Life-Cycle Dynamics and the Expansion Strategies of U.S. Multinational Firms

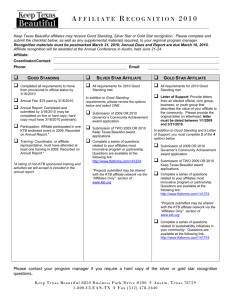

advertisement