Design Limits and Dynamic Policy Analysis

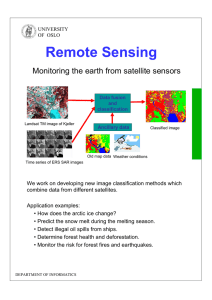

advertisement

Design Limits and Dynamic Policy Analysis

William A. Brock, Steven N. Durlauf, and Giacomo Rondina

May 25, 2006

Preliminary and Incomplete

JEL Classification Codes: C52, E6

Keywords: design limits, stabilization policy, robustness, model uncertainty

Design Limits and Optimal Policy Analysis

Abstract

This paper characterizes the frequency domain properties of linear systems with feedback

control rules. The goal of the analysis is to derive restrictions on how feedback rules

restrict the frequency by frequency fluctuations that underlie a time series of state

variables. The tradeoffs are known in the control literature as design limits. We extend

existing results in the control theory literature to account for discrete time bivariate

systems with rational expectations. Our basic methods provide ways to understand how

fluctuations at different frequencies are subject to tradeoffs via the choice of a feedback

rule. Application is made to the evaluation of monetary policy.

William A. Brock

Department of Economics

University of Wisconsin

1180 Observatory Drive

Madison, WI 53706-1393

wbrock@ssc.wisc.edu

Steven N. Durlauf

Department of Economics

University of Wisconsin

1180 Observatory Drive

Madison, WI 53706-1393

sdurlauf@ssc.wisc.edu

Giacomo Rondina

Department of Economics

University of Wisconsin

1180 Observatory Drive

Madison, WI 53706-1393

grondina@ssc.wisc.edu

I. Introduction

This paper explores a set of constraints on the effects of control policies on

fluctuations from the perspective of the frequency domain. Aspects of these constraints

were initially discussed in Brock and Durlauf (2004,2005) but otherwise do not appear to

have been previously explored in economics contexts.

The constraints we study

represent fundamental limits on the effects of alternative policies in the sense that they

describe how frequency-specific tradeoffs in volatility apply to all linear feedback rules.

The sorts of constraints we explore may be illustrated in the following example.

Suppose one is considering how different controls affect the variance of a state variable

x t . Underlying the statistic var (x t C ) , the variance of the process given a control, is the

spectral density of x given the rule, fx C (ω ) , as of course the variance is derivative of the

spectral density, since

var (x t C ) =

∫

π

−π

fx C (ω )d ω .

(1)

In fact, the spectral representation of the variance of the state means one can understand

the sum of the variances from random and orthogonal sine and cosines of different

frequencies. By implication, calculations of the effects of a rule on the overall variance

mask the effects on fluctuations at the different frequencies in [−π, π ] . Further, eq. (1)

hints at the idea that a rule that minimizes the overall variance may exacerbate

fluctuations at certain frequencies. A major goal of this paper is to determine under what

circumstances this must happen and what forms such fundamental tradeoffs take. In the

control literature, these tradeoffs are known as design limits.

Design limits are a well established area of study in control theory.1 Results of

this type are sometimes known as Bode integral constraints, after Hendrik Bode who first

proposed them in the 1930’s. The great bulk of the work in control theory focuses on

single-input, single-output (SISO) systems. One methodological contribution of this

1

Our description of linear systems owes much to the formulation in Kwakernaak and

Sivan (1972), especially chapter 6.

1

paper is that we derive frequency tradeoffs for multiple-input multiple-output (MIMO)

systems. While there does exist a set of disparate results in the control literature on

frequency tradeoffs for multivariate systems, this work has largely been done for

continuous time systems.2 One methodological contribution of this paper is that we

derive frequency tradeoffs for discrete time. A second methodological contribution is

that we study these tradeoffs when expectations of future state variables affect current

values; a property that, while of course natural for economic models, does not arise in

engineering contexts. Our focus will be on two-input two-output MIMO systems. We

defer consideration of systems with arbitrary dimension to future work, noting here that

the 2 × 2 case captures a range of important contexts, most notably the evaluation of

macroeconomic stabilization policy, which will be the focus of our application of the

general methods.

Why are frequency specific tradeoffs of interest to a policymaker? One reaction

to the proposal that policymakers face frequency-by-frequency constraints might be that

these constraints are irrelevant if the objective of a policymaker is to minimize the overall

variance of some combination of states and controls of the system; such loss functions are

standard in the literature on evaluating monetary policy rules. We argue that our results

are of interest for several reasons. First, there is no principled reason why policymaker

loss functions should only depend on the overall variances of variables of interest, and in

fact nonseparable preferences for policymakers can lead to difference losses for different

frequency-specific fluctuations. Examples of this property are found in Otrok (2001) and

Otrok, Ravikumar, and Whiteman (2002), Second, there are classes of problems for

which the frequency restrictions matter, even if loss functions only depend on

unconditional variances. Specifically, evaluating the robustness of policy rules in the face

of model uncertainty may be facilitated using the constraints we describe; an initial

example of such an analysis is Brock and Durlauf (2005).

The use of frequency domain methods is not original per se, of course. One

classic example is Hansen and Sargent (1980)’s use of z-transform methods to translate

time domain expectations into the frequency domain and thereby solve for testable

restrictions of rational expectations models.

2

Another important contribution is

See Skogestad and Postlethwaite (1996) for a survey.

2

Whiteman’s (1985,1986) work on spectral utility and the frequency domain analysis of

the effects of policies; Whiteman’s work is close in spirit to ours, although it does not

address the issue of frequency-specific tradeoffs. More recently, frequency methods are

proven important in the development of robustness, cf. Sargent (1999). Yet another

interesting application is developed in Kasa (2000) and Kasa, Walker and Whiteman

(2004) which show how frequency domain methods may be used respectively to show

how to characterize how individuals form beliefs about the beliefs of others and the

equilibrium characterization of prices in markets with asymmetric beliefs. That being

said, frequency domain approaches continue to be far less popular than time domain

methods for analyzing macroeconomic dynamics. We believe the methods developed

here complement these other papers in demonstrating that frequency domain approaches

have an important role in understanding stabilization policy. While, in principle, one can

always translate results from the frequency domain to the time domain and vice versa, the

results we exploit are an example in which working in the frequency domain is relatively

straightforward whereas it would appear that the same analysis in the time domain may

well be intractable.3

Section 2 provides an analysis of three classes of models: backwards-looking

MIMO systems, forwards-looking MIMO systems, and SIMO (single input, multiple

output) systems. We also consider tradeoffs between frequency-specific variances of

states and controls. Section 3 provides examples. Section 4 applies our methods to the

evaluation of Taylor rules. Section 5 contains summary and conclusions. Appendices

follow which contains proofs of various claims made in the text as well as some

examples of general findings.

2. Design limits in multivariate systems

i. backwards looking models

3

For example, the Bode integral constraint, which we exploit in the subsequent analysis,

has an extremely convoluted time domain representation for a SISO system, cf. Iglesias

(2001) equation 3.2 and surrounding discussion.

3

We first consider a backward looking system, i.e. one where expectations do not

directly enter into the law of motion for the states. Letting, x t denote a 2 × 1 vector of

states, ut a 2 × 1 vector of controls, and εt a 2 × 1 vector of innovations that is weakly

stationary across time, the canonical law of motion for a backwards looking system is

A0x t = A (L ) x t −1 + B (L ) ut + εt .

(2)

In general, the matrix A0 will possess off diagonal elements because of contemporary

interdependences between the states; without loss of generality, we write the matrix as

⎛ 1 a 0,2 ⎞⎟

⎟⎟ .

A0 = ⎜⎜⎜

⎝⎜a 0,3 1 ⎠⎟⎟

The moving averaging representation of εt is

εt = W (L ) wt .

(3)

We assume that each element of W (L ) may be written as the ratio of two finite

dimensional polynomials,4 i.e.

⎛ wn,1 (L ) wn ,2 (L )⎞⎟

⎜⎜

⎟

⎜⎜ wd ,1 (L ) wd ,2 (L ) ⎟⎟

⎟⎟

.

W (L ) = ⎜⎜

⎜⎜ wn ,3 (L ) wn ,4 (L )⎟⎟⎟

⎟⎟

⎜⎜

⎜⎝ wd ,3 (L ) wd ,4 (L )⎠⎟⎟

(4)

This assumption means that ε t possesses a rational spectral density matrix. See Hansen

and Sargent (1983) for an example of how rational spectral densities have been used in

econometrics.

4

4

Notice that we do not require the moving average representation to be fundamental. The

reason for this is that our interpretation of the backwards looking model is that it is a

structural description of a system.5

Our analysis focuses on linear feedback rules of the form

ut = U (L ) x t −1 .

(5)

Each choice of this polynomial will produce a different spectral density matrix for the

state variable, via the law of motion

A0x t = A (L ) x t −1 + B (L )U (L ) x t −1 + εt .

(6)

The moving average representation of the system is

−1

x t = (A0 − (A (L ) + B (L )U (L )) L ) W (L ) wt .

(7)

This implies that the spectral density matrix for x t , given a choice of U (L ) , is

fx C (ω ) =

1 C −iω

D (e ) Σw DC (e −iω )′ ,

2π

(8)

where Σw is the variance covariance matrix of w and

(

DC (e −iω ) = A0 − (A (e −iω ) + B (e −iω )U (e −iω ))e −iω

)

−1

W (e −iω ) .

(9)

The superscript C is used because of the dependence of the moving average

representation on the choice of control. Each choice of the polynomial U (L ) will

5

See Fernandez-Villaverde, Rubio-Ramirez, and Sargent (2005) for a comprehensive

analysis of the relationship between unrestricted vector autoregressions and structural

models, in which invertibility of analogs to W ( L ) plays a key role.

5

produce a different spectral density matrix for the state variable vector. Our objective is

to describe these limits.

One way to understand the effects of a control role is via the way that U (e −iω )

maps to DC (e −iω ) . Put differently, the feasible outcomes a policymaker can produce via

alternative control rules may be interpreted as the support of the mapping of the set of

possible feedback rules to DC (e −iω ) .

Underlying our calculations of this type is a

lemma due to Wu and Jonckhere (1988) which describes the properties of the integrals of

logarithms of simple squared polynomials. We provide a slightly different statement of

the lemma and a proof in the Appendix.

Lemma 1. (Wu and Jonkheere)

∫

π

−π

2

log e iω − r d ω = 0 if r < 1, 2πlog r 2 otherwise .

