2016-2017 V1 STANDARD VERIFICATION WORKSHEET (Attach V4, V5, V6 if required)

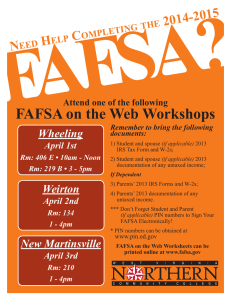

advertisement

2016-2017 V1 STANDARD VERIFICATION WORKSHEET (Attach V4, V5, V6 if required) Your 2016–2017 Free Application for Federal Student Aid (FAFSA) was selected for review in a process called verification. Before awarding Federal Student Aid, the law requires you to confirm the information reported on your FAFSA. To verify the provided information was correct, we will compare your FAFSA with the information on this verification document and any other required documents. If there are differences, your FAFSA information may need to be corrected. You and the parent whose information was reported on the FAFSA must complete and sign this institutional verification document, attach any required documents, and submit the form and other required documents within 15 days. Additional information may be required. If you have questions about verification, contact the Enrollment Services Office at FA@sheltonstate.edu. A. Student Information _________________________________________________ ____________________________ Student Name (last name, first name, M.I.) Student ID/SSN ________________________ Date of Birth _________________________________________________ _________________________________________________________ Street Address City State Zip _________________________________________________ ____________________________ Email Home Phone Number B. Dependency Status (check one) Dependent Student – Born after Jan. 1, 1993 _________________ ______ Cell Phone Number Independent Student – Born before Jan. 1, 1993; married; serving in the armed forces; have a child you provide more than half of their support; or you meet one of the approved FAFSA dependency criteria. If you do not meet one of these criteria, please visit https://studentaid.ed.gov/sa/fafsa/filling-out/dependency. C. Household Members and Number in College – List below the people in your household. Please include: Dependent Student Independent Student Yourself and your parent(s) (including a step-parent) even if you Yourself and your spouse, if married do not live with them; must include step-parent if your custodial parent is remarried, as well as parents who live Your children, if any, and if you will provide more together regardless of marital status or gender. than half of their support from July 1, 2016, through June 30, 2017, or if the children would be required to Your parent(s)’ other children if your parent(s) provide more than half of their support from July 1, 2016, through provide your information if they were completing the June 30, 2017, or if the other children would be required to 2016-17 FAFSA include children who meet either provide parental information if they were completing a one of these standards, even if they do not live with you. FAFSA for 2016-17. Include children who meet either of these standards, even if they do not live with your parent(s). Other people ONLY if they presently live with you AND you will continue to provide more than half of their Other people ONLY IF they presently live with your parent(s), AND your parent(s) will continue to provide more than support from July 1, 2016, through June 30, 2017. half of their support from July 1, 2016, through June 30, 2017. We may request legal/court documentation to support We may request legal/court documentation to support these these additional members of the household. additional members of the household. Full Name Age Relationship to Student College Attending Self (Student) Shelton State Community College Note: Include the name of the college for any household member, excluding your parent(s), who will be enrolled at least half-time in a degree, diploma, or certificate program at a postsecondary educational institution anytime between July 1, 2016, and June 30, 2017. If more space is needed, attach a separate page with your name and student number at the top. Student Name:_________________________________________________ Student Number:_______________________________ D. Student/Spouse/Parent Tax Forms and Income Information to be Verified - Important Note: If you filed or will file an amended 2015 IRS tax return, the student must contact the financial aid administrator before completing this section. The best way to verify income is by using the IRS Data Retrieval Tool that is part of FAFSA on the web. If you have not already used the tool, go to FAFSA.gov, log in to the student’s FAFSA record, select “Make FAFSA Corrections,” and navigate to the financial information section of the form. From there, follow the instructions to determine if you are eligible to use the IRS Data Retrieval Tool (IRS DRT) to transfer 2015 IRS income tax information into the student’s FAFSA. It takes up to two weeks for the IRS income information to be available for the electronic IRS tax return filers and up to eight weeks for paper tax return filers. If you need more information about when or how to use the IRS Data Retrieval Tool, see your financial aid administrator in the Office of Enrollment Services. If you filed a 2015 U.S. Federal Tax Return, complete the information below. Student Spouse Parent(s) Please check the boxes that apply. Has used the IRS DRT to retrieve and transfer 2015 Federal Income Tax information into the FAFSA. Has not yet used the IRS DRT but will use the tool to transfer 2015 Federal Income Tax information into the FAFSA once 2015 IRS Federal Income Tax Return is filed. (See additional information above regarding IRS DRT.) Is unable or chooses not to use the IRS DRT to transfer income information into the FAFSA. I have attached a copy of my 2015 IRS tax return transcript(s). To obtain an IRS tax return