Incentives for Motivated Experts in a Partnership Ting Liu Ching-to Albert Ma

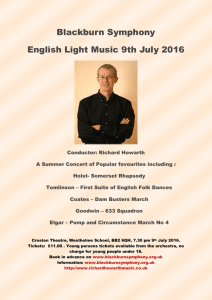

advertisement