$57,161,779, as of Oct. 1, 2010, to $60,855,175 on Dec.... increase of $3,693,396. The quarter showed a 7.37 percent increase...

advertisement

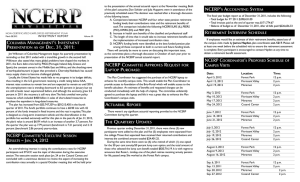

NON-CERTIFICATED EMPLOYEES RETIREMENT PLAN March 29, 2011 Volume 46 investment rePort: annuity Payments for life versus lumP sum Payments: “Should I take a lump sum or annuity payments for life?” Many NCERP participants nearing retirement pose this question, and there is no empirical evidence that one is any better than the other. The answer depends largely on the perspective and risk tolerance of the one making the decision. Some NCERP participants are comfortable that they (or their investment manager) will invest their lump sum payment well and it will earn a good return. Others do not want to take this risk in retirement and want (or need) the security that comes with knowing they will receive a monthly annuity benefit from this plan for the rest of their life. Statistically about 50 percent of all plan participants take the annuity payments for life and about 50 percent take the lump sum benefit. Anyone considering retirement should weigh their options carefully, perhaps by speaking with a trusted financial advisor.You might discuss your risk tolerance and pose the questions, “What investment return will I be able to earn if I invest this lump sum payment? How much monthly income can I receive from my investment?” If you need the monthly income, you can then compare that amount with the monthly annuity amount NCERP provides. Compare the results, and based on your financial situation and the level of risk you are comfortable with, make an informed choice. Remember, everyone’s financial situation is different and there is no perfect answer that fits everyone. You should also remember that NCERP allows you to receive your benefit as 50 percent annuity/50 percent lump sum option. This option provides half of what the full lifetime annuity payment would have been and pays the other half as a lump sum. It is important to understand that your lump sum is equal to your monthly annuity amount multiplied by a lump sum factor that is based on the interest rate for the year and your expected future lifetime. The lump sum factors are provided annually by the plan’s actuary, usually in early May, and go into effect on the upcoming July 1 of the same year. If interest rates have decreased since the prior year these factors increase (increasing the lump sum benefit). If interest rates have increased since the prior year, the lump sum factors decrease (decreasing the lump sum benefit). The interest [AFFIX LABEL HERE] rate being used for the year ending June 30, 2011, will not decrease as of July 1 since it is at the lowest rate allowed by the plan, 4.5 percent. If you have not yet reached the plan’s normal retirement age of 60 and interest rates have not increased, your lump sum payment will increase if you work longer. This is true not only because your benefit will increase due to additional credited service, but also because benefits paid prior to age 60 are reduced for early retirement. However, we have received some questions and comments about what happens to a participant’s monthly benefit and lump sum if he or she decides to work after age 60. It is important to remember that each month an NCERP participant keeps working increases his or her credited service, increasing the amount of the monthly lifetime benefit. However, since the lump sum factor depends on your future life expectancy, the lump sum amount can actually decrease if you work an extra year since your life expectancy is shorter by one year. The impact on individuals will vary depending on how much service you have, how much your earnings increase and how old you are. Generally, the older you are and the more service you have, the greater the likelihood that your lump sum payment will decrease.You can always discuss your situation with the plan coordinator as you plan for whether you will work after age 60. If you have any further question concerning the lump sum benefit please contact your plan coordinator, James Hayden, at ext. 5217 for further explanations. Columbia management’s investment Presentation as of DeCember 31, 2010 Jim Wilkinson, the plan’s portfolio manager, opened his quarterly presentation Feb. 9, 2011, by stating that the plan has progressed well this quarter due to the diversified asset allocation. The asset allocation is presently fixed at 64 percent equities and 36 percent fixed income. Wilkinson further informed the committee that initial jobless claims have improved to their lowest level in over two years and consumer confidence has risen. Markets continue to improve and this month the Gross Domestic Product is up to 3.2 percent from 2.6 percent last month. Additionally, the unemployment rates continue to decline slowly, as the current rate is 9.0 percent down from 9.4 percent at the end of December 2010. There have been 36,000 jobs added last month, but 140,000 became unemployed. The current pool of those seeking employment has declined and companies remain underemployed as the labor force reduces. Wilkinson expressed his opinion is that 70-75 percent of companies earnings are exceeding expectations, but the expectations are higher using less employees and companies are not that interested in increasing their labor force. Wilkinson has articulated that there has been an inflation rumble in the food markets and we have seen obvious increases in the price of petroleum. Economic