(10)

The reason that this lemma is so important in the determination of fundamental limits to

policies is that in linear environments, the various objects of interest, which amount to

products of various polynomials with their associated inner products, can be reduced to

products of inner products of simple polynomials; restrictions on the values of these

polynomials will turn out to be described by (10).

In the case of restrictions on the moving average polynomial DC (e −iω ) , we will

need to focus on the properties of W (L ) , specifically

wMA

det (W (z )) = w

∏ (1 − w z )

t

i =1

wAR

∏(1 − ρ z )

.

(11)

t

i =1

where

wMA

is

the

degree

of

the

polynomial

wn ,1 (L ) wn ,4 (L ) wd ,2 (L ) wd ,3 (L ) − wn ,2 (L ) wn ,3 (L ) wd ,1 (L ) wd ,4 (L ) , wAR is the degree of

6

the polynomial wd ,1 (L ) wd ,4 (L ) wd ,2 (L ) wd ,3 (L ) and w is the ratio of the zero degree

coefficients on the two polynomials above. Since the innovations εt are second order

stationary, the roots ρi all lie inside the unit circle. However, the roots wi may lie

outside the unit circle as we have not assumed the shocks are fundamental.

Our first result characterizes the feasible values of DC (e −iω ) .

Theorem 1. Design limits on the MA polynomial in a backwards looking MIMO

model

For the system described by eq. (2), the Fourier transform of the associated sensitivity

matrix moving average coefficients, DC (e −iω ) , must fulfill

∫

π

−π

(

2

)

log det DC (e −iω ) d ω = K w ,

(12)

where

⎛

K w = 4π ⎜⎜⎜log w − log a + ∑ log wui

⎜⎝

ui

⎞⎟

⎟⎟, i ∈ {ui } if wi > 1, a = det (A0 ) . (13)

⎠⎟

Pf. See Appendix

The restrictions on possible moving average representations for a controlled

system may be elucidated by comparing the properties of the law of motion for the state

vector when a control is present with the law of motion when there is no control, i.e.

ut = 0 ∀t . The uncontrolled system is simply

A0x t = A (L ) x t −1 + εt .

7

(14)

One can understand the effects of the choice of a control via the differences between the

spectral density of the controlled and uncontrolled process, i.e. fx C (ω ) versus fx NC (ω ) .

To make this comparison, first define the spectral density of the no-control system as,

fx NC (ω ) = D NC (e −iω ) Σw D NC (e −iω )′ ,

(15)

where

−1

D NC (e −iω ) = (A0 − A (e −iω )e −iω ) W (e −iω ) .

(16)

Following the control literature, one defines a sensitivity matrix S (e −iω ) via the way in

which the control transforms D NC (e −iω ) into DC (e −iω ) , i.e.

−1

S (e −iω ) = DC (e −iω ) D NC (e −iω ) .

(17)

This allows one to characterize the effects on the spectral density of a given control by

fx C (ω ) = S (e −iω ) fx NC (ω ) S (e −iω )′ .

(18)

This formulation makes clear why in the control literature, the sensitivity function is said

to shape the state vector.

Each DC (e −iω ) maps into a S (e −iω ) , hence for the policymaker one can think of

the choice of control as the choice of a sensitivity function and any constraints on

DC (e −iω ) in turn may be translated into constraints on S (e −iω ) . To understand the

constraints on the sensitivity function, notice that,

8

∫

π

−π

∫

π

−π

(

log det D

C

(e

(

) )d ω − ∫

)

log ( det D

2

log det S (e −iω ) d ω =

−i ω

2

π

−π

NC

(e )

−i ω

2

)d ω.

(19)

The first term is explicitly characterized by Theorem 1. The second term is implicitly

characterized by Theorem 1 and, defining λi as the eigenvalues of the characteristic

polynomial of the uncontrolled system, equals

∫

π

−π

(

2

)

log det D NC (e −iω ) d ω = K w − 4π ∑ log λvi i ∈ {vi } if λi > 1 .

(20)

vi

Combining (13) and (20) immediately provides Theorem 2.

Theorem 2. Design limits on the sensitivity matrix for a backwards looking MIMO

model

For the system described by eq. (2), the associated sensitivity matrix S (e −iω ) must fulfill

∫

π

−π

(

2

)

log det S (e −iω ) d ω = K B ,

(21)

where

K B = 4π ∑ log λvi i ∈ {vi } if λi > 1 .

(22)

vi

This expression has several properties of interest.

First, K B = 0 whenever the unconstrained system is stable. This means that for

a large class of models, the constraint on the sensitivity function is identical. More

generally, different models may be sorted into equivalence classes with respect to K B as

its value is entirely determined by the unstable roots in the A (L ) polynomial. Notice as

9

well that the value of the constraint does not depend on the control rule nor does it

depend on W (L ) , i.e. the (second-order) time series structure of εt .

Second, taken together, the facts that a nonzero constraint only occur when the

uncontrolled system is unstable and that the magnitudes and number of the unstable roots

determine the value of the constraint, indicate that the use of a control to eliminate unit or

explosive roots in a system does have a cost in terms of the ability of the policymaker to

stabilize fluctuations after these roots have been eliminated. In this sense, trends and

cycles do not represent independent aspects of stabilization policy.

Third, policymakers inevitably must trade off variance at different frequencies.

Since λi ≥ 1 , it is immediate from (22) that K B ≥ 0 . This implies that it is impossible

2

for det S (e −iω ) < 1 ∀ω ∈ [−π, π ] and therefore it is impossible to reduce the variance

contributions at all frequencies when one moves from the uncontrolled system to a

2

controlled one. Further, the integral constraint implies that det S (e −iω ) > 1 for some

2

interval of frequencies if det S (e −iω ) < 1 for another. In order to reduce the variance

contributions of one interval of frequencies, it is necessary to increase the variance

contributions of some other interval. This tradeoff is fundamental as it cannot be avoided

by the choice of control.

By implication, minimizing a linear combination of the

variances of the elements of x t will involve trading off frequency specific variance

contributions. In other words, variance minimization implies that, even though overall

variance is reduced when one integrates across frequencies, for some frequencies, a

control that is optimal in this sense leads to greater variance.

ii. forward-looking systems

The law of motion (2) does not embody any direct role for expectations. We next

consider systems of the form

A0x t = βEt x t +1 + A (L ) x t −1 + B (L ) ut + εt .

10

(23)

This system is identical to (2) except for the addition of the expectational term β Et x t +1 .

Expectations are assumed to be rational. This means that the state variables will obey an

equilibrium moving average representation of the form

⎛ f1 (L ) f2 (L )⎞⎟

⎜

⎟⎟ w ,

x t = F C (L ) wt = ⎜⎜

⎜⎜⎝ f3 (L ) f4 (L )⎠⎟⎟ t

(24)

where wt are fundamental innovations.6 It is convenient to work with innovations that

are contemporaneously uncorrelated. Let vt = Vwt denote any orthogonalization of the

fundamental errors.

Then,

⎛g1 (L ) g 2 (L )⎞⎟

⎜

x t = F C (L )V −1vt = G C (L ) vt = ⎜⎜

⎟⎟ v .

⎜⎜⎝g 3 (L ) g 4 (L )⎠⎟⎟ t

(25)

We note that none of our results depend on the choice of orthogonalization.

As is well known, forward looking systems can exhibit multiple solutions. To

ensure uniqueness of the solution it is necessary to restrict the characteristic polynomial

det (A0z − β − z 2 (A (z ) + B (z ) F (z ))) . The following lemma formalizes this; while the

result is closely related to Whiteman (1983), the particular claim is new relative to that

work.

Lemma 2. Uniqueness of forward-looking solution

The system (23) has a unique square summable moving average solution in the space of

vt ’s when exactly two roots of the characteristic polynomial

det (A0z − β − z 2 (A (z ) + B (z ) F (z )))

6

(26)

A proof of uniqueness appears in the technical appendix. While related to Whiteman

(1983), the exact result appears to be new.

11

are inside the unit circle. If more than two roots are inside the unit circle a square

summable moving average solution in the space of vt ’s does not exist. If less than two

roots are inside the unit circle there exist multiple solutions.

Pf. See appendix.

The rational expectations assumption of course places structure on the individual

gi (L ) elements. For our purposes, what matters is that each gi (L ) may be written as a

ratio of finite polynomials with common denominator up to W (L ) ; see the technical

appendix for a proof that (25) may be written as

⎛gnC,1 (z ) gnC,2 (z )⎞⎟

⎜⎜

⎟⎟ .

G (z ) = C

⎜⎜ C

C

(

)

gd z ⎜⎝gn,3 (z ) gn,4 (z )⎠⎟⎟⎟

1

C

(27)

Here, the subscripts n and d refer to numerator and denominator. The denominator

polynomial gdC (L ) is the characteristic polynomial of the system; define gd as its zero

degree coefficient for later use. Given the assumption that policies are of the feedback

form, this coefficient cannot be influenced by the policy choice. Similarly, we define gn

as the coefficient on the zero degree of the polynomial gnC,1 (L ) gnC,4 (L ) − gnC,2 (L ) gnC,3 (L ) .

The form (27) together with the above definitions is useful because it allows us to prove

Theorem 3. Design limits on the MA polynomial in a forwards-looking MIMO

model

The moving average coefficients of a controlled system (23) must obey

∫

π

−π

(

2

)

log detG C (e −iω ) d ω = K w ,F ,

12

(28)

where

⎛

K w ,F = 4π ⎜⎜⎜log gnC − 2 log gd + ∑ log gnC,ui

⎜⎝

ui

⎞⎟

⎟⎟, i ∈ {ui } if gn ,i > 1 .

⎠⎟

(29)

In identifying restrictions on the sensitivity function for this system, we once

again define a system with no control, i.e.

A0x t = βEt x t +1 + A (L ) x t −1 + εt

(30)

and model the associated law of motion as

xt = G

NC

NC

⎛gnNC

⎞

⎜⎜ ,1 (z ) gn,2 (z )⎟⎟

(L ) vt = NC

⎟⎟ vt .

