FORT SCOTT COMMUNITY COLLEGE 2016-2017 Dependent Verification Form (V6-Household Resources)

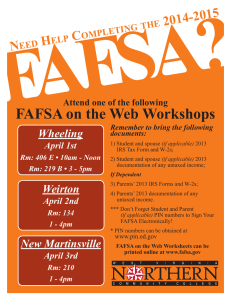

advertisement

FORT SCOTT COMMUNITY COLLEGE 2016-2017 Dependent Verification Form (V6-Household Resources) Your 2016-2017 Free Application for Federal Student Aid (FAFSA) was selected for review in a process called verification. The law says that before awarding Federal Student Aid, we must ask you to confirm the information you reported on your FAFSA. To verify that you provided correct information, we will compare your FAFSA with the information on this institutional verification document and with any other required documents. If there are differences, your FAFSA information may need to be corrected. You and a parent whose information was reported on the FAFSA must complete and sign this institutional verification document, attach any required documents, and submit the form and other required documents to us. We may ask for additional information. If you have questions about verification, contact us as soon as possible so that your financial aid will not be delayed. _____________________________ Student’s Last Name _________________________ ____ Student’s First Name M.I. __________________ SSN or Student ID# _____________________________________________________________________________________________________________________________________________________________ ___________________________________________ Student’s Street Address Student’s DOB City State Zip Household Members and Number in College: List below the people in the parent(s)’ household. EVEN IF THEY ARE NOT ATTENDING COLLEGE. Include: The student The parent(s), including a stepparent, even if the student does not live with the parent(s). The parent(s)’ other children if the parent(s) will provide more than half of their support from July 1, 2016, through June 30, 2017, or if the other children would be required to provide parental information if they were completing a FAFSA for 2016-2017. Include children who meet either of these standards even if the children do not live with the parent(s). Other people if they now live with the parent(s) and the student’s parent(s) provide more than half of their support and will continue to provide more than half of their support through June 30, 2017. Full Name Age Relationship John Doe (example) 18 Brother Self College Attending (Or leave blank) FSCC Enrolled at Least Half Time (Y/N) Yes For any household member you listed above, also indicate who will be enrolled at least half-time at an eligible postsecondary educational institution any time between July 1, 2016 and June 30, 2017 _____________________________ Student’s Last Name _________________________ ____ Student’s First Name M.I. __________________ SSN or Student ID# Receipt of SNAP Benefits: Certify if a member of the parents’ household (refer to page 1), received benefits from the Supplemental Nutrition Assistance Programs or SNAP (formerly known as the Food Stamp Program) sometime during 2014 or 2015. SNAP may be known by another name in some states. For assistance in determining the name used in a state, please call 1-800-433-3243. NOTE: If we have reason to believe that the information regarding the receipt of SNAP benefits is inaccurate, we may require documentation from the agency that issued the SNAP benefits in 2014 or 2015. In 2014 or 2015, did you or any member of your parents’ household receive SNAP benefits? Yes No Child Support Paid: It was indicated on the student’s FAFSA, that the student or one of the parents included in the household, paid child support in 2015. List below the names of the persons who paid the child support, the names of the persons to whom the child support was paid, the names of the children for whom the child support was paid, and the total annual amount of child support that was paid in 2015 for each child. If no child support was paid, please write N/A on the table below. Name of Person Who Paid Child Support Name of Person to Whom Child Support was Paid Name of Child for Whom Support was Paid Amount of Child Support Paid in 2015 NOTE: If we have reason to believe that the information regarding child support paid is not accurate, we may require additional documentation; such as: A copy of the separation agreement or divorce decree that shows the amount of child support to be provided A statement from the individual receiving the child support certifying the amount of child support received Copies of the child support payment checks or money order receipts _____________________________ Student’s Last Name _________________________ ____ Student’s First Name M.I. __________________ SSN or Student ID# Student’s Tax Information: Did the student file taxes for the 2015 year? Yes No If no, skip to the TAX NON-FILER section below. (Do not fill out the tax filer section). If yes, please continue to the TAX FILER section. (Do not fill out the tax non-filer section). ***If the student worked in 2015, all W2 forms must be attached*** TAX FILER: In order to verify the student’s tax information, one of the following steps must be completed: (Please refer to the detailed directions at the end of this form). The student has used or is going to use the IRS Data Retrieval Tool on their FAFSA. The student has submitted or is going to submit an IRS Tax Return Transcript to the Financial Aid Office. NOTE: For electronic filers, the IRS Data Retrieval Tool and the IRS Tax Return Transcript should be available 2-3 weeks after their 2015 IRS Income Tax Return has been accepted by the IRS. For paper filers, they are available after 8-11 weeks. TAX NON-FILER: The student was not employed and had no income earned from work in 2015. The student was employed and had income earned from work in 2015. NOTE: If the student was employed, list below the names of all the student’s employers, the amount earned from each employer in 2015, and attach copies of all 2015 W-2 forms issued by the employer(s). Employer Name John’s Auto Body Shop (example) 2015 Amount Earned $2,000 W-2 Form Attached (Y/N) Yes _____________________________ Student’s Last Name _________________________ ____ Student’s First Name M.I. __________________ SSN or Student ID# Parent(s)’ Tax Information: Did the student’s parent(s) file taxes for the 2015 year? Yes No If no, skip to the TAX NON-FILER section below. (Do not fill out the tax filer section). If yes, please continue to the TAX FILER section. (Do not fill out the tax non-filer section). ***If the parent(s) worked in 2015, all W2 forms must be attached*** TAX FILER: In order to verify the parent(s)’ tax information, one of the following steps must be completed: (Please refer to the detailed directions at the end of this form). The student has used or is going to use the IRS Data Retrieval Tool on their FAFSA for their parent(s)’ tax information. The student has submitted or is going to submit their parent(s)’ IRS Tax Return Transcript(s) to the Financial Aid Office. NOTE: If the student’s parent(s) filed separately, they will need to obtain tax return transcripts for both individuals. For electronic filers, the IRS Data Retrieval Tool and the IRS Tax Return Transcript should be available 2-3 weeks after their 2015 IRS Income Tax Return has been accepted by the IRS. For paper filers, they are available after 8-11 weeks. TAX NON-FILER: The student’s parent(s) were not employed and had no income earned from work in 2015. The student’s parent(s) were employed and had income earned from work in 2015. NOTE: If the student’s parent(s) were employed, list below the names of all the parent(s)’ employers, the amount earned from each employer in 2015, and attach copies of all 2015 W-2 forms issued by the employer(s). Employer Name John’s Auto Body Shop (example) 2015 Amount Earned $2,000 W-2 Form Attached (Y/N) Yes _____________________________ Student’s Last Name _________________________ ____ Student’s First Name M.I. __________________ SSN or Student ID# Other Untaxed Income: The information below applies to the student and the student’s parent(s) whose information is on the FAFSA. If any item does not apply, enter “N/A” for Not Applicable where a response is requested, or enter “0” in an area where an amount is requested. To determine the correct annual amount for each item: if you paid or received the same dollar amount every month in 2015, multiply that amount by the number of months in 2015 you paid or received it. If you did not pay or receive the same amount each month in 2015, add together the amounts each month. Payments to tax-deferred pension and retirement savings List any payments (direct or withheld from earnings) to tax-deferred pension and retirement savings plans (Ex: 401(k) or 403(b) plans), including, but not limited to, amounts reported on W-2 forms in boxes 12a through 12d with codes D, E, F, G, H, and S. Name of Person Who Made the Payment Total Amount Paid in 2015 Child support received List the actual amount of any child support received in 2015 for the children in your household. Do not include foster care payments, adoption payments, or any amount that was court-ordered but not actually paid. Name of Adult Who Name of Child For Whom Amount of Child Support Received the Support Support Was Received Received in 2015 Housing, food, and other living allowances paid to members of the military, clergy, and others Include cash payments and/or the cash value of benefits received. Do not include the value of on-base military housing or the value or a basic military allowance for housing. Amount of Benefit Received Name of Recipient Type of Benefit Received in 2015 Veteran’s non-education benefits List the total amount of veteran’s non-education benefits received in 2015. Include Disability, Death Pension, Dependency and Indemnity Compensation (DIC), and/or VA Educational Work-Study allowances. Do not include Federal veteran’s educational benefits such as: Montgomery GI Bill, Dependents Education Assistance Program, VEAP Benefits, Post-9/11 GI Bill. Type of Veteran’s Amount of Benefit Received Name of Recipient Non-education Benefit in 2015 _____________________________ Student’s Last Name _________________________ ____ Student’s First Name M.I. __________________ SSN or Student ID# Other untaxed income List the amount of other untaxed income not reported and not excluded elsewhere on this form. Include untaxed income such as workers’ compensation, disability, Black Lung Benefits, untaxed portions of health savings accounts from IRS Form 1040 Line 25, Railroad Retirement Benefits, etc. Do not include items reported or excluded in the before mentioned items. In addition, do not include student aid, extended foster care benefits, Earned Income Credit, Additional Child Tax Credit, Temporary Assistance to Needy Families (TANF), untaxed Social Security Benefits, Supplemental Security Income (SSI), Workforce Investment Act (WIA) educational benefits, combat pay, on-base military housing or housing allowance, benefits from flexible spending arrangements (Ex: cafeteria plans), foreign income exclusion, or credit for Federal tax on special fuels. Name of Recipient Type of Other Untaxed Income Amount of Other Untaxed Income Received in 2015 Money received or paid on the student’s behalf List any money received or paid on the student’s behalf (Ex: payment of student’s bills) and not reported elsewhere on this form. Enter the total amount of cash support the student received in 2015. Include support from a parent whose information was not reported on the student’s FAFSA, but do not include support from a parent whose information was reported. Purpose (Cash, Rent, Books) Amount Received in 2015 Source (Who Paid) Additional Information So that we can fully understand the student’s family’s financial situation, please provide below information about any other resources, benefits, and other amounts received by the student and any members of the student’s household. Name of Recipient Type of Financial Support Amount Received in 2015 Comments: __________________________________________________________________________________________ __________________________________________________________________________________________ __________________________________________________________________________________________ __________________________________________________________________________________________ __________________________________________________________________________________________ __________________________________________________________________________________________ Certification and Signatures: Each person signing below certifies that all of the Information reported is complete and correct. ________________________________________ Student’s Signature ______________ Date ________________________________________ Parent’s Signature ______________ Date WARNING: If you purposely give false or misleading information, you may be fined, be sentenced to jail, or both. Certification READ, SIGN, AND DATE If you are the student, by signing this application you certify that you (1) will use federal and/or state student financial aid only to pay the cost of attending an institution of higher education, (2) are not in default on a federal student loan or have made satisfactory arrangements to repay it, (3) do not owe money back on a federal student grant or have made satisfactory arrangements to repay it, (4) will notify your college if you default on a federal student loan, and (5) will not receive a Federal Pell Grant from more than one college for the same period of time. If you are the parent or the student, by signing this application you agree, if asked, to provide information that will verify the accuracy of your completed form. This information may include U.S. or state income tax forms that you filed or required to file. Also, you certify that you understand that the Secretary of Education has the authority to verify information reported on this application with the Internal Revenue Service and other federal agencies. If you sign any document related to the federal student aid programs electronically using a Personal Identification Number (PIN), you certify that you are the person identified by the PIN and have not disclosed that PIN to anyone else. If you purposely give false or misleading information, you may be fined $20,000, sent to prison, or both. Everyone whose information is given on this form should sign below. The student (and at least one parent, if parent information is given) MUST sign below. Student________________________________________________ Date: ____________ Parent_________________________________________________Date:_____________ Student’s FSCC ID# or SSN ________________________________ This form must be submitted to the Financial Aid Office by the following dates: Fall 2016 – November 18th, 2016 Spring 2017 – April 21st, 2017 Summer 2017 – June 5th, 2017 (4 week session) and July 3rd, 2017 (8 week session) Failure to meet these deadlines may result in no aid awarded for that semester HOW TO USE THE DATA RETRIEVAL TOOL ON YOUR FAFSA 1. Log into your FAFSA at www.fafsa.ed.gov. 2. When you come to the tab for Financial Information, select Already Completed your IRS Income Tax Return. 3. On the next question, select the appropriate tax filing status. Ex: Single, Married-Filed Jointly. 4. You may be able to use the Data Retrieval Tool if you answer No to all the questions asked – Did you file an amended tax return? Did you file a foreign tax return? Did you file in the last three weeks? 5. If you answered no to the above questions, click on Link to IRS. 6. Select OK when it asks if you want to leave FAFSA on the Web. 7. On the IRS site, you will have to provide your filing status, name and address exactly as it was listed on your tax return. (If you are having trouble matching your address, go to www.usps.com, use the 8. Look Up a Zip Code option, type your street address, city, state and zip and hit FIND. Use the “standard” address that is displayed). Click on Submit and it will show you the information that will be transferred. (If it did not work than the address you provided is probably incorrect according to the IRS’ records. You may try again but you will be locked out after three failed attempts). 9. Check the Transfer my Tax Information into the FAFSA box and then click the Transfer Now button. 10. Once the information has been transferred, do not make any changes! 11. Enter the information for your wages and click Next. 12. Again, any information transferred by the IRS should not be changed. If selected for verification, this will delay your financial aid being processed. 13. Finish filling out your FAFSA, sign with your PIN, and submit. You may not be eligible to use the IRS Data Retrieval if: You filed your tax return within the past two weeks You filed an amended tax return Your filing status is “Married Filing Separately” You filing status is “Head of Household” and you actually are married (but not separated or divorced). If you are unable to transfer your tax information using the Data Retrieval Tool, you will need to use copies of your tax returns to fill out the FAFSA. If you need the Data Retrieval Tool completed for verification purposes, you will need to request a tax return transcript. If you are still having trouble with using the Data Retrieval, call the FAFSA hotline at 1-800-433-3243. REQUEST TAX RETURN TRANSCRIPT TO BE MAILED 1. Go to www.irs.gov. 2. Under Tools, click on Get a Tax Transcript. 3. Click on Get Transcript by Mail, and then Ok. 4. Type in the required information and then click on Continue. (You must enter the information listed under the primary taxpayer). 5. Under Type of Transcript, select Return Transcript. 6. Under Tax Year, select the correct tax year. If you are using this transcript for your 2016-2017 FAFSA, you will need to select the 2015 tax year. 7. Click on Continue. 8. A Tax Return Transcript will be mailed to the address you provided in approximately 5-10 days. Submit to the Financial Aid Office as soon as possible.