An Overview of the Domiciliary Care Market in the United Kingdom

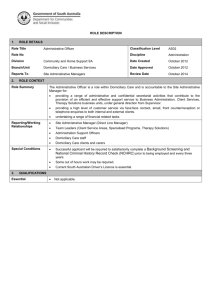

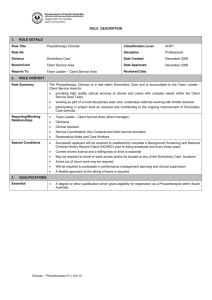

advertisement