⎜

NC

( ) g

( )⎟

gd (z ) ⎜⎜⎝gnNC

⎟

n ,4 z ⎠

,3 z

1

(31)

The sensitivity function is defined by

−1

S (e −iω ) = G C (e −iω )G NC (e −iω )

(32)

so its determinant may be written

−1

det S (e -iω ) = detG C (e -iω ) detG NC (e -iω )

=

2

⎛ gC (e -iω ) gC (e -iω ) − gC (e -iω ) gC (e -iω )⎞⎛

⎞⎟

gdNC (e -iω )

⎟⎟ ⎜⎜

⎜⎜ n,1

n ,4

n ,2

n ,3

⎟⎟ =

⎟⎟ ⎜ NC -iω NC -iω

⎜⎜

-i ω

-i ω ⎟

NC

NC

-i ω 2

C

⎜

⎟

−

g

e

g

e

g

e

g

e

(

)

(

)

(

)

(

)

gd (e )

n ,4

n ,2

n ,3

⎝⎜

⎠⎝⎜ n ,1

⎠⎟

⎛ g NC (e -iω )2 ⎞⎟ ⎛ gC (e -iω ) gC (e -iω ) − gC (e -iω ) gC (e -iω ) ⎞

⎜⎜ d

⎟⎟

n ,4

n ,2

n ,3

⎟ ⎜ n,1

=

⎜⎜ C -iω 2 ⎟⎟ ⎜⎜ NC -iω NC -iω

NC

-i ω

NC

-i ω ⎟

⎟

⎜⎝ gd (e ) ⎠⎟ ⎜⎝ gn,1 (e ) gn,4 (e ) − gn ,2 (e ) gn ,3 (e )⎠⎟

2⎞

⎛ 2 d NC

-i ω

⎟⎟ ⎛⎜ gnC Πnj =C 1 (1 − gnC, je -iω ) ⎞⎟

⎜⎜ gd Π j =1 (1 − gdNC

e

)

,j

⎟⎟

⎟⎟ ⎜

⎜⎜

NC

-i ω ⎟

⎜⎜ g 2 ΠdC (1 − gC e -iω ) 2 ⎟⎟⎟ ⎝⎜⎜⎜ gnNC Πnj =1 (1 − gnNC

e

)⎠⎟

,j

d,j

⎝ d j =1

⎠

(

(

)

)

13

(33)

In the final line of (33), the first ratio also appears in the calculation of the constraints for

the sensitivity function of the backwards system as it is a ratio of simple polynomials

based on the poles of the controlled and the uncontrolled system. The second ratio

incorporates elements of the law of motion that did not affect the sensitivity function for

the backwards-looking case. The application of a control can affect the value of gnC as

well as the location of the zeros gnC, j .

In parallel with Theorem 2, (33) leads immediately to Theorem 4.

Theorem 4. Design limits on the sensitivity function in a forwards-looking MIMO

model

The sensitivity function of a controlled system (23) must obey

∫

π

−π

(

2

)

log det S (e −iω ) d ω = K F ,

(34)

where

⎛

K F = 4π ⎜⎜⎜log gnC − log gnNC + ∑ log gdNC

+ ∑ log gnC,ui − ∑ log gnNC

,vi

,ui

⎜⎝

vi

uC

uiNC

i

⎞⎟

⎟⎟,

⎠⎟

(35)

i ∈ {vi } if gdNC

> 1, i ∈ {uiC } if gnC,i > 1 and i ∈ {uiNC } if gnNC

,i

,i > 1.

From the perspective of design limits, there are several important differences

between this case and the backwards looking case.

First, in the presence of an expectational component, the sensitivity function

constraint K F can be negative. This means that it is possible for a control rule to reduce

all variance contributions relative to an uncontrolled system.

Second, expectations also affect the nature of the constraint value K F as the

terms associated with

∑ log g

uC

i

C

n ,ui

− ∑ log gnNC

,ui do not have an analog in the backwards

uiNC

14

looking case.

These terms are present when G (L ) is not invertible, so that the

fundamental innovations cannot be recovered from equilibrium realizations of the state

variables. Futia (1981) and Hansen and Sargent (1991) refer to this noninvertibility as

one where the equilibrium behavior of the state variables is non-revealing; the idea is that

the fundamental shocks to a system do not correspond to the structural innovations. This

additional constraint may thus be understood as arising from the fact that in a nonrevealing equilibrium, policymakers must employ feedback rules that are conditioned on

an information set that is coarser than the one that agents employ in making decisions.

We provide an example that shows how the application of a control can affect the value

of gnC as well as the location of the zeros gnC,i in Appendix II.

iii. SIMO systems

Our analysis has assumed that there are 2 distinct control variables to the policymaker.

There are important macroeconomic contexts where this is not the case. For example, a

standard question in the analysis of monetary policy rules concerns the effects of

different federal funds rate rules on inflation and unemployment, models of this type are

standard in Taylor (1999).

We call a 2 × 2 system MIMO if the policymaker can apply a control for each

state variable, we call a system SIMO if only one control variable is available to the

policymaker. To clarify this, consider the AR (1) specification of the forward looking

system (36) with A0 = I :

x t = β Et x t +1 + Ax t −1 + But + εt

(37)

⎛a1 a2 ⎞

A = ⎜⎜a a ⎟⎟⎟

⎟

⎜⎝ 3

4⎠

(38)

where

15

Under the MIMO assumption the application of a feedback rule ut = Fx t −1 is able to

change all the elements of the matrix A turning it into AM* ,

⎛a1* a2* ⎞⎟

⎜

⎟⎟

A = ⎜⎜ *

⎜⎜a a * ⎟⎟⎟

4⎠

⎝ 3

*

M

(39)

Under the SIMO assumption the application of a similar feedback rule can change only

the elements of one row of A turning it into AS* ,

⎛a1 a2 ⎞⎟

⎟

A = ⎜⎜⎜ *

*⎟.

⎜⎝a 3 a 4 ⎠⎟⎟

*

S

(40)

We divide the analysis in two parts: first we consider backward looking systems

( β = 0 ), then we generalize to forward looking systems ( β ≠ 0 ) (To be completed).

In the backward looking AR (1) case, the sensitivity matrix function is:

−1

S (L ) = (I − A*L ) (I − AL ) .

(41)

Substituting AM* and AS* in turn it is possible to show that

det S M (L ) =

det (I − AL )

det (I − A*L )

(1 − a1L )(1 − a 4L ) − a2a 3L2

=

(1 − a1*L )(1 − a 4*L ) − a2*a 3*L2

(42)

and

det SS (L ) =

det (I − AL )

det (I − A*L )

=

(1 − a1L )(1 − a 4L ) − a2a 3L2

.

(1 − a1L )(1 − a 4*L ) − a2a 3*L2

16

(43)

Therefore, as long as we evaluate design limits with respect to det (S (e −iω )) there is no

difference between a MIMO and a SIMO system in the backwards looking case. One has

to go deeper into the structure of the sensitivity function to identify an effect of the

number of states exceeding the number of controls.

In order to do this it is necessary to analyze how the sensitivity matrix turns the

uncontrolled spectral density matrix into the controlled spectral density matrix. A

fundamental difference between univariate and multivariate systems is that the control

applied to the latter allocates variances at different frequencies according to the

combination of spectra and cross-spectra of the uncontrolled processes. The difference

between a MIMO and a SIMO system in terms of design limits may be found at this finer

level of analysis.

Suppose that the spectral representation of the variance of the controlled state

variables is7

π

π

⎛ var (x 1 )⎞⎟ ⎛⎜σε2 ∫ fx ,ε |C (ω )d ω + σε2 ∫ fx ,ε |C (ω )d ω ⎞⎟⎟

1

1

1

2

⎜⎜

−π

−π 1 2

⎟⎟ = ⎜⎜

⎟⎟ .

⎜⎜

π

π

⎜

⎟

⎟

⎜⎝var (x 2 )⎠⎟⎟ ⎜⎜⎜σε21 ∫ fx2 ,ε1|C (ω )d ω + σε22 ∫ fx2 ,ε2 |C (ω )d ω ⎟⎟

⎝

⎠

−π

(44)

−π

Employing our definition of the sensitivity matrix it is possible to show (see Appendix)

that each spectral component in (44) can be written in terms of the spectral density matrix

components of the uncontrolled process as follows:

2

⎛ s e −iω 2 f

⎞⎟

) x1,ε1|NC (ω ) + s2 (e −iω ) fx2 ,ε1|NC (ω ) +

⎜⎜ 1 (

⎟⎟

fx1 ,ε1|C (ω ) =

⎟ .(45)

2 ⎜

⎜⎜

−i ω

−i ω

iω

iω

−i ω

sD (e ) ⎜⎝ s1 (e ) s2 (e ) fx1x2 ,ε1|NC (ω ) + s1 (e ) s2 (e ) fx2x1 ,ε1|NC (ω )⎠⎟⎟

1

2

This generalizes the univariate case fC (ω ) = S (e −iω ) fNC (ω ) . Basically, the application

of a feedback policy in a multivariate system shapes the spectral decomposition of the

driving process-specific component in each state variable as the weighted sum of three

7

Notice that a generalized objective function for the policy maker should be applied to a

variance-covariance matrix of the state variables. This is indeed the general approach,

taken from the control literature, of Hansen and Sargent (2005).

17

terms. The first term captures the contribution of the uncontrolled analogue of the

spectrum considered, the second term captures the contribution of the uncontrolled

spectrum of the remaining state variable and the third terms captures the effect of the

uncontrolled cross-spectra of the state variables involved. Underlying these three terms

there is a common effect of the control represented by the common denominator

2

sD (e −iω ) which, by the definition of the sensitivity matrix, corresponds to the

characteristic polynomial of the controlled system.

The multivariate version of the Bode constraint tells us that the choice of si (e −iω )

and sD (e −iω ) are constrained by:

K =

∫

π

−π

π

2

2

ln s1 (e −iω ) s 4 (e −iω ) − s2 (e −iω ) s 3 (e −iω ) d ω − 2∫ ln sD (e −iω ) d ω . (46)

−π

Given the definition of sensitivity matrix the term

∫

π

−π

2

ln sD (e −iω ) d ω is always

equal to zero as it corresponds to the determinant of the matrix solution of the controlled

system and the constraint can be rewritten as:

K =

∫

π

−π

2

ln s1 (e −iω ) s 4 (e −iω ) − s2 (e −iω ) s 3 (e −iω ) d ω .

(47)

The structure of each controlled spectra as presented in (45) prompts one to consider

2

tighter constraints of the same nature on terms such as s1 (e −iω ) . Indeed, part of the

difference between a MIMO and a SIMO system in terms of design limits is found at this

finer level of analysis.

