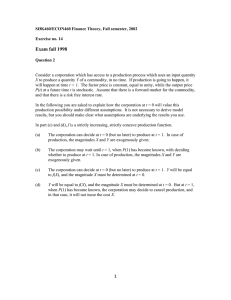

2007 Market Statistics

advertisement