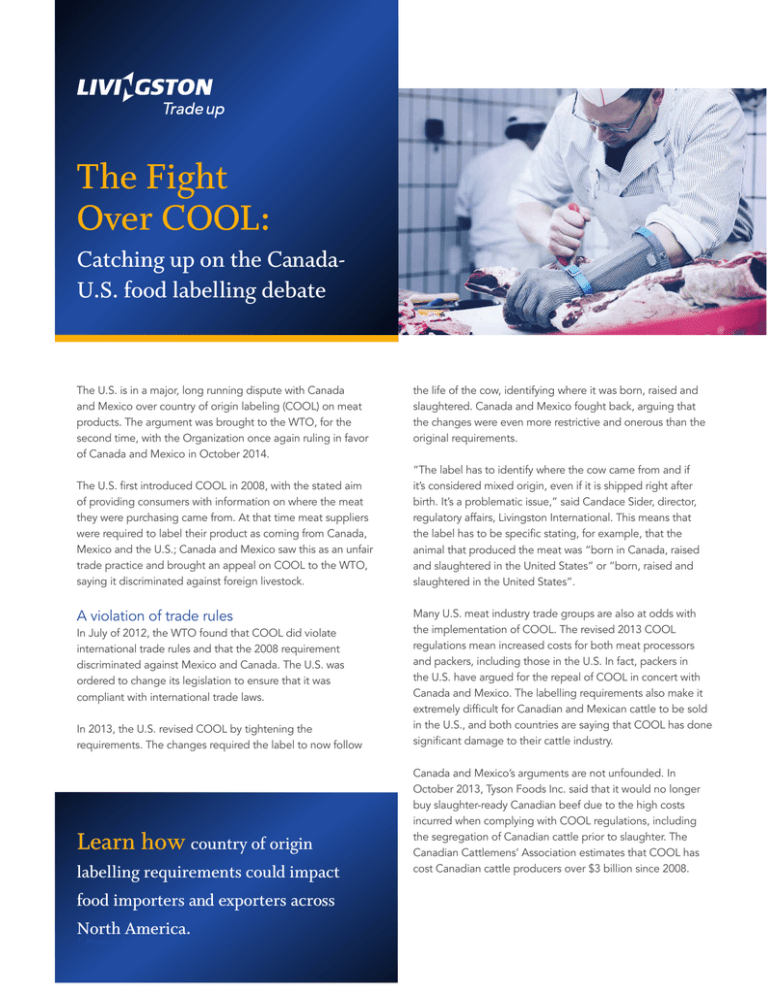

The Fight Over COOL: Catching up on the Canada- U.S. food labelling debate

advertisement

The Fight Over COOL: Catching up on the CanadaU.S. food labelling debate The U.S. is in a major, long running dispute with Canada and Mexico over country of origin labeling (COOL) on meat products. The argument was brought to the WTO, for the second time, with the Organization once again ruling in favor of Canada and Mexico in October 2014. The U.S. first introduced COOL in 2008, with the stated aim of providing consumers with information on where the meat they were purchasing came from. At that time meat suppliers were required to label their product as coming from Canada, Mexico and the U.S.; Canada and Mexico saw this as an unfair trade practice and brought an appeal on COOL to the WTO, saying it discriminated against foreign livestock. A violation of trade rules In July of 2012, the WTO found that COOL did violate international trade rules and that the 2008 requirement discriminated against Mexico and Canada. The U.S. was ordered to change its legislation to ensure that it was compliant with international trade laws. In 2013, the U.S. revised COOL by tightening the requirements. The changes required the label to now follow Learn how country of origin labelling requirements could impact food importers and exporters across North America. 1 Product: Export Process the life of the cow, identifying where it was born, raised and slaughtered. Canada and Mexico fought back, arguing that the changes were even more restrictive and onerous than the original requirements. “The label has to identify where the cow came from and if it’s considered mixed origin, even if it is shipped right after birth. It’s a problematic issue,” said Candace Sider, director, regulatory affairs, Livingston International. This means that the label has to be specific stating, for example, that the animal that produced the meat was “born in Canada, raised and slaughtered in the United States” or “born, raised and slaughtered in the United States”. Many U.S. meat industry trade groups are also at odds with the implementation of COOL. The revised 2013 COOL regulations mean increased costs for both meat processors and packers, including those in the U.S. In fact, packers in the U.S. have argued for the repeal of COOL in concert with Canada and Mexico. The labelling requirements also make it extremely difficult for Canadian and Mexican cattle to be sold in the U.S., and both countries are saying that COOL has done significant damage to their cattle industry. Canada and Mexico’s arguments are not unfounded. In October 2013, Tyson Foods Inc. said that it would no longer buy slaughter-ready Canadian beef due to the high costs incurred when complying with COOL regulations, including the segregation of Canadian cattle prior to slaughter. The Canadian Cattlemens’ Association estimates that COOL has cost Canadian cattle producers over $3 billion since 2008. The impact of COOL: The Wall Street Journal estimates that the combined retaliatory actions of U.S. farm bill prompts WTO action Canada and Mexico had hoped to avoid another WTO battle; they were hopeful that COOL would be addressed in the 2014 farm bill when it passed by the U.S. Congress. However, the bill was passed with no changes, despite appeals from American meat producers and processors. Once the bill was passed, COOL was firmly entrenched leaving Canada and Mexico with only one option – to again bring COOL before the WTO. both Canada and Mexico could cost the U.S. economy $2 billion. The appeal has worked its way through the WTO. In October 2014, WTO again ruled in favor of Canada and Mexico, finding that the U.S. has not done enough to change its labelling rules. The U.S. now has the option to appeal the ruling, or comply. If the U.S. does not make the necessary amendments to COOL, Canada has threatened to take action in the form of trade retaliation, including placing increased tariffs of over $1 billion on various U.S. products imported into Canada. The list Labelling requirements are making it extremely difficult for Canadian and Mexican cattle to be sold in the U.S. of products potentially affected, as compiled by the Canadian government, includes beef, pork, cereals, baked goods, fresh fruit and other items. It is estimated that the combined retaliatory actions of both Canada and Mexico could cost the U.S. economy $2 billion1. “The Canadian retaliation is broader,” said Sider. “They’re looking at retaliatory tariffs on 30 U.S. products if COOL is not repealed.” Canada is not expected to implement retaliatory tariffs until the U.S. has exhausted all legislative and legal options, and the WTO provides authorization for the tariffs. “Canada is waiting for the WTO to run its course before retaliating,” said Sider. 1 Wall Street Journal – Feb. 28 Contact your Livingston account executive e-mail us at solutions@livingstonintl.com or give us a call at 1-800-837-1063 Visit www.livingstonintl.com 2 The Fight Over COOL