SmartVista i High-performance payment processing solution on IBM System i

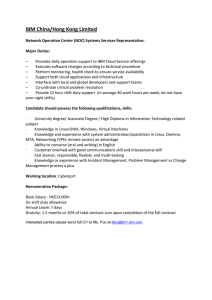

advertisement