 9.4? How does your country answer the three basic economic questions? Place your country on a continuum from command to a market based economy? Has the answer to this question changed over your lifetime? parents? grandparents? Have you lived in a country that had imposed price controls? Did the controls work? Read Appendix to Ch 1 Exercise 2: Growth rates exercises Day 3 Ask your grandparents what was the most significant technological advance in their life time? What is considered to be technology? Give different examples. Listen to Rosling ”The Magic Washing Machine” Read Ch 2.2 Globalization Consider the international financial flows that arise from international trade. pp. 50-52 Read Ch 19.1 Financing Int. Trade, Balance of Payments, Current Account and Capital Account Page 4 of 8 Day 4 Read Ch 2.3 Circular Flow What exchanges are taking place in this diagram? What markets would model the exchange? Label participants and axis for the following markets: output, labor and credit markets. Determine the outcome (effect) from the four single shifts that can occur in each market. Extra Credit Opportunity 2: Find a web site that has a better diagram of the circular flow model. Print it out and provide a brief explanation (250 words) of why it is better. What is better about it that enhances your understanding? Does the model encompass international exchange? Value – maximum of five points on first mid-term. You can take other concepts and find web sites that are educationally effective in explaining the concept and turn them in for additional extra credit. Day 5 Measuring GDP Read Ch 5.1 Income and Expenditure Approaches Read Ch 5.2 Real GDP Exercise 3 Calculating nominal real GDP, actual GDP and the price level Exercise 5 Review the steps of computing real GDP, nominal GDP and the Price Level Exercise 4 More Growth Rate Calculations Day 6 Read Ch 5.3 The Business Cycle: Potential and Actual Real GDP Exercise 6: Calculate Potential GDP and the Output Gap in a Time Series Diagram Day 6 Jobs and Unemployment Read Ch 6.1 Labor Market Indicators: Definitions and Formula Read Ch 6.2 U rate, LFPR, and Alternative Labor Market Measures The Labor Market in 10 Charts (course packet) Unemployment and Full Employment, Types, GDP and Output Gap Read Ch 8.1: More on Potential Real GDP and Read Ch 8.2: Natural Rate of U Rate Read Chapter 1: Macroeconomics: An Introduction in the Course Packet EXTRA CREDIT Opportunity 3: Provide an analysis of the current conditions in your country’s labor market. Your analysis should include a number of different unemployment and employment measures. What are the important trends? If your country does not have enough data to make the assignment interesting, use the US as the default. Data that could be of interest is the labor force participation rate, employment to population rate, number of multiple jobholders, unemployment duration, job loser and Page 5 of 8 leavers, entrant and reentrants to the labor force, and various measures of unemployment the quality of jobs, the average wage rates etc. Maximum value is 10-12 points on first test. Day 7 Chapter 7: The CPI and the Cost of Living 7.1 The CPI 7.2 The CPI and Other Price Level Measures 7.3 Nominal and Real Values: The Labor Market in Ch 8 Uses Real Wages 7.4 Real vs Nominal Interest Rates: The Loanable Funds Market Uses Real Interest Rates. Exercises 9 and 10: Adjusting by the CPI Day 8 Chapter 8 Potential Real GDP and the Natural Unemployment Rate pp. 190 -191 Schools of Thought and Public Policy Ch 13.1 and 13.2 Aggregate Demand & Aggregate Supply Ch 13.3: Three Types of Macro Equilibrium (pp. 334-337) Ch 8.1 Labor Market & Sticky (Rigid) Wages – note the book uses real wages on the vertical axis. Ch 8.2 Real wages are to be determined by the forces of supply and demand in the labor market, but government intervention and efficiency wages beg to differ. The determination of the real wage rate also means that the equilibrium quantity of labor hours is determined by market forces – full employment translates