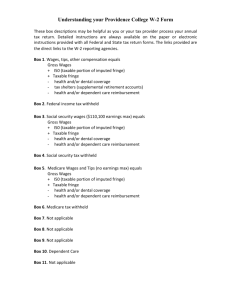

W-2 2013 Wage and Tax Statement

advertisement

Form W-2 Wage and Tax Statement Copy C for Employee’s Records. (See Notice to Employee on back of Copy B) 2013 OMB No. 1545-0008 University of Pittsburgh 4200 Fifth Avenue Pittsburgh, PA 15260 e Employee’s name, address and zip code Darling, Elizabeth 2001 Campus Drive Pittsburgh, PA 15213 2 Federal income tax withheld 46,379.35 7 Social security tips 8 Allocated tips c Employer’s name, address and zip code 1 Wages, tips, other compensation 9 Advance EIC payment 0.00 3 Social security wages 0.00 5 Medicare wages and tips 0.00 12b 12d 13 Statutory 12c 4,107.00 Retirement emp Plan sick pay 14 Other 14E 14G 14H 14A 14D 123-45-6789 This information is being furnished to the Internal Revenue Service. If you are required to file a tax return, a negligence penalty or other sanction may be imposed on you if this income is taxable and you fail to report it. PA 15 State 25-0965591 50,908.35 Employer’s state ID number 16 State wages, tips, etc 17 State income tax 18 Local wages, tips, etc. Box 1 Social Security Wages (FICA) Benefit Credit + 50.00 Imputed WR + + 160.00 Taxable Football Ticket + 260.00 Taxable Moving Expense + 1600.00 Taxable Scholarship - 4,107.00 - 92.00 - 2,425.00 - 250.00 - 1,000.00 = $46,379.35 Medicare Wages $51,333.35 Salary $51,333.35 600.00 250.00 20 Locality name Box 5 Salary + + 19 Local income tax 260.00 250.00 600.00 104.00 50.00 70 1527.24 Box 3 Wages, Tips & Other Compensation $51,333.35 50,908.35 1,562.88 4,217.27 Third-party x 25-0965591 .00 P d Employee’s social security number b Employer identification number 732.05 11 Nonqualified plans 1,000.00 E 2,120.43 6 Medicare tax withheld 50,486.35 10 Dependent care benefits 12a See instructions for box 12 4 Social security tax withheld 50,486.35 7,874.00 Salary 600.00 + 600.00 Benefit Credit + 50.00 + 160.00 Taxable Football Ticket 280.00 Taxable Moving Expense Benefit Credit + 50.00 + 160.00 Taxable Football Ticket + 260.00 Taxable Moving Expense + Imputed WR Imputed WR + 1600.00 Taxable Scholarship + 1 600.00 Taxable Scholarship + 250.00 University Provided Car + - 92.00 Parking - 92.00 HlthCare Spending Fund - 2,425.00 Med/Dent/Vision - 250.00 Med/Dent/Vision Dependent Care - 1,000.00 Dependent Care Amount subject to FICA (Social Security + Medicare) = University Provided Car 250.00 University Provided Car Tax Deferred Retirement Parking Parking - 2,425.00 - 250.00 HlthCare Spending Fund HlthCare Spending Fund Med/Dent/Vision - 1,000.00 = $50,486.35 Dependent Care Amount subject to Federal Income Tax Box 2 Federal Income Tax Withheld FIT Total Federal Income tax withheld for the tax year. $50,486.35 Amount subject to Federal Income Tax Note: Total FICA Wage Base Not to Exceed $113,700 Box 4 Social Security Tax Withheld (FICA) Amount in Box 3 X FICA rate of 6.2%. Box e Employee’s Name & Address Employee’s name and address as it appears in the Payroll Master File. Box 6 Medicare Tax Withheld Amount in Box 5 X rate of 1.45% *Additional .9% for compensation exceeding $200,000 Box 9 Box 17 Box 13 Advance EIC Payment State Income Tax Retirement Plan An “X” indicates that employee participated in retirement plan. Amount paid to the employee as Earned Income Credit advance payment (Form W-5). Total state income tax withheld for the tax year. Box 14 Box 10 Local Wages, Tips, Etc. Dependent Care Benefits Code 14A Amount paid for dependent care benefit. Description Basketball Tickets Football Tickets Scholar Med Scholar Med Refund Executive Misc Imp Fed OAD Imp State OAD Imputed General Income Imputed Medical WR Imputed Income WR Imputed Income 2 NonQualified Moving Expense Pers Clubs Pers Company Car Scholarship Scholarship Dependent Scholarship1 Dependent Scholar ADD Scholar ADD Refund Scholar Life Scholar Life Refund Scholar Bus Pass Scholar Bus Pass Refund Local Service Tax (LST) 14B 14C 14D Box 11 Nonqualified plans Taxable amount from a nonqualified deferred compensation plan. 14E 14F 14G 14H Box 12 Examples of Other Taxable & Non-Taxable Items Code (c) (e) (BB) (DD) (P) Box 18 Other: Taxable Fringe Benefits 14I 14J Description Imputed Life Retirement (TIAA/ Vanguard) Roth IRA Health Coverage Qualified Relocation 14X Box 16 $51,133.35 Salary + 600.00 Benefit Credit + 50.00 Imputed WR + 1,600.00 Taxable Scholarship - 2,425.00 HlthCare Spending Fund - 250.00 Med/Dent/Vision = $50,908.35 Amount subject to Local Income Tax Box 19 Local Income Tax Total local income tax withheld for the tax year. Box 20 Locality Name Box 16 State Wages, Tips, Etc. $51,333.35 Salary + 600.00 + 50.00 Benefit Credit Imputed WR + 1600.00 Taxable Scholarship - 2,425.00 - 250.00 = $50, 908.35 HlthCare Spending Fund Med/Dent/Vision Amount subject to State Income Tax Please note: The above example is for PA only. TCD for Jordan (70)