To show this, we exploit the fact that a policymaker whose objective function is a

linear combination of the variances of the state variables will lead him to a “white noise

equivalent” policy, which means that we assume that the objective of the policy maker is

to convert the states to white noise. The specific form of the spectral density matrix for

the system (48) and (49) is

18

fX |NC (ω ) =

2

⎛

1 − a 4e −iω σε21 + a22σε22

1 ⎜⎜

⎜

d (ω ) ⎜⎜⎜(1 − a e iω )a e −iω σ 2 + (1 − a e −iω )a e iω σ 2

ε1

ε2

4

3

1

2

⎝

(50)

+ (1 − a1e iω )a2e −iω σε22 ⎞⎟⎟

⎟⎟

⎟⎟

−i ω 2 2

2 2

a 3 σε1 + 1 − a1e

σε2

⎟⎠

(1 − a 4e −iω )a 3e iω σε2

1

where

2

d (ω ) = (1 − a1e −iω )(1 − a 4e −iω ) − a2a 3e −2iω .

(51)

Assuming a MIMO system, it is possible to obtain a white noise spectral density matrix:

⎛σε2

⎜ 1

fX |C (ω ) = ⎜⎜

⎜⎜ 0

⎝

0 ⎞⎟

⎟⎟ ,

2 ⎟

σε2 ⎠⎟

(52)

by setting

⎛a1* a2* ⎞⎟ ⎛0 0⎞

⎜

⎟⎟

⎟⎟ = ⎜⎜

A = ⎜⎜ *

.

⎜⎜a a * ⎟⎟⎟ ⎝⎜⎜0 0⎠⎟⎟⎟

4⎠

⎝ 3

*

M

(53)

Now consider a SIMO system, in which a white noise spectral density matrix cannot be

generally be implemented. Suppose in continuity to the previous example, that the policy

maker chooses a control policy so that:

⎛a1 a2 ⎞⎟

⎟,

AS* = ⎜⎜⎜

⎜⎝ 0 0 ⎠⎟⎟

(54)

where we assume, in order for the controlled system to be stable, that a1 < 1 . Then,

under this policy, the spectral density matrix becomes

19

⎛ σε2 + a22σε2

⎜⎜ 1

2

⎜⎜ 1 − a e −iω 2

1

fX |C (ω ) = ⎜⎜⎜

i

⎜⎜ a2e ω σε2

2

⎜⎜

iω

⎜⎝ (1 − a1e )

a2e −iω σε22 ⎞⎟

⎟

(1 − a1e −iω )⎟⎟⎟⎟

⎟⎟ .

⎟⎟

⎟⎟

σε22

⎟

⎠⎟

(55)

A standard class of objective functions for linear systems assumes that the policymaker

cares only about the variances of the state variables which corresponds to being interested

only in the diagonal elements of the above matrix, so we focus on the diagonal elements

for now. If we compare the diagonal elements in (52) and (55) we can see that while the

lower-right component is white noise, the upper-left has a spectral density controlled by

the parameter a1 . This implies that for some frequencies the variance contribution is

reduced in comparison to the MIMO case (modulo the effect of the term a22σε22 ) and for

other frequencies the contribution is increased. However, overall the variance of the state

variable corresponding to the upper-left component is higher, in fact, for a1 < 1 :

2

2 2

σε21 + a22σε22

1 π σε1 + a2 σε2

dω =

> σε21 .

2

∫

−i ω 2

−

π

2π

(1 − a1 )

1 − a1e

(56)

Suppose now that, with the intent of driving the upper-left component towards a white

noise spectrum, the policy maker selects a 3* ≠ 0 . This choice immediately implies that

the lower-right component is no longer white noise and that a positive contribution is

added at all frequencies in reason of a 32σε21 .

As already remarked, this particular limitation of a SIMO system is not detected

by the general type of Bode constraints that we presented for backwards systems. This is

a consequence of the strong model independence of the Bode constraint metric in

backwards models, or, in other words, of the particular coarseness of such a metric. Let

the sensitivity matrix be defined as in (57) then we have (see Appendix):

2

s1 (e −iω ) = (1 − a1e −iω ) (1 − a 4*e −iω ) − a2*a 3e −2iω

20

2

(58)

2

2

2

2

s2 (e −iω ) = (1 − a 4e −iω )a2*e −iω − (1 − a 4*e −iω )a2e −iω

s 3 (e −iω ) = (1 − a1e −iω )a 3*e −iω − (1 − a1*e −iω )a 3e −iω

2

s 4 (e −iω ) = (1 − a1*e −iω )(1 − a 4e −iω ) − a2a 3*e −iω

(59)

(60)

2

(61)

Each of these terms couple with the common denominator sD (e −iω ) to shape the spectral

allocation for each component of the controlled spectral matrix according to expressions

like (45). We evaluate the four terms above according to the MIMO policy (53) and the

SIMO policy (54). This gives:

2

sM ,1 (e −iω ) = 1 − a1e −iω

2

2

sS ,1 (e −iω ) = (1 − a1e −iω ) − a2a 3e −2iω

2

sS ,2 (e −iω ) = a22a 42

2

sS ,3 (e −iω ) = a 32 1 − a1e −iω

2

sM ,2 (e −iω ) = a22

2

sM ,3 (e −iω ) = a 32

2

sM ,4 (e −iω ) = 1 − a 4e −iω

2

2

2

2

(62)

2

sS ,4 (e −iω ) = 1 − a1e −iω 1 − a 4e −iω

2

If we apply the Bode metric to each of these elements, recalling that a1 < 1 by

2

assumption, then there does exist a difference in the constraint on sS ,1 (e −iω ) and

2

sS ,2 (e −iω ) with respect to their MIMO analogues. The difference on the latter term is

directly related to a 4 while the difference in the former is more subtle and it depends on

the location of the zeros of the polynomial

1 − a1z − a2a 3z 2 .

21

(63)

It is not difficult to find values for a2 and a 3 , even under the assumption that a2a 3 < 1 ,

such that at least one zero of the polynomial (63) is inside the unit circle, which results in

an eigenvalues outside the unit circle and thus a Bode metric different from zero. Under

these circumstances one has:

∫

π

−π

(

2

)

ln sS ,1 (e −iω ) d ω >

∫

π

−π

(

2

)

ln sM ,1 (e −iω ) d ω = 0

(64)

which captures the tighter constraint that a SIMO system entails on the spectral density

matrix, exemplified by the difference between (52) and (55). Notice that the difference in

sensitivity constraints between a MIMO and a SIMO is driven mostly by the value of the

uncontrolled coefficients that are controllable by the policy maker, i.e. a 3 and a 4 .

In general, the Bode metric applied element-wise to the sensitivity matrix of a

SIMO system delivers constraint values that are greater or equal to the analogue values of

a MIMO system. The reason is that the fact that there are fewer controls than states

means that there are additional constraints on the individual elements of the

matrix S (e −iω ) in addition to the overall Bode constraint.

3. Examples

In this section we give some simple SISO examples of the way in which frequency

tradeoffs appear in controlled systems.

i. Backwards looking System

Consider

x t = ax t −1 + but −1 + εt

with εt white noise . When there is no control, then

22

(65)

fNC (ω ) =

σε2

.

2π (1 − 2ρ cos ω + ρ 2 )

(66)

σε2

2π

(67)

For a variance minimizing control

fNC (ω ) =

as all temporal dependence is eliminated. For our purposes what matters is that there

must exist a ω (which depends on a) such that

fNC (ω ) =

σε2

σε2

if ω > ω

<

2π (1 − 2ρ cos ω + ρ 2 ) 2π

(68)

so complete stabilization has frequency-specific costs.

ii. Forward looking system: AR(1) and εt i.i.d.

Consider the forward looking system:

x t = β Et x t +1 + αx t −1 + but −1 + εt .

(69)

In absence of control the solution of this system when α ≠ 0 is

x t = Hx t −1 +

H

εt

α

(70)

where H < 1 and:

H =2

α

.

1 + 1 − 4βα

23

(71)

The spectrum of this system is:

fNC (ω ) =

H2

σw2

.

α2 2π (1 + H 2 − 2H cos ω )

(72)

Suppose that an optimal (i.e. variance minimizing) control is applied and implicitly

defined by α * where αx t −1 + but −1 = α *x t −1 , then the controlled spectrum is

fC (ω ) =

H *2

σw2

.

α *2 2π (1 + H *2 − 2H * cos ω )

(73)

A negative Bode constraint corresponds to the possibility that:

fC (ω ) < fNC (ω ) ∀ω

(74)

H2

Notice that, the term 2 is monotonically increasing in α . This means that for α * < α :

α

H *2

H2

.

<

α *2

α2

(75)

One may show that this means that the difference between the spectral densities

σw2

σw2

−

2

2π (1 + H *2 − 2H * cos ω ) 2π (1 + H − 2H cos ω )

(76)

is maximal at ω = {π, −π} and equals

1

(1 + H )

* 2

−

1

2 > 0.

(1 + H )

24

(77)

A sufficient condition for a reduction of variance at all frequencies is therefore

H *2

2

α *2 (1 + H * )

−

H2

2 < 0.

a 2 (1 + H )

(78)

Solving the optimal feedback rule explicitly gives

α* =

1 − 1 + 8 β 2 − 4β 2

.

8β

(79)

1 − 1 + 8β 2

<0.

4β

(80)

Since α* < 0

H* =

H *2

Suppose β = 0.9 , then H = −0.48 and *2 = 0.49 which implies a variance:

α

*

σw2

Ex = 0.63

2π

2

t

(81)

Further, suppose that α = 0.2 , then the optimal policy corresponds a reduction at all

frequencies if

1.78 <

H2

2 = 1.16 .

α 2 (1 + H )

(82)

Under the current parameterization, for values of α such that the solution to the system is

unique, condition this cannot be realized. Hence the optimal rule requires frequencyspecific tradeoffs.

In contrast, consider the alternative sub-optimal policy αˆ = −0.1 . In this case,

25

Hˆ 2

2

(−0.1) (1 + Hˆ )

2

H2

= 1.03 < 1.07 =

2 ,

0.22 (1 + H )

(83)

which implies that the controlled spectral density is smaller than the uncontrolled one at

all frequencies. Therefore, while it is possible in principle to reduce the variance

contribution at all frequencies, if the policy maker cares about the overall variance, such a

policy might not be optimal. The various cases are illustrated in Figure 1.

