A Managed Change: An Agenda for Creating a Sustainable Basis

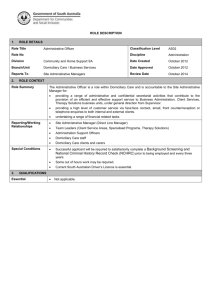

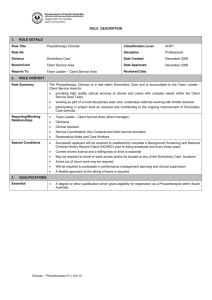

advertisement