ECON 3141/4141: International macro and finance

advertisement

ECON 3141/4141: International macro and finance

Note: The document gives some solution hints to the autumn 2003 exam.

In order to ease the reading, the text with the questions have been

emphasized

Original text starts here:

This is a 3000-words home assignment, i.e., to get a pass the number of words

cannot exceed 3000 (figures, equations, diagrams etc. do not count as words).

The home assignment will be marked and counts 40 % towards the overall mark in

this course. If a student believes that she or he has a good cause not to meet the

deadline (e.g. illness) she or he should discuss the matter with the course teacher

and seek a formal extension. Normally extension will only be granted when there

is a good reason backed by supporting evidence (e.g. medical certificate).

1. Consider the following dynamic macro model

(1)

(2)

Ct = β 0 + β 1 Yt + αCt−1

Yt = Ct + Jt

where Ct denotes private consumption (in period t), Jt denotes autonomous

expenditure and Yt symbolizes GDP. Assume that the initial conditions C0 and

Y0 are known, and that the parameters β 0 , β 1 , α also are known numbers.

(a) Explain the economic interpretation of the model in equation (1) and (2).

Apart from the lagged level of consumption in (1) this is a closed economy

(Keynesian) multiplier model. One underlying assumption is that there

are “idle resources” in the form of unemployment and (under utilized)

production equipment. The lagged level of consumption is essential as it

makes the model dynamic. The dynamic formulation of the consumption

function can be intuitively rationalized in many ways. For example Ct

may depend on Ct−1 because of habit formation, or because of a wish

among households to smooth consumption relative to income (possibility

of this may be limited by credit rationing, though). Since Ct is total

consumption, it also includes durables (e.g., housing) which “produce

services” over several periods. The dynamic consumption function also

“fits the facts” better than the static model (i.e., with α = 0).

(b) Assume Jt = J0 , i.e., constant at the initial level J0 . Draw a graph that

illustrates the stable solution path for Yt in the case where Y0 is above the

long run steady state level of Y . Explain.

Here it is possible to use the material in the lecture and the lecture

note quite freely/directly, perhaps after including a phrase like “from the

lectures and the lecture notes to this course I know that ...” or some other

formulation to the same effect. For example, you might write down the

final equation for Ct (it is obtained by using (2) to substitute Yt from (1))

(3)

Ct = β̃ 0 + α̃Ct−1 + β̃ 2 J0

1

where β̃ 0 and α̃ are the original coefficients divided by (1 − β 1 ), and

β̃ 2 = β 1 /(1 − β 1 ). Clearly, from (2) the solution for Yt is given by the

solution path for Ct with J0 added. For the realistic case of 0 < α̃ < 1,

and setting Y0 > Y ∗ as prescribed by the question (Y ∗ denotes the long

run steady state level), the graph will illustrate a smooth adjustment

process towards Y0 from above. Some students might attempt to derive

the final equation for Yt . Note that Ct = Yt − Jt , and Ct−1 = Yt−1 − Jt−1 ,

hence

Yt − Jt = β 0 + β 1 Yt + α(Yt−1 − Jt−1 )

and

Yt = β̃ 0 + α̃Yt−1 +

1−α

J0 .

1 − β1

Replace (2) by

(4)

Yt = Ct + Jt + P CAt

where P CAt denotes the primary current account (or trade balance). Assume the following function for P CAt :

(5)

P CAt = γ 0 + γ 11 σ t + γ 12 σ t−1 + γ 20 Yt

where σ t denotes the real exchange rate (as defined in the book by Burda

&Wyplosz).

(c) What do you regard to be reasonable signs of the derivative coefficients

( γ 11 , γ 12 , γ 20 ) in equation (5)? What about the sum γ 11 + γ 12 ?

Realistically, imports are positively related to the domestic activity level,

hence γ 20 < 0. γ 11 and γ 12 are related to the dynamic effects of a change

in the real exchange rate on P CA. As explained in the lectures it is

realistic to imagine that γ 11 > 0 (terms of trade effect dominates) and

γ 12 < 0, especially if the time period is not too long (e.g., quarter or year).

