DETERMINING ALLOWABILITY, REASONABLENESS AND ALLOCABILITY

advertisement

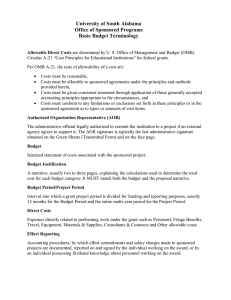

DETERMINING ALLOWABILITY, REASONABLENESS AND ALLOCABILITY OF COSTS FOR GRANTS AND SPONSORED PROJECTS When a sponsor awards funds to Kutztown University in support of a program or project, it requires the University to manage the funds prudently and ensure that costs are allowable, reasonable and allocable. The federal regulations that govern this determination for federal funding are contained in the 2 CFR Part 220 (Office of Management and Budget Circular A-21, Cost Principals for Educational Institutions). In addition, individual awards may include special terms and conditions which must be considered when incurring costs. Principal Investigators or Projects Directors are responsible for ensuring the appropriateness of costs charged to their sponsored program or project accounts. Determination Factors When incurring costs against sponsored funds (i.e., making payments utilizing external funding from grants, contracts and cooperative agreements), the Project Director administering the project is responsible for ensuring that all costs meet allowability, reasonableness and allocability standards prior to the expense. All expenditures must be approved by the Office of Grants and Sponsored Projects. Allowability All costs must be allowable under federal regulations and sponsor terms and conditions. To be allowable costs must: - be reasonable; - be allocable to sponsored projects under the principles and methods provided in OMB Circular A-21; - be given consistent treatment through application of those generally accepted accounting principles appropriate to the circumstances; and - conform to any limitations or exclusions set forth in OMB Circular A-21 or in the terms and conditions of the award. The OMB Circular A-21 lists in detail the allowability of particular elements of cost. Also, allowability of certain costs may be addressed in the terms and conditions of specific awards, and can vary. When an item is questionable, the Office of Grants and Sponsored Projects should be contacted before the cost is incurred. The following items of cost are unallowable according to OMB Circular A-21: Advertising and Public Relations; Alcoholic Beverages; Alumni Activities; Bad Debts; Certain Legal Costs; Contributions or Donations; Entertainment; Fines and Penalties; Fund Raising and Investment Management; Goods and Services for Personal Use; Lobbying; Loses on Sponsored Agreements; and Memberships in Civil, Community and Social Organizations. Reasonableness A cost may be considered reasonable if the nature of the goods or services acquired or applied, and the amount involved therefore, reflect the action that a prudent person would have taken under the circumstances prevailing at the time the decision to incur the cost was made. Considerations involved in the determination of the reasonableness of a cost are: 1 of 2 - whether or not the cost is of a type generally recognized as necessary for the operation of Kutztown University or the performance of the sponsored project; the restraints or requirements imposed by such factors as arm’s length bargaining, federal and state laws and regulations, and sponsored agreement terms and conditions; whether or not the individuals concerned acted with due prudence in the circumstances, considering their responsibilities to the University, its employees, its students, the Government and the public at large; and the extent to which the actions taken with respect to the incurrence of the cost are consistent with established University policies and practices applicable to the work of the University generally, including sponsored projects. Allocability A cost is allocable to a particular cost objective (i.e., a specific function, project, sponsored agreement, department, or the like) if the goods or services involved are chargeable or assignable to such cost objective in accordance with relative benefits received or other equitable relationship (Basic question – Is the expense related to the project?). Subject to the foregoing, a cost is allocable to a sponsored agreement if: - it is incurred solely to advance the work under the sponsored agreement; - it benefits both the sponsored agreement and other work of the University, in proportions that can be approximated through use of reasonable methods; or - it is necessary to the overall operation of the University and, in light of the principles provided in OMB Circular A-21, is deemed to be assignable in part to sponsored projects. Where the purchase of equipment or other capital items is specifically authorized under a sponsored agreement, the amounts thus authorized for such purchases are assignable to the sponsored agreement regardless of the use that may subsequently be made of the equipment or other capital items involved. Any costs allocable to a particular sponsored agreement under the standards provided in OMB Circular A-21, may not be shifted to other sponsored agreements in order to meet deficiencies caused by overruns or other fund considerations, to avoid restrictions imposed by law or by terms of the sponsored agreement, or for other reasons of convenience. In addition, any costs allocable to activities sponsored by industry, foreign governments or other sponsors may not be shifted to federally sponsored agreements. If a cost benefits two or more projects or activities in proportions that can be determined without undue effort or cost, the cost should be allocated to the projects based on the proportional benefit. If a cost benefits two or more projects or activities in proportions that cannot be determined because of the interrelationship of the work involved, then the costs may be allocated or transferred to benefited projects on any reasonable basis. 2 of 2