the ug ct of x Dr

advertisement

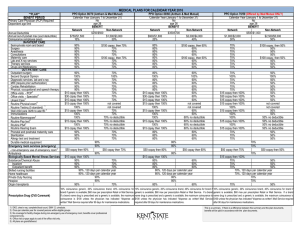

Rx __ __ _ __ __ _ _ __ __ _ _ __ _ _ ___ in, M.D. e Lan Help s B health A li il r W ette , US 10 B nytown A _ __ __ _ John Rother Director Policy & Strategy he t f o t rug c a D p x Im eR r a c i Med lation s Legi nsumers o on C Medicare Rx Drug Coverage: The Need Today’s pharmaceuticals do far more than mitigate symptoms: Control chronic conditions Protect against acute episodes Reverse course of disease, in some cases And, significantly improve the quality of life For Medicare-eligible What are people’s Rx drug costs? $0 <$1K $1 - 3K $3 - 5K $5 - 8K $8 - 10K $10K+ 10% 25% TOTAL Rx SPENDING Medicare pays Person's Co-pay Person's Premiums 11% 3% 5% Distribution of typical costs over approximately 40 million beneficiaries Impact of New Law in 2006 $8,000 16% CBO Projected 2006 The Standard Benefit Design $12,000 $10,000 30% 95% 75% $6,155 … $6,000 $250 $1,500 $4,000 $1,500 $2,000 $563 $0 $500 $1,000 $2,000 $3,000 Prescription cost $3600 out-of-pocket Rx Spending FINAL As passed $35 monthly premium ($420 per year) $1,313 $188 $2250 Total Rx Spending $5,000 $10,000 Referred to as the DONUT HOLE 1 13.4 Million Low-Income Medicare Beneficiaries Helped Below 135% FPL Assets Below $6,000** • No Premium • No Premium • No Deductible • No Coverage Gap • $1 Copay for Generic • $3 Copay for Brand-name • No Copay if in nursing home • No Copay over the $3,600 limit* • No Deductible • No Coverage Gap • $2 Copay for Generic • $5 Copay for Brand-name 4.4 million • No Copay over the $3,600 limit* 6.9 million Below 135% FPL Assets Below $10,000** 135% & 150% FPL Assets Below $10,000 Immediate help • No Premium • Sliding Scale Premium • $50 Deductible • $50 Deductible • No Coverage • No Coverage Gap Gap • 15% Coinsurance • 15% Coinsurance • $2 Generic or $5 Brand-name Copay over the $3,600 limit* • $2 Generic or $5 Brand-name Copay over the $3600 limit* 0.7 million 1.4 million Offers a Medicare discount card as a “transition” benefit for low - income without other Rx coverage- - adds $600/yr 2003 CBO Estimate Dual Eligibles Below 100% FPL Other Low-Income Protections Choices in Benefit Design Private benefit designs will differ even though based on same actuarial value as Medicare Rx 2 or more private insurance plans or federal fallback using the ‘standard benefit’ Medicare Structural Changes Begins in June, 2004 and ends January, 2006 Enrollment • Voluntary, can choose either: – Stand - alone plans sponsored by PBMs – PPO/HMO plans (Medicare Advantage) – No plan, pay no premium • Annual open-season • Late sign-up penalties = 1% per month, or as HHS Sec determines Protects Covered Retirees Strengthens Medicare Employer-provided retiree health coverage Adds chronic care management Adds new prevention benefits Allocates $71b in direct subsidies –now tax free – for employers who offer retirees Rx drug coverage equivalent to Medicare Requires electronic prescribing for doctors and pharmacies, which will improve quality Sec. 631 was dropped (permitted employers to provide retiree health coverage only until age 65) 2 Effect on Employers Typical employer: Expected to retain benefits for present & near-retirees -- limit for future Initiatives to keep pharmaceutical costs down Large employers most likely to “wrap-around” Medicare Rx, AARP surveys in 2002 indicated Initiatives to strengthen benefits Unfinished Agenda Cost initiatives Give HHS Sec negotiating power Legalize importation Call industry to limit price rises Fund “effectiveness” research Speed generic approval Require plans disclosure prices Reform direct-to-consumer ads Reform detailing practices –AMA Rx Unfinished Agenda __ _ ___ __ _ __ ___ ___ _ __ Unfinished Agenda Benefit design initiatives Close the donut hole Eliminate asset tests Change indexing to CPI-U Improve coordination with State Rx aid Strengthen ‘fallback’ provisions Allow States to be Rx plans __ _ _ .D. ___ elpin, M ane L H sB alth Willi tterhe USA e n, 10 B nytow A ___ t he u g f o t r c Impa are Rx D ic Med lation s Legi nsumers o on C 3