Resources for the Future Workshop on Learning-By-Doing in Energy Technologies

advertisement

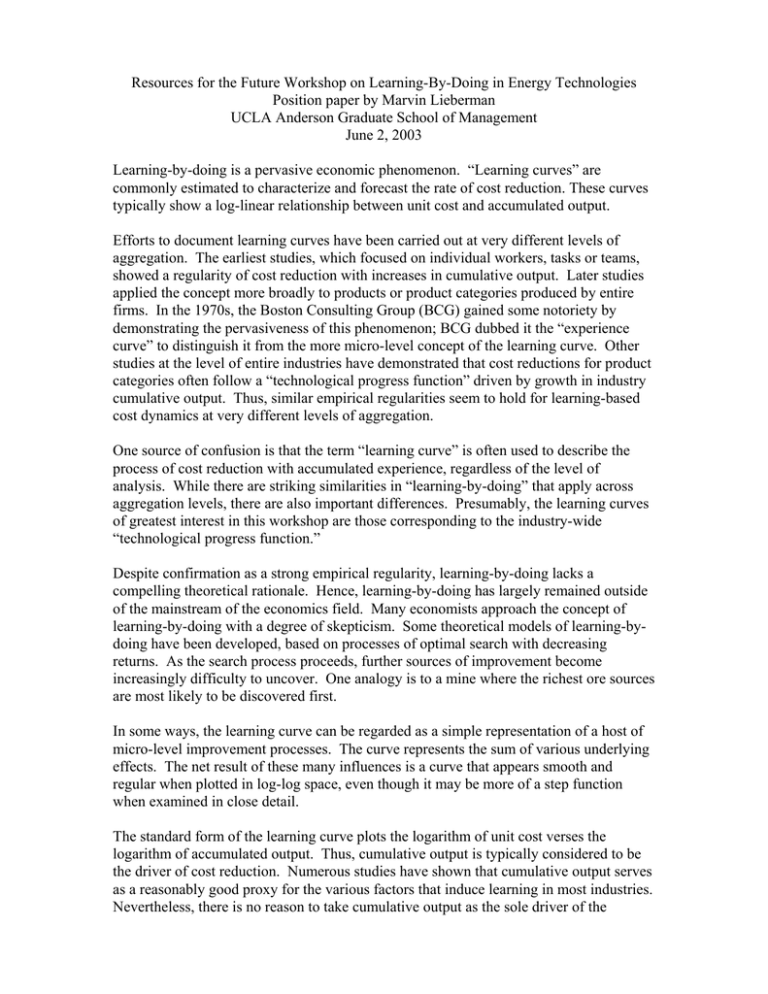

Resources for the Future Workshop on Learning-By-Doing in Energy Technologies Position paper by Marvin Lieberman UCLA Anderson Graduate School of Management June 2, 2003 Learning-by-doing is a pervasive economic phenomenon. “Learning curves” are commonly estimated to characterize and forecast the rate of cost reduction. These curves typically show a log-linear relationship between unit cost and accumulated output. Efforts to document learning curves have been carried out at very different levels of aggregation. The earliest studies, which focused on individual workers, tasks or teams, showed a regularity of cost reduction with increases in cumulative output. Later studies applied the concept more broadly to products or product categories produced by entire firms. In the 1970s, the Boston Consulting Group (BCG) gained some notoriety by demonstrating the pervasiveness of this phenomenon; BCG dubbed it the “experience curve” to distinguish it from the more micro-level concept of the learning curve. Other studies at the level of entire industries have demonstrated that cost reductions for product categories often follow a “technological progress function” driven by growth in industry cumulative output. Thus, similar empirical regularities seem to hold for learning-based cost dynamics at very different levels of aggregation. One source of confusion is that the term “learning curve” is often used to describe the process of cost reduction with accumulated experience, regardless of the level of analysis. While there are striking similarities in “learning-by-doing” that apply across aggregation levels, there are also important differences. Presumably, the learning curves of greatest interest in this workshop are those corresponding to the industry-wide “technological progress function.” Despite confirmation as a strong empirical regularity, learning-by-doing lacks a compelling theoretical rationale. Hence, learning-by-doing has largely remained outside of the mainstream of the economics field. Many economists approach the concept of learning-by-doing with a degree of skepticism. Some theoretical models of learning-bydoing have been developed, based on processes of optimal search with decreasing returns. As the search process proceeds, further sources of improvement become increasingly difficulty to uncover. One analogy is to a mine where the richest ore sources are most likely to be discovered first. In some ways, the learning curve can be regarded as a simple representation of a host of micro-level improvement processes. The curve represents the sum of various underlying effects. The net result of these many influences is a curve that appears smooth and regular when plotted in log-log space, even though it may be more of a step function when examined in close detail. The standard form of the learning curve plots the logarithm of unit cost verses the logarithm of accumulated output. Thus, cumulative output is typically considered to be the driver of cost reduction. Numerous studies have shown that cumulative output serves as a reasonably good proxy for the various factors that induce learning in most industries. Nevertheless, there is no reason to take cumulative output as the sole driver of the learning process. In my own studies of the chemical industry, I found that cumulative investment was also an important driver of cost reduction, although less important than cumulative output. Many improvements in chemical processes are embodied in new capital equipment, so it is not surprising that investment plays an important role. Moreover, some chemical products experienced periods of major technical change, in addition to the more incremental change represented by the standard learning curve. During such periods the learning curve showed discontinuities with steeper than average cost reduction. Part of the learning effect in the chemical industry was also due to economies of scale. Over time, firms built increasingly larger plants as they solved the technical problems needed to make such plants economically feasible. An additional factor was R&D; I found that higher R&D spending raised the slope of the learning curve. Ultimately, learning in the chemical industry was not a simple function of cumulative output, even though cumulative output provided the best overall proxy for learning. Other researchers have obtained similar findings, although the importance of specific factors tends to vary with industry characteristics. In industries with a high labor component, for example, the learning process is more sensitive to human factors (such as employee turnover) than in the capital-intensive chemical industry. Studies suggest that such intrinsic characteristics may cause industries to differ in their learning curve “slopes” when unit cost is plotted against cumulative volume. Industries also differ in terms of the more detailed factors into which the learning curve might be decomposed. This workshop is concerned mostly with “technological progress functions” relating to energy technologies, at the industry level. My studies of the chemical industry were focused at that level; however, most current research on learning curves considers the more disaggregate level of individual firms and organizational units. (See, for example, the many studies reviewed in Linda Argote’s 1999 book, Organizational Learning.) These studies show that learning rates vary greatly among organizations, and that learning should not be viewed as a uniform or automatic process driven simply by increases in cumulative output. Recent studies focus on issues such as organizational “forgetting,” and transfer of learning across organizational units. The findings of these studies are of potential relevance for firms that wish to optimize their rates of learning. From a policy standpoint, one important feature of learning-by-doing is that it can be regarded partly as an investment. Greater production today promotes cost reductions that provide savings in the future. Given this investment component, under some conditions it may be appropriate for private firms or governments to subsidize some part of the current production cost. If learning is proprietary and firms have a long time horizon, they may recognize this investment component and subsidize part of current cost. For example, automobile producers such as Toyota and Honda may now be pursuing such subsidies in the production of their hybrid cars. However, if uncertainty is high, or if spillovers to competitors reduce the proprietary value of learning, firms will not find it in their interest to subsidize learning. In such cases, some form of public subsidy or incentive may be justified.