transcript, go to www.IRS.gov and click on “Get A Tax Transcript,” or call 1.800.908.9946. Make sure to request the “IRS tax return transcript” and not the “IRS tax account transcript.” You will need your Social Security Number, date of birth, and the address on file with the IRS. Normally, this will be the address used when your 2015 IRS tax return was filed. It takes up to two weeks for the IRS income information to be available for electronic IRS tax return filers and up to eight weeks for paper tax return filers. If you are married and you and your spouse filed separate 2015 tax returns, you must submit tax return transcripts for both you and your spouse. Is not filing, and is not required to file a 2015 U.S. Federal Tax Return. Please see section E. E. Student/Spouse/Parent Nontax Filer Information for 2015 Student Spouse Parent(s) Please check the boxes that apply. Was not employed and did not have income earned from work in 2015. Student Spouse Parent(s) Was employed during 2015 and has listed below the names of all employers, the amount earned from each employer, and whether an IRS W-2 is attached. Attach copies of all 2015 W-2 forms issued to you and, if married, your spouse by employers. List every employer even if the employer did not issue an IRS W-2 form. If more space is needed, attach a separate page with your name and student ID number at the top. Annual Amount IRS W-2 Attached? Employer’s Name Earned in 2015 (yes or no) $ $ $ $ Total Amount of Income Earned from Work $ Note: We may require you to provide documentation from the IRS that indicating that a 2015 IRS income tax return was not filed. F. Student/Spouse/Parent Untaxed Income Information for 2015 Student Spouse Parent(s) 2015 UNTAXED INCOME $ $ $ Untaxed Portions of Individual Retirement Account (IRA) Distributions $ $ $ IRA Deductions and Payments $ $ $ Tax Exempt Interest Income Education Credits (American Opportunity, Hope or Lifetime Learning Tax Credits) from IRS Form 1040 (line 68 and 50) 2 Student Name:_________________________________________________ Student Number:_______________________________ G. Child Support Paid in 2015. Did you, your spouse, or one or both of your parents listed in section B of this form pay child support during the 2015 calendar year? Do not include foster care payments, adoption payments, or any amount that was court-ordered but not actually paid. Please indicate below who paid child support. No Yes – Complete the section below. Student Spouse Parent(s) Name of Person Who Paid Child Support Name of Person to Whom Child Support Was Paid Name and Age of the Child for Whom Support Was Paid Annual Amount of Child Support Paid in 2015 $ $ $ $ Total Amount of Child Support Paid in 2015 $ If more space is needed, please attach a separate page with your name and student ID number at the top. Note: If we have reason to believe information regarding child support paid is inaccurate, we may require the following additional documentation: A copy of the separation agreement or divorce decree showing the amount of child support to be provided A statement from the individual receiving the child support certifying the amount received Copies of the child support payment checks or money order receipts H. Supplemental Nutrition Assistance Program (SNAP). The student certifies that _____________________________________________, a member of the student’s household, received benefits from SNAP sometime during 2014 or 2015. SNAP may be known by another name in some states. For assistance in determining the name used in a state please call 1.800.4FED.AID (1.800.433.3243). E. Certification and Signatures: Each person signing this worksheet certifies that all of the information reported on it is complete and correct. If dependent, the student and one parent must sign and date this worksheet. _______________________________________________________________ Student Signature ________________________________________ Date _______________________________________________________________ Parent Signature (if dependent student) ________________________________________ Date WARNING: If you purposely provide false information on this worksheet, you may be fined, sentenced to jail, or both. You may also be subject to disciplinary action by the College. IMPORTANT: Once we receive your completed documentation please allow seven (7) business days for verification/corrections to be processed and indicated on your myshelton account. Do not mail this worksheet to the U.S. Department of Education. Submit or mail this worksheet to the following: SSCC Enrollment Services Office 9500 Old Greensboro Road Tuscaloosa, Alabama 35405 Email: fa@sheltonstate.edu Fax: 205.391.2372 Make a copy of this worksheet for your records. The Free Application for Federal Student Aid (FAFSA) is the only form a student is required to complete to be considered for student assistance from any of the Title IV, HEA programs. No additional application or other request for information can be required by an institution in support of the student’s request for Title IV, HEA program assistance, except for information needed to ensure the student’s eligibility for such assistance (e.g., information needed to complete verification or to demonstrate compliance with the student eligibility provisions of the HEA and the regulations). It is the policy of the Alabama Community College System, including all postsecondary institutions under the control of the Alabama Community College Board of Trustees, that no person shall, on the grounds of race, color, disability, sex, religion, creed, national origin, or age, be excluded from participation in, be denied the benefits of, or be subjected to discrimination under any program, activity, or employment. 3