It is reasonable to assume that in the long run the “quantity effect” on

imports and exports of a permanent change in σ is stronger, hence γ 11 +

γ 12 ≤ 0 (the Marshall-Lerner condition is satisfied (note: knowledge of

the formalities of the M-L condition is not required! It is not covered by

the books. The intuition has been explained in the lectures)).

(d) Discuss the condition(s) of stability of the system made up of (1), (4) and

(5).

We only need to find the final equation for one of the variables of the

simultaneous equation system (why?). Moreover, the essential parameter

to discuss is the coefficient of the lagged variable in the final equation. The

are many ways to proceed, but if we concentrate on (the final equation

of) consumption then, from (4) and (5):

Yt =

1

1

γ 11

γ 12

γ0

Ct +

Jt +

σt +

σ t−1 +

,

(1 − γ 20 )

(1 − γ 20 )

(1 − γ 20 )

(1 − γ 20 )

(1 − γ 20 )

2

substitution of Yt in (1) by the right hand side of this expression gives a

final equation for Ct where the coefficient of the lag Ct−1 is

ᾰ =

α

β1

1−

1 − γ 20

.

If we maintain that γ 20 < 0, then ᾰ < α̃ (for the conventional case of

0 < α ≤ 1 and 0 < β 1 < 1). In this sense, import leakage stabilizes the

system made up of Yt , Ct .

(e) Choose a set of numbers for the derivative coefficients of the system (1),

(4) and (5) and (using that set of coefficients values), show how GDP is

affected by a permanent increase in the real exchange rate.

The question opens for two interpretations: i) Show the full dynamic

adjustment path (the full range of multipliers) of Yt with respect to a

permanent change in σ 0 ; or b) Given that the system is stable, show the

long-run effects of a permanent change in σ on Y . i) is more demanding,

and it is not required to get a top grade.

Based on the second interpretation: Assume that the system is initially

in a long run steady state equilibrium, where Jt = J0 and σ t = σ t−1 =

σ 0 . Let Y ∗ , C ∗ and P CA∗ denote the steady states of the endogenous

variables. We can eliminate P CA∗ by as proceeding as in d., then

β1

β0

+

Y∗

1−α 1−α

1

1

γ + γ 12

γ0

C∗ +

J0 + 11

σ0 +

=

(1 − γ 20 )

(1 − γ 20 )

(1 − γ 20 )

(1 − γ 20 )

C∗ =

Y∗

A permanent change in the real exchange rate can be studied by differentiating this system:

β1

β0

+

dY ∗

1−α 1−α

1

γ + γ 12

dC ∗ + 11

dσ 0

=

(1 − γ 20 )

(1 − γ 20 )

dC ∗ =

dY ∗

and solve to obtain dY ∗ /dσ 0 :

dY ∗

=

dσ 0

γ 11 + γ 12

(γ 11 + γ 12 )(1 − α)

=

β1

(1 − γ 20 )(1 − α) − β 1

1 − γ 20 −

1−α

Assume the following choice of coefficients (just an example!!!!): γ 11 = 5,

γ 12 = −20, γ 20 = −0.3, β 1 = 0.4, α = 0.5, then

dY ∗

=

dσ 0

5 − 20

0.4

1 − (−0.3) −

1 − 0.5

− 30.

hence the long run effect has the opposite sign, and is larger in absolute

value, than the the impact effect, which is 0.1. In principle, we need

3

to check that the system is stable, otherwise the long run multiplier is

without practical interest (why?). For the above choice of parameters we

have

0.5

= 0.72

ᾰ =

0.4

1−

1 − (−0.3)

so the system is in fact stable in this example.

2. In small open economies, there is a lot of interest (and concern) about wage

formation, in particular in the sectors of the economy which face competition

from foreign firms, i.e., the exposed sector.