problems have continued throughout the world. The drought in China and its effect on the cost of grain, the sovereign debt in Europe, the turmoil in Egypt, and various other potentially hot spots in the Middle East are all concerns. Meanwhile, the U.S. continues to support these nations as the federal debt continues to increase and this affects tax payers in the area of state budget cuts. Wilkinson finalized his report by stating the plan’s assets increased from $57,161,779, as of Oct. 1, 2010, to $60,855,175 on Dec. 31, 2010 for an increase of $3,693,396. The quarter showed a 7.37 percent increase and 14.5 percent increase for year to date. rePort from aCtuary Don Schisler, the plan’s actuary, discussed their firm’s analysis after the question raised at the meeting Nov. 11, 2010. Steve Kanterman raised a question concerning the averaging of annual salaries used to calculate pension benefits. The plan currently utilizes the highest four years of annual earnings during the last 10 years of employment, and Kanterman asked about changing this to use the highest four years in the last 15 years. Schisler expressed at the time that, since this would only affect a small percentage of plan participants, the main issue to consider is the additional administrative time and cost. Towers Watson examined plan participants’ last 20 years of annual earnings and found that 75 percent of the participants had their highest earnings during the last four years and another 10 percent of the participants had their highest four years of earnings during the last five years. Another employee had questioned the current practice because they had a year in the past with high earnings, and this year would not be included in the final average if the employee works beyond the normal retirement age. Towers Watson determined that, if this specific employee receives pay increases that average just two percent per year between now and age 60, the final salary will be larger than the highest earnings year in the past. It was also noted that since future benefits will include additional service credit this will also increase the benefit. Schisler noted the following example: If a participant has worked 20 years by age 60, working an extra five years will result in a 25 percent benefit increase since the benefit will be based on 25 percent more service more than offsetting the impact of a small decrease in final average earnings. The current definition of average annual earnings (the average of the highest four years during the last 10 years of employment), protects employees against inflation during their working years by determining pension benefits based on earnings near the time of retirement. The intent is to allow participants to maintain their standard of living in retirement, but it was never meant to guarantee that the highest four years of earnings would always be used. After much discussion at the Feb. 9 quarterly committee meeting, the NCERP retirement committee agreed with this analysis and decided not to pursue a change in the plan provisions. THE QUARTERLY UPDATES During the period of Oct. 1, 2010 through Dec. 31, 2010, there were 10 new participants were added to the plan, three employees separated from the college, and their returned contributions and credited interest totaled $12,414.83. During the same period, there were five plan participants that chose to retire. One retiree chose the annuity payments for life, two chose the 50 percent Lump/50 percent Annuity Option, two others chose the Lump Sum option payment totaling $180,698.32. During this period, Susan Lagunoff, who worked at Florissant Valley, passed Nov. 18, 2010. retirement interview sCheDule The fiscal year budget report as of Dec. 31, 2010, includes the following: • Total budget for FY 2010: $393,175 • Total invoices paid at the end of quarter as of Dec. 31, 2010: $168,260.62 • Balance of FY2011 budget as of Dec. 31, 2010, after all bills paid: $224,914.38 nCerP CoorDinator’s ProPoseD sCheDule of CamPus visits If employees would like an estimate of their retirement benefits, attend any of the campus visits made by James Hayden, plan coordinator, ext. 5217. Please call at least one week before the scheduled visit to ensure the retirement assessment is complete. Every participant is encouraged to contact Hayden at any time to obtain a retirement benefit assessment. Date: Location: Time: April 7, 2011 Forest Park Noon April 11, 2011 Florissant Valley 2 p.m. April 21, 2011 Meramec 2 p.m. May 5, 2011 Forest Park Noon May 12. 2011 Florissant Valley 2 p.m. May 19, 2011 Meramec 2 p.m. May 26, 2011 Cosand Center 2 p.m. June 2, 2011 Forest Park Noon June 9, 2011 Florissant Valley 2 p.m. June 16, 2011 Meramec 2 p.m. July 7, 2011 Forest Park Noon July 14, 2011 Florissant Valley 2 p.m. July 21, 2011 Meramec 2 p.m. July 28, 2011 Cosand Center 2 p.m. Aug. 4, 2011 Forest Park Noon Aug. 11, 2011 Florissant Valley 2 p.m. Aug. 18, 2011 Meramec 2 p.m. Sept. 1, 2011 Forest Park Noon Sept. 8, 2011 Florissant Valley 2 p.m. Sept. 15, 2011 Meramec 2 p.m. Sept. 22, 2011 Cosand Center 2 p.m. Oct. 6, 2011 Forest Park Noon Oct. 13, 2011 Florissant Valley 2 p.m. Oct. 20, 2011 Meramec 2 p.m. Nov. 3, 2011 Forest Park Noon Nov. 10, 2011 Florissant Valley 2 p.m. Nov. 17, 2011 Meramec 2 p.m. Dec. 1, 2011 Forest Park Noon. Dec. 8, 2011 Florissant Valley 2 p.m. Dec. 15, 2011 Florissant Valley 2 p.m. Locations are: Cosand Center, Room 208, Florissant Valley, Training Center, TC-109; Forest Park,VP Academic Affairs’ Conference