. Real-time Model Uncertainty in the United States:

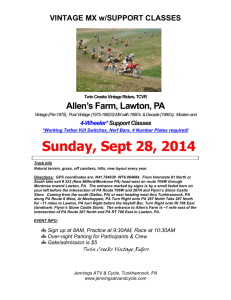

advertisement