(a) Why, according to your understanding, is wage formation so important

in the economic-policy debate?

Here we expect answers that reflect a certain level of insight into the

socioeconomic role of wage formation. For example, for employment and

unemployment, for an industry’s profitability and competitiveness, and

for inflation. Via inflation, wage formation also has an effect on monetary

policy (given the target of monetary policy). Most peoples’ income is

mainly wage earnings, so wage formation is also important for households

income and economic welfare. Is the wage distribution fair or unfair?

That issue is also recurrent.

A general wage equation is represented by

(6)

we,t = β 0 + β 11 mct + β 12 mct−1 + β 21 ut + β 22 ut−1 + αwe,t−1 .

where we is the log of hourly wage costs (wage costs per man-hour) in

the exposed sector, and ut is the rate of unemployment (or its log) in the

economy. mct represents the main-course variable of the Norwegian model

of inflation, hence mct = qe,t + ae,t where qe,t and ae,t denote the logs of

the e-sector product price and average labour productivity, respectively.

(b) Explain (briefly) under which theoretical assumptions mct can be viewed

as an exogenous variable in the wage equation.

The most commonly used definition of exogeneity says that a variable is

exogenous if it is determined outside the model, in our case that mean

outside (6). On this definition, ae,t is exogenous if average labour productivity is unaffected by we,t or lags of we,t , i.e., it is a separate productivity

trend. This may well be realistic. qe,t is the sum of the product price in

foreign prices, and the nominal exchange rate (both in logs). Exogeneity of the price component is realistic if e-sector firms are price takers.

However, even if individual firms are price takers, the exchange rate may

depend on we,t (and/or its lags) if the exchange rate is floating and determined “freely” in the market for foreign exchange. One possibility is that

expected depreciation depends the wage share, thus linking the exchange

rate to we,t (or its lag), and thus implying that in a float regime the exchange rate is exogenous. Conversely, in a fixed exchange rate regime,

the foreign exchange rate is exogenous.

4

(c) Show that the restriction 0 < α < 1 implies a dynamic wage equation in

equilibrium correction form (EC).

Equation (6) is an example of a first order difference equation which

determines {we,1 , we,2 , } .... for an initial condition we,0 and exogenous

sequences {mc1 , mc2 , ......} and {u1 , u2 , ....}. Thus, we know from mathematics (it is not necessary to give any references to the literature!) that

the condition for (asymptotic) stability is 0 < α < 1, as stated. To

establish the EC interpretation, we can transform (6) in the usual way:

∆we,t = β 0 +β 11 ∆mct +(β 11 +β 12 )mct−1 +β 21 ∆ut +(β 21 +β 22 )ut−1 +(α−1)we,t−1

and

(7)

∆we,t = β 0 + β 11 ∆mct + β 21 ∆ut

¾

½

β 21 + β 22

β 11 + β 12

mc −

u

−(1 − α) we −

1−α

1−α

t−1

which is an equilibrium correction (EC) model: Subject to 0 < α < 1

wage growth corrects a proportion of last period’s deviation between the

actual wage level and the long run steady state wage level given by

w∗ =

β 11 + β 12

β + β 22

mc + 21

u + Constant.

1−α

1−α

(d) Show that the following restrictions on (6): α = 1, β 11 + β 12 = 0, β 21 +

β 22 < 0, imply a dynamic wage equation in Phillips-curve form.

If we apply the restrictions to the first equation in the answer to c., we

obtain:

∆we,t = β 0 + β 11 ∆mct + β 21 ∆ut + (β 21 + β 22 )ut−1

which is a wage Phillips-curve.

(e) Explain why both the Phillips-curve and the EC versions of equation (6)

are consistent with a main hypothesis of the Norwegian model of inflation,

namely that in steady-state, wage growth ( ∆we,t ) is equal to the growth

in the main-course variable ( ∆mct ).

Subject to the restriction that the long-run multiplier with respect to mc

+β 12

is unity, i.e., β 111−α

= 1, the EC version is consistent with the maincourse model: The nominal wage level is stable around an exogenous and

extended main-course:

mct +

β 21 + β 22

ut + Constant.

