Exchange Bulletin January 28, 2005 ...

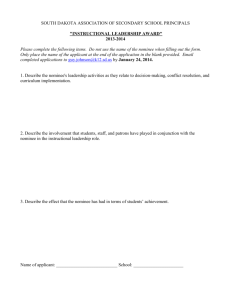

advertisement

January 28, 2005 Exchange Bulletin Volume 33, Number 4 The Constitution and Rules of the Chicago Options Exchange, Incorporated (“Exchange”), in certain specific instances, require the Exchange to provide notice to the Exchange membership. To satisfy this requirement, a complimentary copy of the Exchange Bulletin, including the Regulatory Bulletin, is delivered to all effective members on a weekly basis. CBOE members are encouraged to receive the Exchange and Regulatory Bulletin and Information Circulars via e-mail. E-mail subscriptions may be obtained by submitting your name, firm, mailing address, e-mail address, and phone number, to members@cboe.com, or, by contacting the Membership Department by phone, at 312-786-7449. There is no charge for e-mail delivery of the Exchange and Regulatory Bulletin or for Information Circulars. If you do sign up for e-mail delivery, please remember to inform the Membership Department of e-mail address changes. Additional subscriptions for hard copy delivery may be obtained by submitting your name, firm, mailing address, e-mail address and telephone number to: Chicago Board Options Exchange, Accounting Department, 400 South LaSalle, Chicago, Illinois 60605, Attention: Bulletin Subscriptions. The cost of an annual subscription (July 1 through June 30) is $200.00 ($100.00 after January 1), payable in advance. The Exchange reserves the right to limit subscriptions by non-members. For up-to-date Seat Market Quotes, refer to CBOE.com and click “Seat Market Information” under the “About CBOE” tab. For access to the CBOE Member Web Site, please also notify the Membership Department using the contact information above. Copyright © 2004 Chicago Board Options Exchange, Incorporated SEAT MARKET QUOTES AS OF FRIDAY, JANUARY 28, 2005 CLASS CBOE/FULL CBOT/FULL BID $300,000.00 $1,050,000.00 OFFER $320,000.00 $1,200,000.00 LAST SALE AMOUNT $300,000.00 $1,075,000.00 LAST SALE DATE January 27, 2005 January 27, 2005 MEMBERSHIP SALES AND TRANSFERS From X-Change Financial Access, LLC To Citadel Derivatives Group, LLC Price/Transfer $300,000.00 Date 01/27/05 Page 2 January 28, 2005 Volume 33, Number 3 Chicago Board Options Exchange MEMBERSHIP INFORMATION FOR 1/20/05 THROUGH 1/26/05 MEMBERSHIPAPPLICATIONS RECEIVED FOR WHICH A POSTING PERIOD IS REQUIRED MEMBERSHIP LEASES New Leases Effective Date Lessor: Loren H. Newman Lessee: Cutler Group, LP Robert J. Leone, NOMINEE Rate: 0.875% Term: Monthly 1/21/05 1/20/05 1/20/05 Lessor: S & S Options Lessee: Citigroup Derivatives Markets Inc. Rate: 0.875% Term: Monthly 1/24/05 George M. Fushi, Nominee Blue Capital Group LLC 935 Linden Lane Glenview, IL 60025 1/24/05 Yonaton Cohen, Nominee Andrie Trading LLC 1128 W. Armitage, #3F Chicago, IL 60614 1/24/05 Lessor: KISAY 1, LP Lessee: Citigroup Derivatives Markets Inc. Rate: 0.875% Term: Monthly Lessor: Essex Radez, LLC Lessee: Citigroup Derivatives Markets Inc. Rate: 0.875% Term: Monthly 1/24/05 Jason Chippas, Nominee Israel A. Englander & Co., Inc. 2420 W. Farragut, Apt. 6 Chicago, IL 60625 1/24/05 Lessor: Steven Hirschtritt Lessee: Citigroup Derivatives Markets Inc. Rate: 0.875% Term: Monthly 1/24/05 Benjamin H. Szelag, Nominee Andrie Trading LLC 2614 N. Marshfield, Apt. C Chicago, IL 60614 1/24/05 Lessor: James Richardson Lessee: Ronin Capital, LLC Terrence J. Moran, NOMINEE Rate: 0.8920% Term: Monthly 1/24/05 Anthony Hozian, Nominee Right Side Trading, LP 2934 Lakewood Avenue Chicago, IL 60657 1/25/05 Lessor: Marshall C. Spiegel Lessee: Hurricane Capital, LLC Stephen K. Fox, NOMINEE Rate: 0.875% Term: One Day 1/26/05 Andrew B. Levin, Nominee CTC LLC 421 W. Belden Ave. #3-2 Chicago, IL 60614 1/25/05 Lessor: OAKPORTE, LP Lessee: Northern Access LLC Timothy W. Scharf, NOMINEE Rate: 0.75% Term: Monthly 1/26/05 Ryan P. Price, Nominee Consolidated Trading, LLC 3014 N. Racine - #2 Chicago, IL 60657 1/26/05 Terminated Leases Termination Date Amar Bagwe, Nominee Bear Wagner Specialists LLC 212 W. Washington, Unit 1107 Chicago, IL 60606 1/26/05 Member Organization Applicants Date Posted Lighthouse Trading, LLC Yaron Kim, Nominee 435 W. Erie St., Apt. 2003 Chicago, IL 60610 Yaron Kim – Managing Member 1/21/05 Individual Membership Applicants Date Posted Hugh J. Flannery, Nominee Morgan Stanley & Co., Inc. 742 Bonnie Brae Place River Forest, IL 60305 Lessor: Loren H. Newman 1/21/05 Lessee: Susquehanna Investment Group Christopher G. Larkin (LKN), NOMINEE Thor Trading, LLC 1/26/05 Mark Thorsen, Nominee 537 W. Fullerton Pkwy. Chicago, IL 60614 Mark M. Thorsen – Managing Member Lessor: Kevin J. Hincks Lessee: SLK-Hull Derivatives LLC 1/24/05 Lessor: OAKPORTE, LP Lessee: Futrex Trading LLC Timothy W. Scharf (TSF), NOMINEE 1/26/05 MEMBERSHIP TERMINATIONS Individual Members CBT Registered For: Termination Date Christopher Borgmeyer (CBG) Klr Trade Corp Inc. 440 S. LaSalle St., Ste. 625 Chicago, IL 60605 1/24/05 Andrew M. Sullivan (DRU) AB Financial LLC 440 S. LaSalle St., Ste. 3100 Chicago, IL 60605 1/26/05 Page 3 January 28, 2005 Volume 33, Number 3 Nominee(s) / Inactive Nominee(s): Termination Date Stephen C. Pechloff (PEC) Citadel Derivatives Group LLC 141 W. Jackson, Ste. 500 Chicago, IL 60604 1/20/05 James M. Jacobsen (JAM) PTR, Incorporated 131 S. Dearborn, 37th Fl. Chicago, IL 60603 1/20/05 Carlos Saez (SEZ) TD Options, LLC 230 S. LaSalle St., Ste. 688 Chicago, IL 60604 1/20/05 Richard C. Deogracias (DEO) TradeLink LLC 2351 W. Moffat Chicago, IL 60647 1/25/05 Brian Huddleston (HUD) Everest Trading, LLC 440 S. LaSalle St., Ste. 3100 Chicago, IL 60605 1/26/05 Scott P. Nicholson (SPN) Third Millennium Trading, LLC 440 S. LaSalle St., Ste. 3100 Chicago, IL 60605 1/26/05 Matthew H. Bentley (MHB) Everest Trading, LLC 440 S. LaSalle St., Ste. 3100 Chicago, IL 60605 1/26/05 Member Organizations CBT Registered For: Termination Date KLR Trade Corp Inc. 440 S. LaSalle St., Ste. 1600 Chicago, IL 60605 1/24/05 EFFECTIVE MEMBERSHIPS Individual Members CBT Registered For: Effective Date Ryan Michael Sellers (RZA) 1/20/05 Saen Options USA Inc. 440 S. LaSalle St., Suite 1506 Chicago, IL 60605 Type of Business to be Conducted: Market Maker Nominee(s) / Inactive Nominee(s): Chicago Board Options Exchange Effective Date Stephen K. Fox (FOX) 1/26/05 Hurricane Capital, LLC 5 Greenwood Drive New City, NY 10956 Type of Business to be Conducted: Market Maker JOINT ACCOUNTS New Participants Acronym Effective Date Ryan Michael Sellers QOS 1/20/05 Luke C. Mraz QHS 1/21/05 Luke C. Mraz QRV 1/21/05 Sestino Milito QAZ 1/26/05 Timothy W. Scharf QLN 1/26/05 Terminated Participants Acronym Termination Date Stephen C. Pechloff CIT 1/20/05 Carlos Saez QBB 1/20/05 Carlos Saez QRX 1/20/05 Carlos Saez QWJ 1/20/05 Richard C. Deogracias QDO 1/25/05 Brian Huddleston QAZ 1/26/05 Timothy W. Scharf QAG 1/26/05 Timothy W. Scharf QED 1/26/05 Andrew M. Sullivan QBH 1/26/05 Andrew M. Sullivan QNI 1/26/05 Scott P. Nicholson QMJ 1/26/05 Matthew H. Bentley QAZ 1/26/05 Terminated Accounts Acronym Termination Date Chad R. Gramann QJK 1/21/05 John S. Stafford Jr. QJK 1/21/05 CHANGES IN MEMBERSHIP STATUS Individual Members Effective Date Effective Date Luke C. Mraz (LCM) 1/21/05 Ronin Capital, LLC 230 S. LaSalle St., Suite 400 Chicago, IL 60604 Type of Business to be Conducted: Market Maker Robert J. Leone (RBY) 1/21/05 440 S. LaSalle St., Suite 1124 Chicago, IL 60605 Type of Business to be Conducted: Market Maker Sestino Milito (SSM) 1/26/05 Everest Trading, LLC 440 S. LaSalle St., Suite 3100 Chicago, IL 60605 Type of Business to be Conducted: Market Maker Kevin J. Hincks 1/24/05 From: Lessor To: CBOE Registered For BBS Partners