2015-2016 STANDARD VERIFICATION WORK-SHEET (V1, V3, V4, V5, V6)

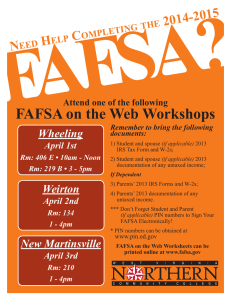

advertisement

2015-2016 STANDARD VERIFICATION WORK-SHEET (V1, V3, V4, V5, V6) Your 2015–2016 Free Application for Federal Student Aid (FAFSA) was selected for review in a process called verification. The law says that before awarding Federal Student Aid, we may ask you to confirm the information you reported on your FAFSA. To verify that you provided correct information, we will compare your FAFSA with the information on this verification document and with any other required documents. If there are differences, your FAFSA information may need to be corrected. You and a parent whose information was reported on the FAFSA must complete and sign this institutional verification document, attach any required documents, and submit the form and other required documents to us within 15 days. We may ask for additional information. If you have questions about verification, contact the Office of Enrollment Services FA@sheltonstate.edu. A. Student Information _____________________________________________ Student Name (Last name, First name, M.I.) ________________________________________________________ Student ID (S Number) Date of Birth _____________________________________________ ________________________________________________________ _____________________________________________ ________________________________________________________ Street Address Email City State Zip Home Phone Number Cell Phone Number B. Dependency Status (Check One) Dependent Student – Born after Jan. 1, 1992 Independent Student – Born before Jan. 1, 1992, or married or serving in armed forces or provide more than ½ of child support for your child or you meet one of the approved FAFSA dependency criteria. If you do not meet one of these criteria, please visit https://studentaid.ed.gov/sites/default/files/dependency-status.png. C. Household Members and Number in College – List below the people in your household. Please include if you are a: Dependent Student (parents’ household) Yourself and your parent(s) (including a step-parent) even if you do not live with them, must include step-parent if your custodial parent is remarried as well as parents who live together regardless of marital status or gender. Your parent(s)’ other children if your parent(s) provides More than half of their support from July 1, 2015, through June 30, 2016, or if the other children would be required to provide parental information if they were completing a FAFSA even if they do not live with your parent(s). Other people ONLY IF they live with your parent(s) now, AND your parent(s) will continue to provide more than half of their support from July 1, 2015, through June 30, 2016. We may request legal/court documentation to support these additional members of the household. Full Name Age Independent Student Yourself and your spouse, if married. Your children, if any, and if you will provide more than half of their support from July 1, 2015, through June 30, 2016, or if the children would be required to provide your information if they were completing the 2015-16 FAFSA include children who meet either one of these standards, even if they do not live with you. Other people ONLY if they live with you now, AND you will continue to provide more than half of their support from July 1, 2015, through June 30, 2016. We may request legal/court documentation to support these additional members of the household. Relationship to Student College Attending Self (Student) Shelton State Community College If more space is needed, please attach a separate page with your name and Student ID number at the top. Note: Include the name of the college for any household member, excluding your parent(s), who will be enrolled at least half-time in a degree, diploma, or certificate program at a postsecondary educational institution anytime between July 1, 2014, and July 30, 2015. If more space is needed, attach a separate page with your name and Student Number at the top. Student Name:______________________________________________________ Student Number:___________________________________ D. Student/Spouse/Parent Tax Forms and Income Information To Be Verified - Important Note: If you filed or will file an amended 2014 IRS tax return, the student must contact the financial aid administrator before completing this section. The best way to verify income is by using the IRS Data Retrieval Tool that is part of FAFSA on the Web. If you have not already used the tool, go to FAFSA.gov, log in to the student’s FAFSA record, select “Make FAFSA Corrections,” and navigate to the financial information section of the form. From there, follow the instructions to determine if you are eligible to use the IRS Data Retrieval Tool (IRS DRT) to transfer 2014 IRS income tax information into the student’s FAFSA. It takes up to two weeks for the IRS income information to be available for the electronic IRS tax return filers and up to eight weeks for paper tax return filers. If you need more information about when or how to use the IRS Data Retrieval Tool, see your FA administrator in the Office of Enrollment Services. If you filed a 2014 U.S. Federal Tax Return, complete the information below. Student Spouse Parent(s) Please check the boxes that apply. Has used the IRS DRT to retrieve and transfer 2014 income information into the FAFSA Has not yet used the IRS DRT but will use the tool to transfer my 2014 income information into the FAFSA once I have filed my 2014 IRS tax return (See additional information above regarding IRS DRT.) Am unable or choose not to use the IRS DRT to transfer my income information into the FAFSA I have attached a copy of my 2014 IRS tax return transcript(s). To obtain an IRS tax return transcript, go to www.IRS.gov and click on the “Order a Return or Account Transcript” link, or call 