INFORMATIONAL MESSAGES & IMPROVED DECISIONS: THE CASE OF MEDICARE DRUG PLANS

advertisement

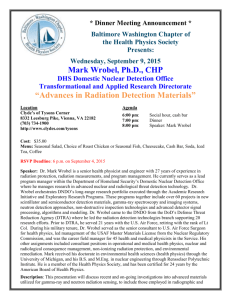

INFORMATIONAL MESSAGES & IMPROVED DECISIONS: THE CASE OF MEDICARE DRUG PLANS Marian V. Wrobel, Mathematica Policy Research Academy Health Annual Research Meeting June 29, 2009 Authors & Affiliations Jeffrey R. Kling, The Brookings Institution Sendhil Mullainathan, Harvard Eldar Shafir, Princeton Lee Vermeulen, University of Wisconsin Marian V. Wrobel, Mathematica Policy Research* – * Dr. Wrobel was at Harvard at the time most of this work was completed. Wrobel, 6/29/2009 2 Acknowledgements We gratefully acknowledge support from the John D. and Catherine T. MacArthur Foundation, the Charles Stuart Mott Foundation, the Robert Wood Johnson Foundation’s Changes in Health Care Financing and Organization Initiative, and the National Institute on Aging (P01 AG005842). We also thank CVS Caremark Corporation and Experion Systems (www.planprescriber.com) for sharing data. Wrobel, 6/29/2009 3 Introduction Medicare drug plans A smart but small intervention has big effect on choices – Lowers spending with no other adverse effects Randomized field experiment Wrobel, 6/29/2009 4 Choice among Public Services Interest in choice & competition for public benefits – Also schools, health insurances exhanges Rationale for choice – Tastes & circumstances differ – Choices lets people choose what they want – Private provision & competition yield efficiency and innovation Concerns about choice – People make dumb choices – Sometimes we wish to protect or influence them Wrobel, 6/29/2009 5 Approaches to Influencing Choices Laws & regulations – “You must eat your peas!” Financial incentives – “If you eat your peas, you can play on the computer.” Education – “Peas promote good health.” Architecture / environment – Peas are within easy reach & potato chips are far away. – Focus of our intervention Wrobel, 6/29/2009 6 Psychology of Choice Choice can be difficult – Proliferation of alternatives may be detrimental – Tendency to delay, pronounced among elderly Tendency to focus on “easy” information – Available, comparable, invariant – E.g. focus on premium not out-of-pocket costs Wrobel, 6/29/2009 7 Public Perception that Medicare Part D Confusing Wrobel, 6/29/2009 8 Medicare Part D Free-standing private drug plans – Voluntary, choice-based Typical senior chooses among ~ 54 plans Differ by: – – – – Premium, deductible, cost-sharing schedule Formulary Brand & financial stability of sponsor Etc. Plan difference interact with individual differences – Drugs & other Drugs are more standard / less personal than some other services Wrobel, 6/29/2009 9 Two Theories Perfect choice – Consumers take advantage of all information – Make choices that are right for them • Subject to available information, costs of finding it, costs of change Fragile choice – Consumers may make imperfect or fragile choices – Small changes in the environment may influence what they choose Different implications for policy Wrobel, 6/29/2009 10 Three Predictions of Fragile Choice If we carefully design an informational intervention – Present same information as Medicare – Use psychological principles known to promote action Then 1. Choices will change. 2. Predicted costs will be lower. 3. Effect will be concentrated in out-of-pocket costs not premiums No judgment about whether choices made better Wrobel, 6/29/2009 11 Study Concept Small intervention – Information from Medicare website • Not new / not hard to get • Tweak to promote action • Study focuses on costs because Medicare focuses on cost – No implication that cost is optimal focus. – No reduction in effort • Seniors still had to find Medicare phone number & make call to change plans Design = randomized experiment Wrobel, 6/29/2009 12 Methods Participants: patients of University hospital, over 65 – Enrolled in Part D Baseline interview, Fall of 2006 – Predicted drug utilization for 2007 Intervention