1−α

Alternatively: the wage share we,t − mct does not have a trend, but is

+β 22

stable around a β 211−α

ut +Constant. The exogeneity of ut may be due to

unemployment targeting in economic policy.

The Phillips curve version is (on its own) an unstable difference equation

for we,t : if the rate of unemployment is different from the natural rate

5

(called the main-course rate in the lectures) of unemployment, we,,t and

the wage share are unstable. However, if we postulate a separate dynamic

equation with ut depending positively on the lagged wage share, the twoequation system is asymptotically stable. Hence, stability requires that

ut is endogenous in the Phillips-curve case.

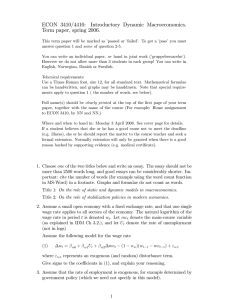

3. Figure 1 shows graphs of the Swedish nominal and real exchange rate. You

may want to down-load the data series from the web-page:

http://folk.uio.no/rnymoen/ECON3410_index.htm.

The name of the file is swefex.zip.

(a) In your view, has the Swedish governments of the past successfully used

devaluation to improving competitiveness?

The direct impact of the two devaluation in the 1980s on the real exchange

rate is evident from the graph. The effect also seems to have lasted

several years, so price adjustment in the aftermath of these devaluations

did not restore the previous level of competitiveness, it seems more like

a permanent change (albeit smaller than the initial improvement) in the

long-run mean of the real exchange rate. If this is what the Swedish

government intended then the devaluations must be regarded as a success.

(b) What does macroeconomic theory predict about the short- and long-run

effects of a devaluation on the real exchange rate?

As always in economics, a good way to start is to ask oneself “which

theory?” Of course as student (and teachers) we have limited knowledge

of the “theory universe”, so the best we can do is to make the best of

the few models that we know about. So, based on what we have covered

so far, a good starting point is the aggregate demand (multiplier) model,

with or without a Phillips curve. Note that in the answer to 1e) most

students actually adopt a model with fixed prices, and it is indeed relevant

to refer to that here. However, most students will implicitly or explicitly

allow for price effects of the devaluation as time passes. Formally, in

the framework where a Phillips curve is introduced, a devaluation affects

the real exchange rate in the period of the devaluation (in fact since the

price level is a “stock variable”, the impact effect (if the time period is

short) is one-to-one: A 10 percent devaluation improves competitiveness

(measured by the real exchange rate) by 10 percent (note that the graph

shows that this fits the facts quite nicely). In the aftermath, the activity

level then picks up (according to the model) and inflation increases. Over

time, this erodes the gain in competitiveness and the real exchange rate

starts to adjust back to the initial level. In the long run (according to

this model) there is no long run effect, since GDP output is fixed at its

full employment (natural rate) level.

(c) In late 1992, Sweden adopted a floating exchange rate regime. Try to

investigate empirically, using the data set, whether the correlation between

the nominal and real exchange rate has been increased or reduced after the

change to a floating exchange rate regime.

6

It is possible to comment on the graph in figure 1 directly, and/or to

use Pc-Give to produce scatter plots for the whole sample, and the two

sub-samples. The file swefex.log shows some regressions. It is interesting

to note that the correlation is higher/stronger in the float regime than

in the fixed exchange rate regime. This may reflect that domestic price

formation is more or less unaffected by the regime shift: The increased

correlation reflects that there are more frequent changes in the nominal

exchange rate during the float. while domestic price adjustments are just

as sluggish as before.

160

150

Nominal effective exchange rate (fall means devaluation/depreciation)

140

130

120

110

Real effective exchange rate (fall means improved competetiveness)

100

90

1980

1985

1990

1995

2000

Figure 1: Swedish effective (i.e., trade weighted) exchange indices (1995=100).

7