26

0.75

0.625

0.5

0.375

0.25

0.125

0

0

0.5

1

1.5

2

Figure 1: Spectral Densities for Uncontrolled System ( α

2.5

3

= 0.2 ), Optimally Controlled System

(thick line), White Noise (dashed line), Generalized Frequency Reduction Control (gray line)

27

In terms of our notation for the multivariate case, the solution to the univariate

uncontrolled system can be written as:

x tC = gnC

1

wt

g (1 − gdC,1L )

C

d

(84)

where

gnC =

H*

, gdC,1 = H *, gdC = 1 .

*

α

(85)

From the formula for the design limits in forward looking system given in Theorem 3,

K w ,F = 4π (log gnC

)

= 4π (log H * − log α * ).

(86)

Notice that the term K w ,F depends on the difference between the autoregressive part of

the reduced form representation H * (closed loop) and the autoregressive part of the

structural representation log α * (open loop). Using the parameterization of our example

one has K wC,F = −4.53 . Similarly, under free dynamics one has K wNC

,F = 3.37 . Finally,

the Bode constraint from Theorem 4 is:

K FC = K wC,F − K wNC

,F = −7.90 .

ˆ

(87)

The negative values of K FC and K FC are evidence that the system is subjected to a less

stringent constraint compared to the backward looking case.

28

4. Application: Taylor rules

In this section we consider some frequency domain properties of Taylor rules.

i. forward looking models

First, we study of forward looking New-Keynesian model, following the example

studied in Levin and Williams (2003); the model they study is closed by a feedback

simple Taylor rule it = gπ π t −1 + g y yt −1 , where i denotes the nominal interest rate, π

denotes inflation and y denotes the output gap. The estimated model is

0

⎛ 1 −0.096 ⎞ ⎛ π t ⎞ ⎛ .99 0 ⎞ ⎛ π t +1 ⎞ ⎛

=

+

E

⎜

⎟

⎜

⎟⎜ ⎟ ⎜

⎟ t⎜

1 ⎠ ⎝ yt ⎠ ⎝1.59 1 ⎠ ⎝ yt +1 ⎠ ⎝ −1.59 gπ

⎝0

⎞ ⎛ π t −1 ⎞ ⎛ 1 0 ⎞ ⎛ v1t ⎞

(88)

+

⎟

−1.59 g y ⎠ ⎜⎝ yt −1 ⎟⎠ ⎜⎝ 0 1 ⎟⎠ ⎜⎝ v2t ⎟⎠

0

Under the original Taylor rule ( gπ = 1.5 , g y = 0.5 ) one can show that the

spectral densities for inflation and the output gap are

fπ ( ω ) =

σ ε2

2π

1

⎛ 1.53 ⎞ 1 + ( 0.52 ) + 2*0.52*cos ω σ ε 2

+

⎜

⎟

2

⎝ 1.78 ⎠ 1 + ( 0.57 ) + 2*0.57 *cos ω 2π

2

2

2

2

1

⎛ 0.066 ⎞

⎜

⎟

2

⎝ 1.78 ⎠ 1 + ( 0.57 ) + 2*0.57 *cos ω

(89)

and

f y (ω ) =

σ ε2

2π

1

2

2

2

2

(90)

1

⎛ 1.60 ⎞ 1 + (1.49 ) + 2*1.49*cos ω σ ε 2 ⎛ 1.088 ⎞

−

+

⎜

⎟

⎜

⎟

2

2

⎝ 1.78 ⎠ 1 + ( 0.57 ) + 2*0.57 *cos ω 2π ⎝ 1.78 ⎠ 1 + ( 0.57 ) + 2*0.57 *cos ω

29

We fix σ ε21 = 1 and σ ε22 = 1.5 for convenience when constructing figures for the spectral

densities. (what matters is the ratio of the two disturbances). We study next the solution

to (1) under free dynamics: gπ = 0 and g y = 0 , which leads to the spectral densities

σ ε2 σ ε2

2

fπ ( ω ) =

+

( 0.096 )

2π 2π

(91)

σ ε2

f y (ω ) =

2π

(92)

1

2

and

2

Note that these solutions are both white noise; this follows from the fact that the model is

purely forward looking as well as they way we eliminate the possibility of multiple

solutions (described in the Appendix)8.

The inflation and output gap spectra under free dynamics together with the

controlled spectra under the original Taylor rule are reported in Figure 2.

8

We are exploring how our findings change when other assumptions are used to achieve

uniqueness.

30

0.625

0.5

0.375

0.25

0.125

0

0

0.5

1

1.5

2

2.5

3

Figure 2: Normalized Spectral Density for Output Gap (thick line) and Inflation

Gray lines are the respective densities under free dynamics.

Consistent with the examples in Section 3, the controlled process features a form of

negative autoregression which allows the policy maker to exploit the information that

agents embed into their expectations. This effect of the original Taylor rule on the

volatility of inflation and output may be rationalized by an objective function that gives

most of the weight to inflation volatility rather than output gap volatility.

We consider next a policy rule that has been proposed by Levin and Williams

(2003) as optimal when both output gap volatility and change in interest rate enter

together with inflation the policy maker objective function, this rule is: gπ = 1.3 and

g y = 0.9 .

31

0.625

0.5

0.375

0.25

0.125

0

0

0.5

1

1.5

2

2.5

3

Figure 3: Normalized Spectral Density for Output Gap (thick line) and Inflation under the rule

( gπ = 1.3 and g y = 0.9 ). Gray lines are the respective densities under free dynamics.

32

The policy rule of Figure 3 is optimal when output gap volatility is regarded as important

by the policy maker. In fact, the contribution to output gap volatility is reduced at low

frequencies. However, it is increased markedly at higher frequencies, this happens in

order to reduce the variance contribution for inflation almost at all frequencies.

ii. Backwards looking models

The next model we consider is a pure backwards looking model estimated by

Rudebusch and Svensson (1997)

⎛πt ⎞

⎜ ⎟=

⎝ yt ⎠

⎛

0.70 − 0.1L + 0.28 L2 + 0.12 L3

⎜

⎜

2

3

2

3

⎜ −0.10*0.25 (1 + L + L + L ) 0.25 (1 + L + L + L ) gπ − 1

⎝

⎛ 1 0 ⎞ ⎛ v1t ⎞

+⎜

⎟⎜ ⎟

⎝ 0 1 ⎠ ⎝ v2t ⎠

(93)

(

)

⎞

⎟ ⎛ π t −1 ⎞

1.16 − 0.25 L

⎟⎜

⎟

⎝ yt −1 ⎠

2

3

⎟

−0.10*0.25 (1 + L + L + L ) g y ⎠

0.14

with var ( v1t ) = 1.018 and var ( v2t ) = 0.671 (see Rudebusch and Svensson, 1997, page

208). The solution of this system under the rule ( gπ = 5.1 , g y = 1.9 ) is:

⎛ 1 − 1.1L + 0.3L2 + 0.047 L3 + 0.048 L4

⎞

0.14 L

⎟

1 ⎜

2

3

4

D ( L) =

−0.0069 L − 0.039 L − 0.071L − 0.1L

⎜

2

3

4⎟

d ( L) ⎜

1 − 0.7 L + 0.1L − 0.28L − 0.12 L ⎟

5

6

7

⎝ −0.096 L − 0.064 L − 0.032 L

⎠

where

d ( L ) = 1 − 1.8 L + 1.2 L2 − 0.55 L3 + 0.25 L4 + 0.036 L5 − 0.031L6 − 0.01L7 − 0.0012 L8

33

The finiteness of variance of the system is entirely determined by the roots of this

polynomial. Under the policy rule the nine roots are

z1 = −3.61 + 4.05i, z2 = −3.61 − 4.05i

z3 = −4.81

z4 = −0.01 + 1.60i, z5 = −0.01 − 1.60i,

z6 = 1.63

z7 = 1.14 + 0.27i, z8 = 1.14 − 0.27i

The moduli of these roots is always bigger than one, making the system one of finite

variance. Under the free-dynamics specification ( gπ = 0.0 , g y = 0.0 ) the solution is:

⎛

⎞

1 − 1.2 L + 0.25 L2

0.14 L

DF ( L ) =

⎜

2

3

4

2

3

4⎟

d F ( L ) ⎝ −0.025 L − 0.025 L − 0.025 L − 0.025 L 1 − 0.7 L + 0.1L − 0.28L − 0.12 L ⎠

1

and the roots of the polynomial d F ( z ) are:

z1 = −3.35, z2 = 3.34

z3 = 0.0010 + 1.59i, z4 = 0.0010 − 1.59i

z5 = 1.25, z6 = 0.95

We notice that the system under free dynamics features a zero inside the unit circle

( z6 = 0.95 ), which signals that the variance is not finite. Any good control rule will try to

eliminate such an unstable zero. However, the multivariate Bode constraint (make

reference here to the result in the paper) tells us that such an elimination has a price, i.e.

the variance contribution is likely to be high at some frequency ranges. To see this we

can plot the spectral densities for inflation and output under the optimal policy in the

form of a Taylor rule. Under free dynamics, given the roots inside the unit circle, a

spectral representation does not exist. We consider two rules of a set of optimal rules

suggested by Levin and Williams (2003): gπ = 5.1 , g y = 1.9 and gπ = 3.4 , g y = 2.5

where for the Rudebusch-Svensson model

34

it = gπ

1

1 + L + L2 + L3 ) π t + g y yt

(

4

(94)

The first rule is optimal when the policy maker does not attach any loss to the volatility

of output gap but she cares only about inflation. On the other hand, the second rule is

optimal when the policy maker gives equal weights to the volatility of inflation and

output gap in her loss function. Our calculations show that both policy strategies are able

to remove the unstable eigenvalues from the system; however, they do so by creating a

strong periodicity of output gap (the first rule also in inflation) at business cycle

frequencies (2-8 years). This is a clear example that, given the existence of fundamental

limits in designing control policies to a stochastic system, restricting attention to the

overall unconditional variance of the state variables can overlook important frequencyspecific effects of optimal policies.

12

10

8

6

4

2

0

0

0.5

1

1.5

2

2.5

3

Figure 4: Normalized Spectral Density of Output Gap (Thick line) and Inflation for RudebushSvensson Backward Looking Model under Taylor Rule ( gπ = 5.1 and g y = 1.9 ). Dashed line is

white noise spectrum under zero persistence in both processes.