LLC; Market Maker Timothy W. Scharf 1/26/05 From: Nominee For Futrex Trading LLC; Market Maker To: Nominee For Northern Access LLC; Market Maker Member Organizations Effective Date BBS Partners LLC 1/24/05 From: Owner/ Lessee; Associated with a Market Maker/ Floor Broker To: Owner/ Lessee/ Member Organization Affiliated with a CBOE Registered For; Associated with a Market Maker/Floor Broker Page 4 January 28, 2005 Volume 33, Number 3 Chicago Board Options Exchange MEMBER NAME CHANGES MEMBER ADDRESS CHANGES Individual Members Effective Date Member Organizations Sallie Leaf 16 Dartmouth Drive Rancho Mirage, CA 92270 1/21/05 From: To: Effective Date Fleet Securities, Inc., 1/21/05 DBA US Clearing Corp. ADP Clearing & Outsourcing Services, Inc. RESEARCH CIRCULARS The following Research Circulars were distributed between January 20 and January 27, 2005. If you wish to read the entire document, please refer to the CBOE website at www.cboe.com and click on the “Trading Tools” Tab. New listings and series information is also available in the Trading Tools section of the website. For questions regarding information discussed in a Research Circular, please call The Options Clearing Corporation at 1-888-OPTIONS. Research Circular #RS05-046 January 20, 2005 Stelmar Shipping Ltd. (“SJH”) Merger COMPLETED with Overseas Shipholding Group, Inc. (“OSG”) Research Circular #RS05-047 January 20, 2005 Bayer AG (“BAY”) Cash Distribution in Lieu of Ordinary Shares of Laxness AG - Form of Election Ex-Distribution Date: To Be Announced Research Circular #RS05-048 January 21, 2005 Frontline Ltd. (“FRO & adj. JVU/FXW/FMZ”) Determination of Cash-in-Lieu Amounts Research Circular #RS05-050 January 24, 2005 *****REVISION*****REVISION*****REVISION***** Cendant Corporation (“CD/WLD/VUC”) Distribution of Shares of PHH Corporation (“PHH”) Ex-Distribution Date: February 1, 2005 Research Circular #RS05-057 January 27, 2005 MICROS Systems, Inc. (“MCRS/MFK”) 2-for-1 Stock Split Ex-Distribution Date: February 2, 2005 Research Circular #RS05-058 January 27, 2005 Embarcadero Technologies, Inc. (“EMBTE/MBQ”) Underlying Symbol Change to “EMBT” Effective Date: January 27, 2005 Research Circular #RS05-059 January 27, 2005 TALX Corporation (“TALX/TUB”) 3-for-2 Stock Split Ex-Distribution Date: February 18, 2005 February 2, 2005 Volume RB16, Number 5 Regulatory Bulletin The Constitution and Rules of the Chicago Board Options Exchange, Incorporated (“Exchange”), in certain specific instances, require the Exchange to provide notice to the membership. The weekly Regulatory Bulletin is delivered to all effective members to satisfy this requirement. Copyright © 2004 Chicago Board Options Exchange, Incorporated Regulatory Circulars Regulatory Circular RG05-12 To: Members and Member Firms From: SPX Floor Procedure Committee Options on SPDRs Floor Procedure Committee Date: January 24, 2005 Re: SPX-SPDR option spread orders The SPX Floor Procedure Committee and the Options on SPDRs Floor Procedure Committee have determined to expand the types of spread orders that are permitted under CBOE Rule 24.19 to include any combination of SPX and SPDR options. The procedures to be followed in representing and filling an SPX-SPDR option spread order are the same procedures as those that apply to representing and filling an OEX-SPX spread order. SPX-SPDR option spread orders may be represented in the SPX and SPDR option trading crowds. Any questions concerning the above may be directed to Craig Johnson, Trading Floor Liaison at extension 7939, or to David Doherty, Legal Division at extension 7466. APPROVED RULE CHANGES The Securities and Exchange Commission (“SEC”) has approved the following change(s) to Exchange Rules pursuant to Section 19(b) of the Securities Exchange Act of 1934, as amended (“the Act”). Copies are available from the Legal Division. The