Document 11625024

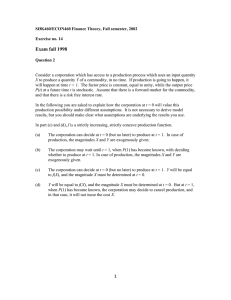

advertisement