letter, December 2006 • First follow-up, Spring 2007 – Whether switched plans, N=406 Second follow-up, Spring 2008 – Actual drug utilization in 2007 – Evaluation of own choices, N=306 Wrobel, 6/29/2009 13 Information Intervention Both groups: – Letter on university stationery – Standard introductory and concluding paragraphs – Brochure on using the Medicare website Comparison group: address of Medicare website only Wrobel, 6/29/2009 14 Intervention Group: Personalized Information Simple, personalized, comparative information – – – – Current plan and estimated annual cost Lowest cost plan and its estimated annual cost Potential savings from the lowest-cost plan Also, Plan Finder printout on all plans & website address Behaviorally sensitive / favor action – Challenge confirmation bias by showing available savings – Alternative default: the lowest cost plan – Deadline Wrobel, 6/29/2009 15 Distribution of Plan Costs Medications as of 2006 0-3 4-6 7-10 11+ Share of sample .36 .33 .20 .10 Least expensive plan $623 $1417 $2580 $3556 Median plan $1053 $2010 $3383 $4789 Average cost of plan selected $937 $1883 $3142 $4279 Letters showed substantial savings Seniors not choosing lowest cost plans. Many lower-priced options available. Wrobel, 6/29/2009 16 Prediction 1: Effect on Choices 28 percent of intervention group switched plans – vs. 17 percent of comparison group – Difference .12** – Regression adjusted .12** Wrobel, 6/29/2009 17 Prediction 2: Effect on Predicted Savings Predicted savings – Difference in cost between 2007 plan & 2006 plan • Zero if don’t change plans – Computed by the Medicare Plan Finder – Based on drug utilization collected at baseline Predicted savings (all) – – – – – Intervention: $132 Comparison $16 Difference $116** Regression-adjusted $104** Regression-adjusted ln (Y 07/Y 06)=.063** Wrobel, 6/29/2009 18 Prediction 3: Concentration of Effect in Out-ofPocket Spending (Not Premiums) Total savings: $104 – Decreases in premiums: $11 – Decreases in OOP: $92 Out-of-pocket costs as share of total – Costs in 2006 plan: 81% – Potential savings from changing to least expensive plan: 80% – Intervention effect: 91% Wrobel, 6/29/2009 19 Retrospective Evaluation of Choices Based on second follow-up survey (2008) Difference between intervention & comparison group – Realized savings (all) • Regression-adjusted $83** • Regression-adjusted ln (Y 07/Y 06)=.043** – Switch rates in open enrollment 2008: no difference – Plan ratings / satisfaction in 2007: no difference – Reported issues with access in 2007: no difference – Medicare quality ratings: no difference Wrobel, 6/29/2009 20 Summary Randomized experiment of information re Medicare drug plan choice – Switching increased by 11 percentage points – Savings of $83 / 4 percent Noteworthy that our small intervention had such a substantial impact – Consistent with fragile choices & role for information environment Wrobel, 6/29/2009 21 Policy Significance – Part D Additional efforts to distribute information can affect & potentially improve choices If goal is to help beneficiaries reduce costs – Publicize significant cost differences among plans – Emphasize importance of personalized cost estimates – Suggest ways to simplify the choice process – Make more pro-active efforts to distribute info Important to pay close attention to design of information market – Address some concerns about choices in this way Wrobel, 6/29/2009 22 Wider Significance Small, smart interventions can affect behavior in big ways – Opportunities to alter environment to promote smart choices Interventions which reflect back personalized health information in actionable manner have potential. Theories and models that rely exclusively on rational actors & costs may overlook key drivers on behavior and key levers/opportunities Wrobel, 6/29/2009 23 Thank you. Marian V. Wrobel, PhD Senior Researcher Mathematica Policy Research, Inc. 617-301-8971 mwrobel@mathematica-mpr.com http://mathematica-mpr.com Wrobel, 6/29/2009 24