effective date of the rule change is the date of approval unless otherwise noted. SR-CBOE-2005-06 Increased Position and Exercise Limits for SPDR Options On January 14, 2005, the SEC approved Rule Change File No. SR-CBOE-2005-06, which filing amends Exchange Rule 4.11 to increase position and exercise limits for options on SPDRs (Securities Exchange Act Release No. 51041, 70 FR 3408 (January 24, 2005)). Any questions regarding the rule change may be directed to Jaime Galvan, Legal Division, at 312-786-7058. The text of the amended rules is set forth below. New language is italicized. Rule 4.11 Position Limits **** …Interpretations and Policies: Rule Changes, Interpretations and Policies continued SR-CBOE-2005-06 continued .01 - .06 No change. .07 The position limits under Rule 4.11 applicable to options on shares or other securities that represent interests in registered investment companies (or series thereof) organized as open-end management investment companies, unit investment trusts or similar entities that satisfy the criteria set forth in Interpretation and Policy .06 under Rule 5.3 shall be the same as the position limits applicable to equity options under Rule 4.11 and Interpretations and Policies thereunder. The position limits under Rule 4.11 applicable to options on the Nasdaq-100 Index Tracking StockSM ( “QQQ”), the Standard and Poor’s Depositary Receipts Trust (SPDR), and the DIAMONDS Trust (DIA) shall be 300,000 option contracts. SR-CBOE-2004-91 Market-Maker Access to Automatic Execution On January 12, 2005, the SEC approved Rule Change File No. SR-CBOE-2004-91, which filing extends the pilot program in Exchange Rule 6.13 relating to Market-Maker access to the Exchange’s automatic execution system, and eliminates its rule prohibiting the electronic generation of orders (Securities Exchange Act Release No. 51030, 70 FR 3404 (January 24, 2005)). Any questions regarding the rule change may be directed to Steve Youhn, Legal Division, at 312-786-7416. The text of the amended rules is set forth below. New language is italicized. Rule 6.8A. Reserved Rule 6.13: CBOE Hybrid System’s Automatic Execution Feature (a) No change (b) Automatic Execution (i) * * * * * (A) - (B) No change (C) Access: (i) – (ii) No change (iii) 15-Second Limitation: With respect to orders eligible for submission pursuant to paragraph (b)(i)(C)(ii), members shall neither enter nor permit the entry of multiple orders on the same side of the market in an option class within any 15-second period for an account or accounts of the same beneficial owner. The appropriate FPC may shorten the duration of this 15-second period by providing notice to the membership via a Regulatory Circular that is issued at least one day prior to implementation. The effectiveness of this rule shall terminate on October 12, 2005. ***** (ii) - (iv) No change (c) * * * * (i) RB2 No change February 2, 2005, Volume RB16, Number 5 Rule Changes, Interpretations and Policies continued SR-CBOE-2004-91 continued (ii) ***** (A) No change (B) Effecting transactions that constitute manipulation as provided in Rule 4.7 and Exchange Act Rule 10b-5. (d) – (e) No change PROPOSED RULE CHANGES Pursuant to Section 19(b)(1) of the Securities Exchange Act of 1934, as amended (“the Act”), and Rule 19b-4 thereunder, the Exchange has filed the following proposed rule changes with the Securities and Exchange Commission (“SEC”). Copies of the rule change filings are available from the Legal Division. Members may submit written comments to the Legal Division. The effective date of a proposed rule change will be the date of approval by the SEC, unless otherwise noted. SR-CBOE-2005-11 Listing Standards for ETFs On January 24, 2005, the Exchange filed Rule Change File No. SR-CBOE-2005-11, which filing proposes to revise the Exchange’s current listing standards