35

Figure 4 shows that although the policy rule succeeds in making the system stable, it

creates a strong business cycle of medium-low frequency which might be undesirable to

the policy maker. Figure 5 shows the same result for the second policy rule we are

considering: as one would expect, the magnitude of the business cycle in output is

reduced but it is still distinctly present, whereas inflation is now a very persistent process.

12

10

8

6

4

2

0

0.5

1

1.5

2

2.5

3

Figure 5: Normalized Spectral Density of Output Gap (Thick line) and Inflation for RudebuschSvensson Backward Looking Model under Taylor Rule ( gπ = 3.4 and g y = 2.5 ). Dashed line is

white noise spectrum under zero persistence in both processes.

36

Comparing Figure 4 to Figure 5 seems interesting because in the first case the policy

maker is concerned with output gap only because inflation depends on it. On the other

hand, when the volatility of output gap becomes directly relevant in the policy maker

objective, the peak in the spectrum is reduced but this implies the acceptance of a very

persistence process for inflation, compared to Figure 4. Finally, Figure 6 shows the same

calculations under the original Taylor rule. Notice that the variance of inflation under the

original Taylor rule is smaller than the variance of inflation under the optimal rule of

Figure 4. This fact is a consequence of considering the variance of the change in the

interest rate when evaluating the optimality of the a policy rule (as Levin and Willimas

(2003) do). Since the process for the interest rate inherits the properties of the process for

output gap and inflation, the change in interest rate will be more volatile when these two

processes have a spectral densities more distributed across the frequency range. Both the

processes for inflation and output are more persistent under the optimal rule of Figure 4

than under the original Taylor rule of Figure 6 implying that the change in interest rate is

less volatile in the former case, thereby determining the optimality of that rule over the

Taylor rule.

37

12

10

8

6

4

2

0

0.5

1

1.5

2

2.5

3

Figure 6: Normalized Spectral Density of Output Gap (Thick line) and Inflation for RudebuschSvensson Backward Looking Model under Original Taylor Rule ( gπ = 1.5 and g y = 0.5 ). Dashed

line is white noise spectrum under zero persistence in both processes.

iii. hybrid models

TO BE COMPLETED

5. Summary and conclusions

TO BE COMPLETED

38

Appendix I. Proofs and Derivations

Proof of lemma 1

Elementary calculations show that

2

e iω − r = 1 − 2 r cos (ω − θ ) + r 2

(95)

where θ = arg (r ) . Taking logs and integrating both sides of (95),

π

∫

−π

2

log e iω − r d ω =

∫

π

−π

log (1 − 2 r cos (ω − θ ) + r 2 )d ω .

(96)

Focusing on the right hand side of (96), it is apparent that the integral is a periodic

function with period 2π , so

∫

π

−π

log (1 − 2 r cos (ω − θ ) + r 2 )d ω =

∫

π

−π

log (1 − 2 r cos ω + r 2 )d ω .

(97)

From Gradeshtyn and Ryzhik (1965),

∫

π

−π

log (a + b cos ω )d ω =2π log

a + a 2 + b2

,

2

(98)

which means that (96) and (97) imply that

∫

π

−π

2

iω

2

log e − r d ω = 2π log

1 + r 2 + (1 + r 2 ) − 4 r 2

2

1 + r + (1 − r )

2

= 2π

2

2

39

.

(99)

Therefore, if r ≤ 1 ,

∫

π

−π

1 + r 2 + (1 − r 2 )

= 0.

2

(100)

1 + r 2 −1 + r 2

= 2π log r 2

2

(101)

2

log e iω − r d ω = 2π log

Whereas if r > 1 ,

∫

π

−π

2

log e iω − r d ω = 2π log

which is the required result.

Proof of Theorem 1

From the description of the system,

det D (e

−i ω

)=

detW (e −iω )

det (A0 − A (e −iω )e −iω )

1

det (A0 ) Π

m

i =1

(1 − λie −iω )

Therefore,

40

w

=

Πwi =MA1 (1 − wie −iω )

Πwi =AR1 (1 − ρie −iω )

(102)

.

∫

π

−π

(

2

)

log det D (e −iω ) d ω =

∫

π

−π

log

1

det (A0 ) Πmi =1 (1 − λie −iω )

w

Πwi =MA1 (1 − wie −iω )

Πiw=AR1 (1 − ρie −iω )

2

dω =

2

⎛

Πwi =MA1 e iω − wi ⎞⎟⎟

1

⎜⎜

2

∫−π log ⎜⎜⎜ det (A )2 Πm eiω − λ 2 w ΠwAR eiω − ρ 2 ⎟⎟⎟d ω =

⎝

⎠

0

i =1

i

i =1

i

π

n

π

wAR

π

wMA

π

−∑ ∫ log e − λi d ω − 4π log det (A0 ) + 4π log w + ∑ ∫ log e − wi d ω − ∑ ∫ log e iω − ρi d ω

2

iω

−π

i =1

i =1

2

iω

−π

i =1

(103)

π

∫

From Lemma 1,

2

−π

e iω − r d ω = 0 if r < 1 . We have assumed that the driving

process is second order stationary which means that ρi < 1. Hence the last terms in

n

(103)

are

0.

The

terms

of

interest

are

∑∫

i =1

wAR

∑∫

i =1

π

−π

π

−π

2

log e iω − λi d ω

and

2

log e iω − wi d ω . Concerning the former, the λi ’s are the eigenvalues of the

system. When a control is applied to a system it seems desirable to eliminate any unstable

eigenvalues,

n

∑∫

i =1

π

−π

which

means

that

λi < 0 ∀i .

From

Lemma

1

this

means

2

log e iω − λi d ω = 0 . However, when we evaluate the expression for

uncontrolled systems, unstable eigenvalues cannot be ruled out, which means that

n

∑∫

π

−π

i =1

log e iω − λi d ω = 4π ∑ log λvi i ∈ {vi } if λi > 1

2

vi

wAR

Consider now the latter term.

∑∫

π

−π

i =1

2

log e iω − wi d ω . As already noticed, we allow for

wi > 1 , therefore we have

wAR

∑∫

i =1

π

−π

log e iω − wi d ω = 4π ∑ log wui

2

ui

41

i ∈ {ui } if wi > 1

−π

2

which verifies the theorem. Notice that this last term does not change when a control is

applied to an uncontrolled system, and in fact, theorem 2 makes clear that the structure of

the driving process does not affect the constraint on the sensitivity function in backwards

looking models. What do matter for the constraint are the unstable eigenvalues of the

uncontrolled system: as the feedback control must be designed in order to stabilize the

system, the freedom in allocating the variance at different frequencies is reduced.

Proof of Lemma 2

Since x t = G (L ) vt , and vt maps 1 to 1 with wt , the Wiener-Kolmogorov prediction

formula implies that

Et x t +1 = L−1 (G (L ) − G 0 ) vt

(104)

which, given eq. (104), means that

G (L )(A0 − L−1β − (A (L ) − B (L )U (L )) L ) vt = (−L−1βG 0 + V (L )) vt

(105)

Taking z -transforms,

G (z ) =

adj (zA0 − β − (A (z ) − B (z )U (z )) z 2 )

det (zA0 − β − (A (z ) − B (z )U (z )) z 2 )

⎛ β1

Recall that the specific forms of β and G0 are β = ⎜⎜⎜

⎜⎝β3

respectively.

(−βG0 + zV (z ))

β2 ⎞⎟

⎟⎟

β4 ⎠⎟⎟

⎛g 0,1

and G0 = ⎜⎜g

⎜⎝ 0,3

(106)

g 0,2 ⎞

⎟

g 0,4 ⎠⎟⎟⎟

The term (−βG 0 + zV (z )) on the right hand side therefore may be

rewritten

42

⎛ β1g 0,1 + β2g 0,3 − zv1 (z ) β1g 0,2 + β2g 0,4 − zv2 (z )⎞⎟

⎟⎟

−βG0 + zV (z ) = − ⎜⎜⎜

⎜⎝β3g 0,1 + β4g 0,3 − zv 3 (z ) β3g 0,2 + β4g 0,4 − zv 4 (z )⎠⎟⎟

(107)

The solution G (L ) is thus determined up to the elements in G 0 . Following Whiteman

(1983) we use the requirement of analyticity for each term in G (z ) as a set of extra

conditions for uniqueness. Define

⎛J 1 (z ) J 2 (z )⎞⎟

−adj (zA0 − β − (A (z ) − B (z )U (z )) z 2 ) = ⎜⎜⎜

⎟⎟

⎜⎝J 3 (z ) J 4 (z )⎠⎟⎟

(108)

J (z ) = det (zA0 − β − (A (z ) − B (z )U (z )) z 2 )

(109)

and

Note that under our assumptions, each term J i (z ) is a finite degree polynomial. The

candidate solution can be then written as:

G (z )

β1g 0,1 + β2g 0,3 − zv1 (z ) β1g 0,2 + β2g 0,4 − zv2 (z )⎞⎟

1 ⎛⎜J 1 (z ) J 2 (z )⎞⎛

⎟

⎜

⎟

⎟⎟ (110)

⎜

=

⎟⎟ ⎜⎜

J (z ) ⎜⎝⎜J 3 (z ) J 4 (z )⎠⎝

⎟⎜β3g 0,1 + β4g 0,3 − zv3 (z ) β3g 0,2 + β4g 0,4 − zv4 (z )⎠⎟⎟

The conditions for uniqueness corresponds to each numerator term in this matrix to

become zero at the unstable poles of the denominator (zeros inside the unit circle) that we

denote by z . Each z provides the associated set of equations:

J 1 (z )(β1g 0,1 + β2g 0,3 − zv1 (z )) + J 2 (z )(β3g 0,1 + β4g 0,3 − zv 3 (z )) = 0

J 3 (z )(β1g 0,1 + β2g 0,3 − zv1 (z )) + J 4 (z )(β3g 0,1 + β4g 0,3 − zv 3 (z )) = 0

J 1 (z )(β1g 0,2 + β2g 0,4 − zv2 (z )) + J 2 (z )(β3g 0,2 + β4g 0,4 − zv 4 (z )) = 0

