Problems for the sixth seminar

advertisement

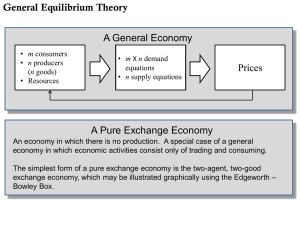

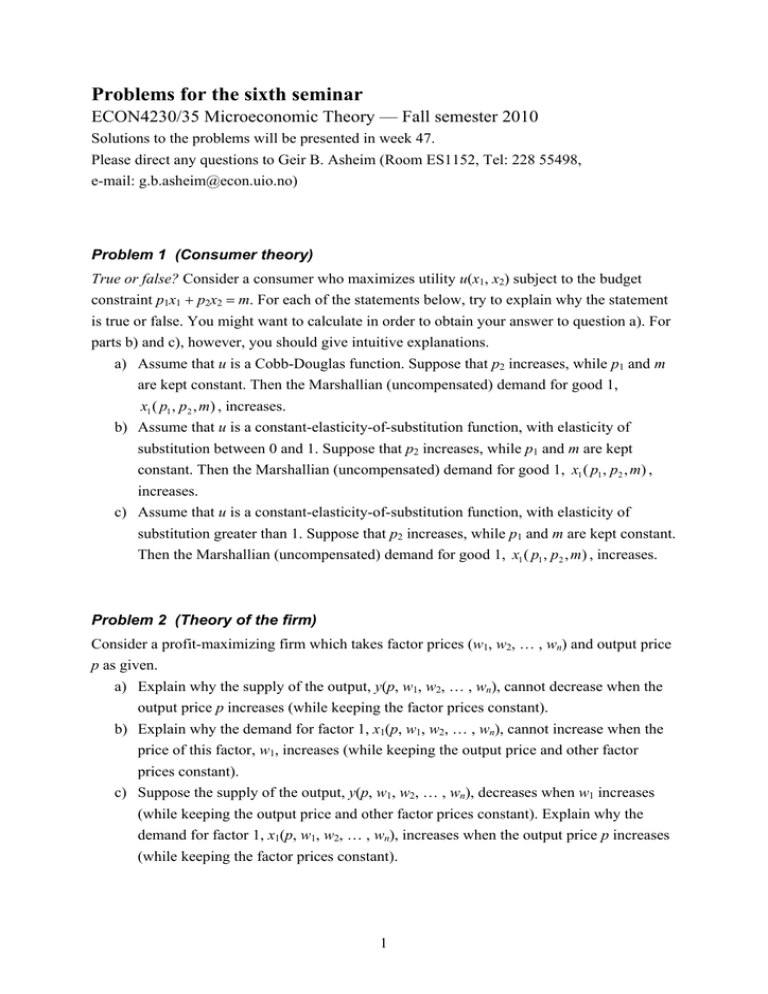

Problems for the sixth seminar ECON4230/35 Microeconomic Theory — Fall semester 2010 Solutions to the problems will be presented in week 47. Please direct any questions to Geir B. Asheim (Room ES1152, Tel: 228 55498, e-mail: g.b.asheim@econ.uio.no) Problem 1 (Consumer theory) True or false? Consider a consumer who maximizes utility u(x1, x2) subject to the budget constraint p1x1 p2x2 m. For each of the statements below, try to explain why the statement is true or false. You might want to calculate in order to obtain your answer to question a). For parts b) and c), however, you should give intuitive explanations. a) Assume that u is a Cobb-Douglas function. Suppose that p2 increases, while p1 and m are kept constant. Then the Marshallian (uncompensated) demand for good 1, x1 ( p1 , p2 , m) , increases. b) Assume that u is a constant-elasticity-of-substitution function, with elasticity of substitution between 0 and 1. Suppose that p2 increases, while p1 and m are kept constant. Then the Marshallian (uncompensated) demand for good 1, x1 ( p1 , p2 , m) , increases. c) Assume that u is a constant-elasticity-of-substitution function, with elasticity of substitution greater than 1. Suppose that p2 increases, while p1 and m are kept constant. Then the Marshallian (uncompensated) demand for good 1, x1 ( p1 , p2 , m) , increases. Problem 2 (Theory of the firm) Consider a profit-maximizing firm which takes factor prices (w1, w2, … , wn) and output price p as given. a) Explain why the supply of the output, y(p, w1, w2, … , wn), cannot decrease when the output price p increases (while keeping the factor prices constant). b) Explain why the demand for factor 1, x1(p, w1, w2, … , wn), cannot increase when the price of this factor, w1, increases (while keeping the output price and other factor prices constant). c) Suppose the supply of the output, y(p, w1, w2, … , wn), decreases when w1 increases (while keeping the output price and other factor prices constant). Explain why the demand for factor 1, x1(p, w1, w2, … , wn), increases when the output price p increases (while keeping the factor prices constant). 1 Problem 3 (General equilibrium analysis) Consider a pure exchange economy with two consumers, A and B, and two goods. a) What is a Walrasian equilibrium? b) Suppose that (p, x) (( p1 , p2 ), ( x1A , x A2 ), ( x1B , xB2 )) is a Walrasian equilibrium. Explain why it is not feasible to make both consumers better off. For parts c) and d), consider the exchange economy described by the following Edgeworth box. B Indifference curve for A: x Indifference curves for B: Α c) Suppose that vector of initial endowments is equal to (( 1A , A2 ), ( 1B , B2 )) ((0, 1), (1, 0)) . Explain why there may not exist a Walrasian equilibrium in this situation. d) The allocation x (( x1A , x A2 ), ( x1B , xB2 )) has the property that it is not feasible to make one consumer better off without making the other worse off. Explain why this allocation cannot be realized as a Walrasian equilibrium even after a redistribution of the initial endowments. Problem 4 (Partial equilibrium analysis) A monopolist has the cost function C ( y ) 100 6 y 12 y 2 . Assume that there are two markets. In market 1, the demand function is given by 2 x1 24 14 p1 . In market 2, the demand function is given by x2 84 34 p2 . a) Assume first that the monopolist has only access to market 1, so that y x1 . Calculate the output-price combination which maximizes profits. b) Assume next that the monopolist has access to both markets, so that y x1 x2 . Calculate the prices that will be set in the two markets and the quantities supplied to the two markets. c) Now suppose that the firm still has access to both markets, but is prevented from discriminating between them. What will be the result? Problem 5 (Partial equilibrium analysis) Consider a Cournot market with identical firms each having the cost function C(yi) 120 10 yi, and where the inverse demand function is p 70 – i yi. (a) Assume first that the fixed cost of 120 cannot be avoided by not producing. What will be the equilibrium price, market output, and firm profits with 2, 3, 4, and 5 firms? (b) Assume next that there is free entry and exit in the long run; in particular that the fixed cost of 120 is incurred if and only if a firm is active in the market. What will be the long-run equilibrium number of firms? 3