Room; Meramec, BA-106; nCerP Committee meeting sCheDule S M T W T F S The quarterly NCERP Committee meetings now are being rotated from various campus locations. The tentative schedule is as follows: May 11, 2011, Florissant Valley, 9:15 a.m. Aug. 10, 2011, Meramec, 9:15 a.m. Nov. 9, 2011, Forest Park, 9:15 a.m. Feb. 8, 2012, Cosand Center, 9:15 a.m. benefiCiary aCCuraCy Make sure beneficiary information on file for NCERP retirement contributions is accurate. Failure to do so could result in retirement contributions being paid to the employee’s estate versus having the contributions going to loved ones. If there are questions or concerns, contact James Hayden, plan coordinator, at ext. 5217. unoffiCial… Financial Spring Cleaning Sort through you financial papers and get rid of the ones you longer need. As a general rule, you should save papers that support your tax returns for three to six years in case of an audit and retain indefinitely records that serve as proof of important financial transactions. The rest can go. Be sure to shred all documents before you throw them out.Although your individual situation may vary, here’s a list of what to toss and what to keep, according to Stephanie Denton, former president of the National Association of Professional Organizers. Dump after one year or less. • ATM and bank-deposit slips after you’ve recorded the amounts in your check register and checked them against your monthly statement. • Sales receipts from minor purchases. • Bank, brokerage, mutual fund and credit card statements after you’ve reconciled them with your year-end summary. • Pay stubs after you’ve checked the amounts against your W-2. Keep three to six years. • Copies of your W-2s and 1099s. • Cancelled checks, mortgage statements and receipts for deductible expenses. • Year-end credit card summaries that detail spending for deductible items. • Year-end statements documenting mortgage and property interest paid. Retain indefinitely. • Your old tax returns (but not the supporting documents). • Records of major purchases for insurance purposes. • Transaction records and year-end brokerage and mutual fund statements for as long as you own the investment, plus three to six years for tax purposes. • Receipts for home improvements for tax reasons. • Wills, living wills and trust documents. • A list of the beneficiary designations on your retirement and other financial accounts, as well as the financial firms with whom you do business and your account numbers.Tell the person you’ve designated as executor where to find the list and other relevant financial papers. St. Louis Community College FLORISSANT VALLEY FOREST PARK MERAMEC WILDWOOD imPortant Points of ContaCt: Board of Trustees Appointment Calla White 6688 Chesapeake Drive Apartment C Florissant, Missouri 63033 Phone: 314-355-9112 Term expires: BOT’s pleasure Board of Trustees Appointment Ruth Lewis 10455 Litzsinger Road St. Louis, MO 63131 Telephone: 314-567-7098 Term Expires: BOT’s pleasure Unit Representative Kevin White FP - Media Services Phone: 314-644-9213 E-mail: kwhite@stlcc.edu Term expires: June 30, 2013 Physical Plant Mike Wibbenmeyer - Vice Chair MC – Utilities/HVAC Phone: 314-984-7749 E-mail: mwibbenmeyer@stlcc.edu Term expires: Oct. 30, 2013 Non-Unit Representative Vicki Lucido - Chair FV - VP Academic Affairs' Office Telephone: 314-513-4214 e-mail: vlucido@stlcc.edu Term expires: June 30, 2014 Individuals with speech or hearing impairments may call via Relay Missouri by dialing 711. Any suggestions for improvements, questions, comments or other concerns about the retirement plan may be directed to any of the NCERP Committee representatives. Any proposed agenda items may be sent to James Hayden or the employee representative 10 days prior to the meeting date. aCCommoDations statement St. Louis Community College makes every reasonable effort to accommodate individuals with disabilities. If you have accommodation needs, please contact the Access office at the campus where you are registering at least six weeks before the beginning of the class. Event or other public service accommodation requests should be made with the event coordinator or applicable location nondiscrimination officer at least two working days prior to the event or public service. non-DisCrimination statement St. Louis Community College is committed to non-discrimination and equal opportunities in its admissions, educational programs, activities and employment regardless of race, color, creed, religion, sex, sexual orientation, national origin, ancestry, age, disability, genetic information or status as a disabled or Vietnam-era veteran and shall take action necessary to ensure non-discrimination. In furtherance of the college’s commitment, grievance procedures for the prompt and equitable resolution of complaints are set forth in the college’s designated Administrative Procedures. This newsletter is designed to summarize and explain basic changes in the Non-Certificated Employees Retirement Plan and provides updates on other related matters. Since it is only a summary, this newsletter does not cover the plan's provisions in detail. Therefore, if there is any conflict between this newsletter and the plan document itself, the plan document will always govern. An official copy of the plan is available for inspection in the Human Resources department at the Joseph P. Cosand Community College Center, 300 South Broadway, St. Louis, Mo. and in each campus’ library during regular business hours. 100387 3/2011