Inside the Black Box Aspects of Actuarial Pricing End Game

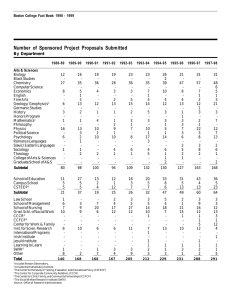

advertisement

Overview of the Black Box Inside the Black Box Aspects of Actuarial Pricing Underlying End Game Predictability and Adequacy for Risks Assumed Generation of Surplus AcademyHealth June 8, 2004 John C. Lloyd FSA, MAAA Reden & Anders, Ltd. Concepts - Commercial Insurers Elements Claims Costs: Estimation and Management Expenses Profit / Surplus © 2003 Reden & Anders, Ltd. Pricing and Surplus – Linkages Premium Investment Income Conceptual Model – Linkages Premium Balance Sheet Surplus Benefits Investment Viability • Predictability • Frequency Control • Network Negotiation Expenses 8- 15% • Recovery • Efficiency Benefits Solvency Expenses Taxes Benefits 75- 90% External Capital Expenses Service Improvement • Risk / Reward • Surplus Goals Profits -2 10% Profit Contribution to Surplus © 2003 Reden & Anders, Ltd. Reasons for Surplus © 2003 Reden & Anders, Ltd. Solvency Surplus Health RBC Solvency Market/Asset Liability Management Risk Minimum amounts of surplus to weather underwriting downturns Measured by RBC formula based on industry earnings simulations H1 Underwriting Risk Investment Multi-year capital investments in products and systems Amortize expense over several years H2 • Product Specific Risk • Managed Care Credit • Rate Guarantees Viability Lower premiums for competitive positioning Pure R&D Mergers, acquisitions, strategic initiatives H3 • Reinsurance • Capitation • Receivables Operational / Business Risk H4 • Admin Risk • Rapid Growth • ASO H0 • Interest in Affiliates © 2003 Reden & Anders, Ltd. Page <#> • Asset Devaluation • Asset Concentration Credit Risk H 0 + H12 + H 22 + H 32 + H 42 © 2003 Reden & Anders, Ltd. 1 Pricing - Framework One - Claims Costs – Pooling Concept Year Horizon Almost all employer group coverage focuses on a single year Prices are reset based on actual and anticipated cost Pooling Concept Average rate: low-cost individuals cover the catastrophic claim “ 80 / 20 Rule” bulk of the cost incurred by a few individuals Turnover Seldom the same individuals at risk or on claim Groups lapse, employees change Claimants recover, new accidents and illnesses are incurred Underwriting Used to create and maintain a broad pool of risks Can be used to position and entire block of business © 2003 Reden & Anders, Ltd. Claims Costs – Changes over Time © 2003 Reden & Anders, Ltd. Underwriting – Maintaining the Pool Contractual Aging Broader Coverage Provisions- Eligibility Rate for Deviation from Pool – Demographics Rate for Deviation from Pool – Industry Factors Historical Claims Analysis – Rx; Large Claims Employee Medical Underwriting Predictive Modeling Trend Balance between cost, market acceptance, practicality © 2003 Reden & Anders, Ltd. At Last – Formulas Pricing Approaches © 2003 Reden & Anders, Ltd. Experience Rating Premium = Experience Rating / Aggregate Claims Basis Historical Claims on Aggregate Year-of-Experience Basis [(Claims t- 1* Typical of Employer-Based Indemnity Group Insurance Claims: Service Component Basis Manual Rates (drawn from the broad pool of risk) Aggregate block of business claims, often throw out big claims and replace with pool charge Typical of MCO Selection - Credibility Blending Based Manual Rates or Prior Year Claims Credibility based on size of group, may be multiple years Anticipated Utilization by Group for Various Options Often Used in POS or Consumer-Driven Health Plans Adjustments to Resulting Claims Cost Benefit Changes Demographics © 2003 Reden & Anders, Ltd. Page <#> Historical Claims Cost Employer experience if available Pool Claims Utilization/1000 times Cost/Unit for Types of Service Cred) + (Pool Claims * (1-Cred)] * (1 + Trend) (1 - %Expense - % Profit) © 2003 