into potential real GDP. The Natural Rate of Unemployment END OF MATERIAL FOR FIRST MIDTERM Day 9 End of new material for the first test: Catch up and Review Day 11 MIDTERM 1 Tuesday - September 23 Day 10 Ch 9 Economic Growth – This section will not appear on the first test. Ch 9.1 Growth rates and the Rule of 70 Ch 9.2 Labor Productivity Growth Capital Accumulation and Diminishing Returns Expansion of Human Capital and the Discovery of New Technology Ch 9.3 Growth Theories Page 6 of 8 Ch 9.4 Achieving Faster Growth: Preconditions and Policies Listen to Rosling “Asia’s rise: how and when?” & “Population growth using IKEA boxes” Day 12 Ch 10 Finance, Savings and Investment 10.1 Financial Institutions and Markets 10.2 The Loanable Funds Market - skim 10.3 Government in Loanable Funds Market - skim Bond yields – not in textbook Exercise to be handed out in class Day 13 Chapter 11: The Monetary System 11.1 What is Money? 11.2 The Banking System Day 14 and 15: The role of the Fed and the fractional reserve banking system in the creation and destruction of money through the open market purchase or sale of government bonds is demonstrated. The Expansionary case is introduced as is the contractionary case. The distinction between the monetary base and the money supply is critical. The quizzes are identical to what will be asked on test 2 and the final exam. Read Chapter 9 from the course packet. The money multiplier is introduced through these two cases and the influence that the public and the banking system can have on the multiplier is discussed through the history of the Great Depression EXTRA CREDIT Opportunity 4: Google the Causes of the Great Depression. Summarize from several presentations the various causes of the Great Depression. Maximum value is 8 points on mid-term II. EXTRA CREDIT Opportunity 5: Google the Bank Panic of 1907. What are the most important issues surrounding this particular bank panic? Turn in your summary of the causes and consequences of this panic. Maximum value is 8 points on mid-term II Day 16 11.3 11.4 The Federal Reserve System Regulating the Quantity of Money – this is an extremely important section. Day 17 Chapter 12: Money, Interest and Inflation 12.1 Money and the Interest Rate 12.2 Money, the Price Level and Inflation 12.3 The Cost of Inflation Read Chapter 9 from the course packet. Day 18 Chapter 17: Monetary Policy Page 7 of 8 17.1 How the Fed Conducts Monetary Policy: 17.2 Monetary Policy Transmission: Summary pages: 434-437 17.21 The Fed Fights Recession (pp. 434-435) 17.22 The Fed Fights Inflation (pp. 436-437) Ch 10: The Loanable Funds and the Credit Market – the role of inflationary expectations Read excerpt from Chapter 10 of the manuscript (course packet) Day 19 17.3 Alternative Monetary Policy Strategies – The Role of the Fed. Chapter 13: Aggregate Demand & Aggregate Supply: Sections 13.1 and 13.2: Chapter 13.3: Aggregate Demand and Aggregate Supply (pp. 334-337) Day 20: Extra Day for review MIDTERM 2 October 30 Day 21 Day 22 The Keynesian Influence Day 23 Chapter 16.1 the Federal Budget. Read Chapter 11 Fiscal Policy (course packet) 16.1 Federal Budget: Deficits and the Time Bomb 16.2 Fiscal Stimulus 16.3 The Supply Side - Potential GDP - and Growth Extra Credit Opportunity 6: Hand in a 400 -1000 word analysis of Reaganomics. This requires that you must first define what Reaganomics is or is not. OR Extra Credit Opportunity 7: Hand in a 400-1000 word analysis of the causes and consequences of the 2008 Financial Meltdown. Footnote web sources. Maximum value is 20 points on the final exam Day 24 Bubbles and Taylor’s Rule and the Financial Meltdown Day 25 The Causes of the Financial Meltdown Day 26 Chapter 19: International Finance 19.1 The Exchange Rate 19.2 Monetary Policy and the Exchange Rate Review Monetary Policy Episodes and Include Taylor’s Rule Day 27 Catch up Day and Day 28 – Nov 25 – Review for the final 28th class on November 25 Final Exam 9:30 TR class - December 4, 8 – 11 am Final Exam 11 TR class – December 9, noon – 3 pm Page 8 of 8