J 3 (z )(β1g 0,2 + β2g 0,4 − zv2 (z )) + J 4 (z )(β3g 0,2 + β4g 0,4 − zv 4 (z )) = 0

43

(111)

These four equations are actually two blocks of two equations (first and third, second and

fourth) that can be solved independently for g 01 , g 03 and g 02 , g 04 respectively. To see this

we focus on the first block which can be written as:

⎛J 1 (z ) β1 + J 2 (z ) β3 J 1 (z ) β2 + J 2 (z ) β4 ⎞⎟ ⎛g 0,1 ⎞ ⎛J 1 (z ) zv1 (z ) + J 2 (z ) zv 3 (z )⎞⎟

⎜

⎟⎜ ⎟ ⎜

⎟

⎜⎜⎜J (z ) β + J (z ) β J (z ) β + J (z ) β ⎟⎟ ⎜⎜g 0,3 ⎟⎟⎟ = ⎜⎜⎜J (z ) zv (z ) + J (z ) zv (z )⎟⎟ (112)

⎟

⎟

⎝

⎠

1

4

3

3

2

4

4⎠

1

4

3

⎝ 3

⎝ 3

⎠

from which it is evident that

J 1 (z ) β1 + J 2 (z ) β3

J 1 (z ) β2 + J 2 (z ) β4

J 3 (z ) β1 + J 4 (z ) β3 J 3 (z ) β2 + J 4 (z ) β4

=0

(113)

In order to have a unique solution for this block system it is therefore necessary to have

two zeros inside the unit circle. When this holds, the two equations in two unknowns are

⎛J 1 (z 1 ) β1 + J 2 (z 1 ) β3 J 1 (z 1 ) β2 + J 2 (z 1 ) β4 ⎞⎟ ⎛g 0,1 ⎞

⎜⎜

⎟⎟ ⎜⎜ ⎟⎟ =

⎜⎜

⎟

⎟

⎜⎝J 1 (z 2 ) β1 + J 2 (z 2 ) β3 J 1 (z 2 ) β2 + J 2 (z 2 ) β4 ⎠⎟ ⎜⎝g 0,3 ⎠⎟

⎛ J 1 (z 1 ) z 1v1 (z 1 ) + J 2 (z 1 ) z 1v 3 (z 1 ) ⎞⎟

⎜⎜

⎟⎟

⎜⎜

⎟⎟

+

J

z

z

v

z

J

z

z

v

z

(

)

(

)

(

)

(

)

⎜⎝ 1 2 2 1 2

1

2

2 3

2 ⎠

(114)

which identify a unique solution for g 01 and g 03 . The solution method for g 02 and g 04 is

identical.

Derivation of Equation (27)

Let

det (zA0 − β − (A (z ) − B (z )U (z )) z 2 ) = gd (z ) .

44

(115)

We denote the determinant by gd (z ) to stress that the cancellation of unstable roots that

allows the uniqueness of the solution has not yet been considered. The solution matrix

can thus be written as

⎛J 1 (z ) J 2 (z )⎞⎛

β1g 0,1 + β2g 0,3 − zv1 (z ) β1g 0,2 + β2g 0,4 − zv2 (z )⎞⎟

⎟

⎜

⎜

⎟

⎜

G (z ) =

⎟⎜

⎟⎟ (116)

gd (z ) ⎜⎝⎜J 3 (z ) J 4 (z )⎠⎝

⎟⎟⎜⎜β3g 0,1 + β4g 0,3 − zv3 (z ) β3g 0,2 + β4g 0,4 − zv4 (z )⎠⎟⎟

1

Each of the four still-undefined constants in the second matrix on the right hand side are

then chosen in order to make G (z ) analytic inside the unit circle. Once the constants

have been chosen it is possible to write each term of G (L ) as having a common

denominator whose zeros are all outside the unit circle, we denote it by gd (z ) ; as

noticed, this is true conditional on the structure of V (L ) , a statement which now we

clarify.

Recalling that the W (L ) , has the form (4) it must be the case that for V (L )

⎛ vn,1 (L ) vn ,2 (L )⎞⎟

⎜

⎟

⎛v1 (L ) v2 (L )⎞⎟ ⎜⎜⎜ v (L ) v (L ) ⎟⎟

d ,1

d ,2

⎜⎜

⎟⎟

V (L ) = ⎜

,

⎟⎟ = ⎜⎜

⎜⎜⎝v3 (L ) v 4 (L )⎠⎟⎟ ⎜⎜ vn,3 (L ) vn,4 (L )⎟⎟⎟

⎟⎟

⎜⎜

⎜⎝ vd ,3 (L ) vd ,4 (L )⎠⎟⎟

(117)

where the numerator polynomials are defined so that:

vi (L ) =

vin (L )

=

vie (L )

vin (L )

ki

∏(1 − v L )

.

(118)

d

i, j

j =1

The terms in the second matrix of the solution matrix will be of the form

β1g 0,1 + β2g 0,3 − z

vn,1 (L )

vd ,1 (L )

=

vd ,1 (L )(β1g 0,1 + β2g 0,3 ) − zvn,1 (L )

vd ,1 (L )

45

≡

vˆn,1 (L )

vd ,1 (L )

. (119)

It follows that the form of the solution matrix is

G (z ) =

1 ⎛⎜J 1 (z )

⎜

gd (z ) ⎜⎜⎝J 3 (z )

⎛ vˆn ,1 (z ) vˆn ,2 (z ) ⎞⎟

⎜

⎟

J 2 (z )⎞⎟ ⎜⎜⎜ vd ,1 (z ) vd ,2 (z ) ⎟⎟

⎟

⎟⎟⎜⎜

⎟

J 4 (z )⎠⎟⎟ ⎜⎜ vˆn ,3 (z ) vˆn ,4 (z )⎟⎟⎟

⎟⎟

⎜⎜

⎜⎝ vd ,3 (z ) vd ,4 (z ) ⎠⎟

⎛

ˆ ( )

ˆ ( )

⎜⎜J 1 (z ) vn ,1 z + J 2 (z ) vn ,3 z

vd ,1 (z )

vd ,3 (z )

1 ⎜⎜⎜

=

⎜⎜

vˆ (z )

vˆ (z )

gd (z ) ⎜

⎜⎜J 3 (z ) n ,1

+ J 4 (z ) n ,3

⎜⎝

vd ,3 (z )

vd ,1 (z )

⎛

g1n (z )

⎜⎜

1 ⎜⎜⎜ vd ,1 (z ) vd ,3 (z )

=

⎜

gn3 (z )

gd (z ) ⎜⎜

⎜⎜

⎝ vd ,1 (z ) vd ,3 (z )

⎛ gn ,1 (z )

⎜⎜

1 ⎜⎜ vd ,1 (z ) vd ,3 (z )

⎜

=

gd (z ) ⎜⎜⎜ gn ,3 (z )

⎜⎜ ( ) ( )

⎝ vd ,1 z vd ,3 z

vˆn ,4 (z ) ⎞⎟

⎟

vd ,2 (z )

vd ,4 (z ) ⎟⎟⎟

⎟

vˆn ,2 (z )

vˆn ,4 (z )⎟⎟⎟

⎟⎟

J 3 (z )

+ J 4 (z )

vd ,2 (z )

vd ,4 (z ) ⎠⎟

⎞⎟

g2n (z )

⎟

vd ,2 (z ) vd ,4 (z )⎟⎟⎟

⎟⎟⎟

gn4 (z )

⎟⎟

(

)

(

)

vd ,2 z vd ,4 z ⎠⎟⎟

gn ,2 (z ) ⎞

⎟⎟

vd ,2 (z ) vd ,4 (z )⎟⎟⎟

⎟

gn ,4 (z ) ⎟⎟

⎟⎟

(120)

v (z ) v (z )⎠⎟⎟

J 1 (z )

d ,2

vˆn ,2 (z )

+ J 2 (z )

d ,4

The first step is just matrix multiplication, the second step defines the numerators

of each term as gn ,i (z ) since the free parameters are not pinned down yet; the last step

applies the requirements for the uniqueness of a solution by choosing the free parameters

so as to cancel the zeros of the common denominator gd (z ) inside the unit circle with the

zeros of each numerator gn ,i (z ) . Since the disturbance process is assumed stationary,

each of the terms vd ,i (z ) have all their zeros outside the unit circle and therefore they do

not play any direct active role in the value of the Bode constraint. They of course play a

more subtle role as the zeros (possibly inside the unit circle) of the terms gn ,i (z ) will

depend on them too. The last line of the above equation clarifies the statement that the

solution G (z ) , for the purpose of applying the Wu-Jonckheere results, can be written as

46

G (z ) =

⎛gn ,1 (z ) gn ,2 (z )⎞⎟

⎜⎜

⎟

gd (z ) ⎜⎝gn ,3 (z ) gn ,4 (z )⎠⎟⎟

1

(121)

conditional on the autoregressive structure of V (L) summarized by the polynomial

vd ,1 (z ) vd ,3 (z ) vd ,2 (z ) vd ,4 (z ) . In fact, notice that

gn ,2 (z ) ⎞⎤

⎡

⎛ gn ,1 (z )

⎟⎟⎥

⎜⎜

⎢

⎢ 1 ⎜⎜ vd ,1 (z ) vd ,3 (z ) vd ,2 (z ) vd ,4 (z )⎟⎟⎥

⎜⎜

det ⎢⎢

⎟⎟⎟⎥⎥ =

(

)

(

)

g

z

g

z

(

)

⎜

⎟⎟⎥

n ,3

n ,4

⎢ gd z ⎜⎜

⎢

⎜⎝ vd ,1 (z ) vd ,3 (z ) vd ,2 (z ) vd ,4 (z )⎠⎟⎟⎟⎥⎥

⎣⎢

⎦

⎡ 1 ⎛gn ,1 (z ) gn ,2 (z )⎞⎤

1

⎟⎟⎥

⎜⎜

det ⎢⎢

⎟

(

)

(

)

⎥

⎜

g

z

g

z

( )

n ,4

⎠⎟⎦⎥ vd ,1 (z ) vd ,3 (z ) vd ,2 (z ) vd ,4 (z )

⎣⎢ gd z ⎝ n ,3

(122)

Since the denominator terms have been constructed so that

k

vd ,1 (z ) vd ,3 (z ) vd ,2 (z ) vd ,4 (z ) = ∏ (1 − v j L )