for exchange traded funds, or Units as currently described in Exchange rules. Specifically, this rule change proposes to expand the range of exchange traded funds (“ETFs”) on which the Exchange may list options, including ETFs that represent interests in non-securities assets. Any questions regarding the proposed rule change may be directed to Jim Flynn, Legal Division, at 312-7867070. The text of the proposed rule amendments is set forth below. Proposed new language is underlined. Proposed deleted language is [stricken out]. A copy of the filing is available from the Legal Division. Rule 5.1 – 5.2 No change. Rule 5.3 - Criteria for Underlying Securities (a) - (b) No change. …Interpretations and Policies: .01-.05 No change. .06 Securities deemed appropriate for options trading shall include shares or other securities (“Units” or “Fund Shares”) that (i) represent interests in trusts, [registered] investment companies (or series thereof) [organized as open-end management investment companies, unit investment trusts] or [similar] other entities that hold one or more investment assets consisting of securities, futures, options on futures, swaps, forward contracts, commodities, or indexes or portfolios of the foregoing, or that hold interests in entities that themselves hold such investment assets, and (ii) are [principally] publicly traded on a national securities exchange or through the facilities of a national securities association and are reported as “national market” securities[, and that hold portfolios of securities comprising or otherwise based on or representing investments in indexes or portfolios of securities (or that hold securities in one or more other registered investment companies that themselves hold such portfolios of securities)]; provided that all of the following conditions are met: February 2, 2005, Volume RB16, Number 5 RB3 Rule Changes, Interpretations and Policies continued SR-CBOE-2005-11 continued (A) any non-U.S. component securities of [the]an index or portfolio of securities on which the Fund Shares[Units] are based that are not subject to comprehensive surveillance agreements do not in the aggregate represent more than 50% of the weight of the index or portfolio; (B) component securities of an index or portfolio of securities on which Fund Shares are based for which the primary market is in any one country that is not subject to a comprehensive surveillance agreement do not represent 20% or more of the weight of the index; (C) component securities of an index or portfolio of securities on which Fund Shares are based for which the primary market is in any two countries that are not subject to comprehensive surveillance agreements do not represent 33% or more of the weight of the index; and (D) either (x) [the Units]Fund Shares meet the criteria and guidelines set forth in Rule 5.3 and Interpretation and Policy .01 thereunder, or (y) [the Units] Fund Shares are available for creation or redemption each business day from or through the issuing trust, investment company or other entity in cash or in kind at a price related to net asset value, and the issuer [investment company] is obligated to issue [Units]Fund Shares in a specified aggregate number even if some or all of the [securities]investment assets required to be deposited have not been received by the issuer [investment company], subject to the condition that the person obligated to deposit the [securities]investment assets has undertaken to deliver them [securities] as soon as possible and such undertaking is secured by the delivery and maintenance of collateral consisting of [case]cash or cash equivalents satisfactory to the issuer of Fund Shares [investment company], all as described in the Fund Share [investment company] prospectus. .07-.09 No change. RB4 February 2, 2005, Volume RB16, Number 5