Reden & Anders, Ltd. 2 Experience Rating Formula [(Claims tClaims: 1 Service Component Formula * Cred) + (Pool Claims * (1-Cred)] * (1 + Trend) (1 - %Expense - % Profit) Utilization of Services times Cost/Service Net Claims Cost is Trended and Expenses/Surplus Loaded Historical Claims Cost Cost Share: Adjustments Expenses Recovery of cost of operations Can be flat or % of premium – often converted to % anyway Profit / Surplus Trend Projection Flat Member Type of Type of Service Hospital Inpatient: Copay Coins % Util Medical Surgical Ungroupable Subtotal Non-MH/SA Mental Health Substance Abuse Subtotal MH/SA ECF/SNF Subtotal Hospital Inpatient Hospital Outpatient: $200.00 $158.63 $152.18 Emergency Room OP Lab OP Radiology OP Observation OP Other OP Surgery Subtotal Hospital Outpatient Claims Costs: Estimation and Management The primary factor in terms of impact and uncertainty © 2003 Reden & Anders, Ltd. Days Days Days $153.18 $200.00 Days Days $67.26 Days $50.00 $10.00 $25.00 Visits Visits Visits Visits Visits Visits $100.00 Util/ 1,000 Cost/ Unit Gross Copay Net PMPM PMPM PMPM 1,155 662 1 1,818 42 4 47 1,002 2,867 $1,172 2,462 1,172 $1,642 592 754 $607 381 $1,184 $112.77 135.81 0.14 $248.72 2.09 0.27 $2.36 31.83 $282.91 $19.24 8.75 0.02 $28.01 0.54 0.07 $0.61 5.62 $34.24 $93.53 127.06 0.12 $220.71 1.55 0.20 $1.75 26.21 $248.67 334 681 688 24 555 329 2,611 $435 74 375 1,014 213 1,199 $12.10 4.22 21.46 2.07 9.84 32.92 $82.61 $1.39 0.57 1.43 0.00 0.00 2.75 $6.14 $10.71 3.65 20.03 2.07 9.84 30.17 $76.47 © 2003 Reden & Anders, Ltd. Selection-Based Pricing POS blends In-Network and Out-of Network Versions Cost Share: Cost Share: Flat Member Type of Service Hospital Inpatient: Copay Coins % Medical Surgical Ungroupable Subtotal Non-MH/SA Mental Health Substance Abuse Subtotal MH/SA ECF/SNF Subtotal Hospital Inpatient Hospital Outpatient: $200.00 $158.63 $152.18 Emergency Room OP Lab OP Radiology OP Observation OP Other OP Surgery Subtotal Hospital Outpatient Type of Util Days Days Days Util/ 1,000 Cost/ Unit Gross Copay Net PMPM PMPM PMPM 1,155 662 1 1,818 42 4 47 1,002 2,867 $1,172 2,462 1,172 $1,642 592 754 $607 381 $1,184 $112.77 135.81 0.14 $248.72 2.09 0.27 $2.36 31.83 $282.91 $19.24 8.75 0.02 $28.01 0.54 0.07 $0.61 5.62 $34.24 $93.53 127.06 0.12 $220.71 1.55 0.20 $1.75 26.21 $248.67 334 681 688 24 555 329 2,611 $435 74 375 1,014 213 1,199 $12.10 4.22 21.46 2.07 9.84 32.92 $82.61 $1.39 0.57 1.43 0.00 0.00 2.75 $6.14 $10.71 3.65 20.03 2.07 9.84 30.17 $76.47 In-Network $153.18 $200.00 Days Days $67.26 Days $50.00 $10.00 $25.00 Visits Visits Visits Visits Visits Visits $100.00 Flat Member Type of Service Hospital Inpatient: Copay Coins % Medical Surgical Ungroupable Subtotal Non-MH/SA Mental Health Substance Abuse Subtotal MH/SA ECF/SNF Subtotal Hospital Inpatient Hospital Outpatient: $200.00 $158.63 $152.18 Days Days Days $153.18 $200.00 Type of Days Days Util Util/ 1,000 Cost/ Unit Gross Copay Net PMPM PMPM PMPM 1,155 662 1 1,818 42 4 47 1,002 2,867 $1,172 2,462 1,172 $1,642 592 754 $607 381 $1,184 $112.77 135.81 0.14 $248.72 2.09 0.27 $2.36 31.83 $282.91 $19.24 8.75 0.02 $28.01 0.54 0.07 $0.61 5.62 $34.24 $93.53 127.06 0.12 $220.71 1.55 0.20 $1.75 26.21 $248.67 334 681 688 24 555 329 2,611 $435 74 375 1,014 213 1,199 $12.10 4.22 21.46 2.07 9.84 32.92 $82.61 $1.39 0.57 1.43 0.00 0.00 2.75 $6.14 $10.71 3.65 20.03 2.07 9.84 30.17 $76.47 Out-of-Network Movement Emergency Room OP Lab OP Radiology OP Observation OP Other OP Surgery Subtotal Hospital Outpatient $67.26 Days $50.00 $10.00 $25.00 Visits Visits Visits Visits Visits Visits $100.00 CDHP blends interplay between Priced Options and PCA Employer PCA Employee Options Employer PCA1 PCA2 Employer PCA3 Employee Options PCA HMO PPO Employee Options © 2003 Reden & Anders, Ltd. Page <#> 3