ECON 3200 / 4200 Seminars, Fall term 2011

advertisement

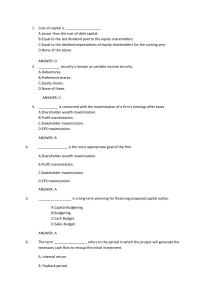

ECON 3200 / 4200 Seminars, Fall term 2011 Problems to be discussed at the second seminar I Cowell problem 2.13 (page 48 - 49) In question 6, assume that the yield of breed F is (60,60). II Cowell problem 3.1 (page 65) III (This is a follow-up of the Cobb-Douglas exercise, 2.4, from the first week. We are now not interested in effects of changes in the factor prices. Thus we can simplify the cost function, and specify only output as its argument.) Consider a firm producing a quantity q with the cost function C ( q ) = kq a , where k and a are positive constants. The product price is p. The firm wants as large profits as possible. In the four different cases below you are asked to study this maximization problem. Remember to check both first and second order conditions. Hint: Start without specifying a numerical value for a, and solve first the monopoly problem without specifying the demand function. Find the first and second order conditions for profit maximization. Then cases (a) – (d) come out as special cases. (a) What can you tell about the solution to the firm's maximization problem under competitive conditions when a = 4/3? (b) What can you tell about the solution to the firm's maximization problem under competitive conditions when a = 2/3? For the parts (c) and (d) you shall assume that the firm is a monopoly, and the demand is − 1 given by p ( q ) = q 2 . (c) What can you tell about the solution to the monopoly's maximization problem when a = 4/3? (d) What can you tell about the solution to the monopoly's maximization problem when a = 2/3? (e) How will you explain the basic difference between the answers to (b) and (d)?