1.800.908.9946. Make sure to request the “IRS tax return transcript” and not the “IRS tax account transcript.” You will need your Social Security number, date of birth, and the address on file with the IRS, normally, this will be the address used when your 2014 IRS tax return was filed. It takes up to two weeks for the IRS income information to be available for the electronic IRS tax return filers and up to eight weeks for paper tax return filers. If you are married and you and your spouse filed separate 2014 tax returns, you must submit tax return transcripts for both you and your spouse. No, I am not filing, and I am not required to file a 2014 U.S. Federal Tax Return. Please see section E. E. Student/Spouse/Parent Nontax Filer Information 2014 Student Spouse Parent(s) Please check the boxes that apply. Was not employed and did not have income earned from work in 2014 Student Spouse Parent Was employed during 2014 and have listed below the names of all employers, the amount earned from each employer in 2014 and whether an IRS W-2 form is attached, attach copies of all 2014 W-2 forms issued to you (and, if married, to your spouse) by employers. List every employer even if the employer did not issue an IRS W-2 form. If more space is needed, attach a separate page with your name and S number at the top. Annual Amount Employer’s Name Earned in 2014 IRS W-2 Attached? $ $ $ Total Amount of Income Earned from Work $ Note: We may require you to provide documentation from the IRS that indicates a 2014 IRS income tax return was not filed with the IRS. F. Student/Spouse/Parent Untaxed Income Information 2014 2014 UNTAXED INCOME Student $ $ $ $ Untaxed Portions of Individual Retirement Account (IRA) Distributions IRA Deductions and Payments Tax Exempt Interest Income Education Credits (American Opportunity, Hope or Lifetime Learning Tax Credits) from IRS Form 1040 (line 49) or 1040A (line 31) Spouse or Parent $ $ $ $ Student Name:______________________________________________________ Student Number:___________________________________ G. Child Support Paid in 2014 Did you, your spouse, or one or both of your parents listed in section B of this form pay child support during the 2014 calendar year? Do not include foster care payments, adoption payments, or any amount that was court-ordered but not actually paid. Please indicate below who paid child support. No Yes – Complete the section below. Annual Amount of Student Spouse Parent Name of Person Who Paid Child Support Name of Person to Whom Child Support Was Paid Name and Age of the Child for Whom Support Was Paid Child Support Paid in 2014 $ $ $ $ $ Total Amount of Child Support Paid in 2014 $ If more space is needed, please attach a separate page with your name and Student ID number at the top. Note: If we have reason to believe that the information regarding child support paid is inaccurate, we may require additional documentation: A copy of the separation agreement or divorce decree showing the amount of child support to be provided; A statement from the individual receiving the child support certifying the amount of child support received; or Copies of the child support payment checks or money order receipts. H. Supplemental Nutrition Assistance Program (SNAP) The student certifies that ___________________________________________________________, a member of the student’s household, received benefits from the Supplemental Nutrition Assistance Program (SNAP) sometime during 2013 or 2014. SNAP may be known by another name in some states. For assistance in determining the name used in a state, please call 1.800.4FED.AID (1.800.433.3243). I. Certification and Signatures: Each person signing this worksheet certifies that all of the information reported on it is complete and correct. If dependent, the student and one parent must sign and date this worksheet. ________________________________________________________ ____________________________________ ________________________________________________________ ____________________________________ Student Signature Parent Signature (if dependent student) Date Date WARNING: If you purposely give false information on this worksheet, you may be fined, sentenced to jail, or both. Also, you may be subject to disciplinary action by the College. IMPORTANT: Once we receive your completed documentation, please allow seven (7) business days for verification/corrections to be processed and indicated on your Myshelton account. Do not mail this worksheet to the U.S. Department of Education. Submit or mail this worksheet to the following: SSCC Enrollment Services Office 9500 Old Greensboro Road Tuscaloosa, Alabama 35405 Email: fa@sheltonstate.edu Fax: 205.391.2372 You should make a copy of this worksheet for your records. The Free Application for Federal Student Aid (FAFSA) is the only form that a student is required to complete to be considered for student assistance from any of the Title IV, HEA programs. No additional application or other request for information can be required by an institution in support of the student’s request for Title IV, HEA program assistance, except for information needed to ensure the student’s eligibility for such assistance (e.g., information needed to complete verification or to demonstrate compliance with the student eligibility provisions of the HEA and the regulations). It is the official policy of the Alabama Department of Postsecondary Education, including postsecondary education institutions under the control of the State Board of Education, that no person shall, on the grounds of race, color, handicap, gender, religion, creed, national origin, or age, be excluded from participation in, be denied the benefits of, or be subjected to discrimination under any program, activity, or employment. Shelton State Community College will make reasonable accommodations for qualified disabled applicants or employees.