(123)

j =1

where k is the sum of the degrees of each denominator term and the v j ’s are the

eigenvalues associated to the zeros of each denominator term, which are assumed all

inside the unit circle, thus the contribution of the last term in (123) to the Bode constraint

is null. It is the assumption (118) about the representation embedded in vn ,i (z ) that

allows the results of the theorems to be applicable in presence of a generic V (L ) . In

fact, given that assumption, it will be true in general that vn ,i ≠ 1 in

kn ,i

vn ,i (L ) = vn ,i ∏ (1 − vn ,i, j L )

j =1

SIMO derivation

47

(124)

Suppose that the spectral representation of the variance of the state variables is9

⎛ π

⎛vx1 ⎞⎟ ⎜⎜ ∫−π fx1 ,ε1 (ω )d ω

⎜⎜v ⎟⎟⎟ = ⎜⎜ π

⎜⎝ x2 ⎠ ⎜⎜

⎜⎝ ∫−π fx2 ,ε1 (ω )d ω

fx1 ,ε2 (ω )d ω ⎞⎟⎟ ⎛⎜σε21 ⎞⎟

⎟⎟⎟ ⎜⎜ 2 ⎟⎟⎟ ,

fx ,ε (ω )d ω ⎠⎟⎟ ⎜⎝⎜σε2 ⎠⎟⎟

−π 2 2

∫

∫

π

−π

π

(125)

where

−i ω

−i ω

⎛x 1,t ⎞⎟ ⎛⎜x 1,ε1 (e ) x 1,ε2 (e )⎞⎟⎟ ⎛ε1t ⎞⎟

⎜⎜ ⎟ = ⎜⎜

⎟⎜ ⎟ ,

⎜⎝x 2,t ⎠⎟⎟ ⎜⎜x (e −iω ) x (e −iω )⎟⎟⎟ ⎝⎜⎜ε2t ⎠⎟⎟

2,ε2

⎝ 2,ε1

⎠

(126)

and

2

⎛ fx1 ,ε1 (ω ) fx1 ,ε2 (ω )⎞⎟ ⎜⎛ x 1,ε1 (e −iω )

⎟⎟ ≡ ⎜⎜

⎜⎜⎜

(

)

(

)

⎜⎝ fx2 ,ε1 ω fx2 ,ε2 ω ⎠⎟⎟ ⎜⎜ x (e −iω ) 2

⎜⎝ 2,ε1

2

x 1,ε2 (e −iω ) ⎞⎟⎟

⎟⎟ .

2⎟

−i ω

⎟

x 2,ε2 (e ) ⎠⎟

(127)

Then the controlled system can be written as:

−i ω

−i ω

⎛πC t ⎞⎟ ⎛⎜s1 (e −iω ) s2 (e −iω )⎞⎛

⎟⎟ ⎜⎜x 1,ε1 (e ) x 1,ε2 (e )⎞⎟⎟ ⎛⎜ε1t ⎞⎟

⎜⎜ ⎟ ⎜

⎟⎟ ⎜

⎟⎜ ⎟

⎜⎜ C ⎟⎟ = ⎜⎜

−i ω

−i ω ⎟

−i ω

−i ω ⎟ ε ⎟

⎜⎝y t ⎠⎟⎟ ⎜⎝s 3 (e ) s 4 (e )⎠⎝

⎟ ⎜⎜x 2,ε1 (e ) x 2,ε2 (e )⎠⎟⎟ ⎜⎝ 2t ⎟⎠

⎛s1 (e −iω ) x 1,ε (e −iω ) + s2 (e −iω ) x 2,ε (e −iω ) s1 (e −iω ) x 1,ε (e −iω ) + s2 (e −iω ) x 2,ε (e −iω )⎞⎟ ⎛ε1t ⎞

⎜

1

1

2

2

⎜

⎟⎟ ⎜ ⎟⎟

=⎜

⎜s (e −iω ) x (e −iω ) + s (e −iω ) x (e −iω ) s (e −iω ) x (e −iω ) + s (e −iω ) x (e −iω )⎟⎟⎟ ⎜⎝⎜ε2t ⎠⎟⎟

⎜⎝ 3

1,ε1

4

2,ε1

3

1,ε2

4

2,ε2

⎠

(128)

It is useful to compare (126) with (128) in order to grasp the effect of a feedback policy

in a multivariate (bivariate) system. Each term in the matrix transfer function of the

9

Notice that a generalized objective function for the policy maker should be applied to a

variance-covariance matrix of the state variables. This is indeed the general approach,

taken from the control literature, of Hansen and Sargent (2005).

48

controlled system depends on a linear combination of the transfer functions of the

uncontrolled system for both state variables relative to the same term of the driving

process vector. In other words, the transfer function x 1,Cε1 (e −iω ) depends on x 1,ε1 (e −iω ) and

x 2,ε1 (e −iω ) combined linearly by s1 (e −iω ) and s2 (e −iω ) . The action in the state variable

generated by x 1,Cε1 (e −iω ) is thus a combination of the independent actions of both the

uncontrolled state variables and their common action. In fact, the controlled matrix of

spectra is

⎛ fxC,ε (ω ) fxC,ε (ω )⎞⎟

⎜⎜ 1 1

1 2

⎟⎟

⎜⎜ C

⎟

C

(

)

(

)

f

ω

f

ω

⎜⎝ x2 ,ε1

x 2 ,ε2

⎠⎟⎟

⎛ s e −iω x e −iω + s e −iω x e −iω 2

) 1,ε1 ( ) 2 ( ) 2,ε1 ( )

⎜⎜ 1 (

≡ ⎜⎜

2

−i ω

−i ω

−i ω

−i ω

⎜

⎜⎝ s 3 (e ) x 1,ε1 (e ) + s 4 (e ) x 2,ε1 (e )

2 (129)

s1 (e −iω ) x 1,ε2 (e −iω ) + s2 (e −iω ) x 2,ε2 (e −iω ) ⎞⎟⎟

⎟⎟

2⎟

−i ω

−i ω

−i ω

−i ω

s 3 (e ) x 1,ε2 (e ) + s 4 (e ) x 2,ε2 (e ) ⎟⎠⎟

and each spectral component is of the form:

fxC1 ,ε1 (ω ) =

2

2

2

2

s1 (e −iω ) x 1,ε1 (e −iω ) + s2 (e −iω ) x 2,ε1 (e −iω ) +

(130)

s1 (e −iω ) s2 (e iω ) x 1,ε1 (e −iω ) x 2,ε1 (e iω ) + s1 (e iω ) s2 (e −iω ) x 1,ε1 (e iω ) x 2,ε1 (e −iω )

Following Sargent (1987, eq. (47) page 268) we notice that the cross-spectrum is defined

as:

fx1x2 ,ε1 (ω ) = x 1,ε1 (e −iω ) x 2,ε1 (e iω ) and

fx2x1 ,ε1 (ω ) = x 1,ε1 (e iω ) x 2,ε1 (e −iω )

Thus each spectrum component of the controlled process can be finally written as:

49

(131)

fxC1 ,ε1 (ω ) =

2

2

s1 (e −iω ) fx1 ,ε1 (ω ) + s2 (e −iω ) fx2 ,ε1 (ω ) +

(132)

s1 (e −iω ) s2 (e iω ) fx1x2 ,ε1 (ω ) + s1 (e iω ) s2 (e −iω ) fx2x1 ,ε1 (ω )

fxC1 ,ε2 (ω ) =

2

2

s1 (e −iω ) fx1 ,ε2 (ω ) + s2 (e −iω ) fx2 ,ε2 (ω ) +

(133)

s1 (e −iω ) s2 (e iω ) fx1x2 ,ε2 (ω ) + s1 (e iω ) s2 (e −iω ) fx2x1 ,ε2 (ω )

2

2

fxC2 ,ε1 (ω ) = S 3 (e −iω ) fx1 ,ε1 (ω ) + S 4 (e −iω ) fx2 ,ε1 (ω ) +

S 3 (e −iω ) S 4 (e iω ) fx1x2 ,ε1 (ω ) + S 3 (e iω ) S 4 (e −iω ) fx2x1 ,ε1 (ω )

2

(134)

2

fxC2 ,ε2 (ω ) = S 3 (e −iω ) fx1 ,ε2 (ω ) + S 4 (e −iω ) fx2 ,ε2 (ω ) +

S 3 (e −iω ) S 4 (e iω ) fx1x2 ,ε2 (ω ) + S 3 (e iω ) S 4 (e −iω ) fx2x1 ,ε2 (ω )

(135)

as claimed in the text.

Derivations for Section 4 forward looking model

Define the matrix

z − .99

⎛

Jˆ ( z ) = ⎜

2

⎝ −1.59 + 1.59 gπ z

−0.096 z

⎞

2⎟

−1 + z + 1.59 g y z ⎠

(136)

which implies

Jˆ ( z ) G ( z ) wt = ( β g 0 − zW ( z ) ) wt

50

(137)

This means off-diagonal elements of the characteristic matrix are non-zero. Note that

under our assumptions, each term

(

Jˆij ( z ) is a finite degree polynomial. Let

)

J ( z ) = Adj Jˆ ( z ) , then the candidate solution can be then written as:

−1

G ( z ) = Jˆ ( z ) ( β g 0 − zW ( z ) )

G (z) =

⎛ J11 ( z ) J12 ( z ) ⎞ ⎛ β11 g 0,11 + β12 g 0,21 − zv11 ( z ) β11 g 0,12 + β12 g 0,22 − zv12 ( z ) ⎞

1

⎟

⎜

⎟⎜

det Jˆ ( z ) ⎝ J 21 ( z ) J 22 ( z ) ⎠⎝ β 21 g 0,11 + β 22 g 0,21 − zv21 ( z ) β 21 g 0,12 + β 22 g 0,22 − zv22 ( z ) ⎠

(

)

⎛

⎜

⎜

1

G ( z) =

⎜

det Jˆ ( z ) ⎜

⎜

⎝

(

)

J11 ( z ) ( β11 g 0,11 + β12 g 0,21 − zv11 ( z ) ) + J12 ( z ) ( β 3 g 0,11 + β 4 g 0,21 − zv21 ( z ) )

⎞

⎟

J11 ( z ) ( β11 g 0,12 + β 2 g 0,22 − zv12 ( z ) ) + J12 ( z ) ( β 21 g 0,12 + β 22 g 0,22 − zv22 ( z ) ) ⎟

⎟