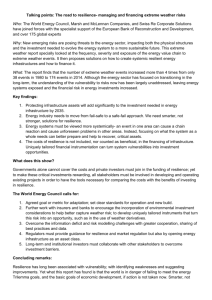

World Energy Perspective The road to resilience − managing and

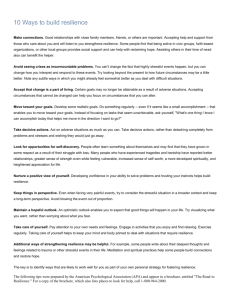

advertisement